Shareholders in Controladora Vuela Compañía de Aviación. de (BMV:VOLARA) have lost 74%, as stock drops 7.8% this past week

It's not possible to invest over long periods without making some bad investments. But you want to avoid the really big losses like the plague. So consider, for a moment, the misfortune of Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (BMV:VOLARA) investors who have held the stock for three years as it declined a whopping 74%. That would be a disturbing experience. And the share price decline continued over the last week, dropping some 7.8%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Controladora Vuela Compañía de Aviación. de

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Controladora Vuela Compañía de Aviación. de moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

We note that, in three years, revenue has actually grown at a 20% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Controladora Vuela Compañía de Aviación. de more closely, as sometimes stocks fall unfairly. This could present an opportunity.

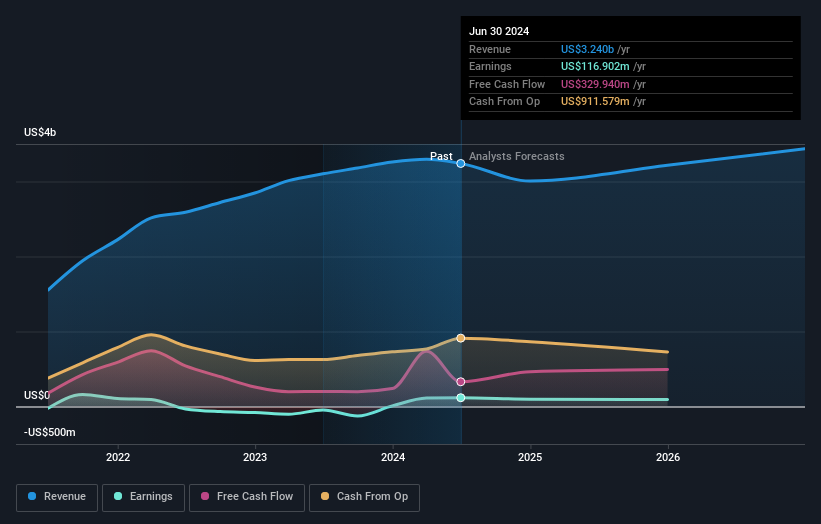

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Controladora Vuela Compañía de Aviación. de is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Controladora Vuela Compañía de Aviación. de shareholders gained a total return of 1.6% during the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 8% per year, over five years. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Controladora Vuela Compañía de Aviación. de is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

But note: Controladora Vuela Compañía de Aviación. de may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Mexican exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:VOLAR A

Controladora Vuela Compañía de Aviación. de

Controladora Vuela Compañía de Aviación, S.A.B.

Very undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives