Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (BMV:VOLARA) Investors Are Less Pessimistic Than Expected

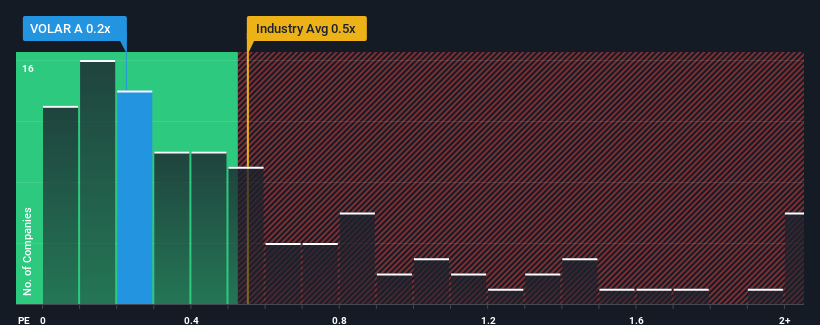

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Airlines industry in Mexico, you could be forgiven for feeling indifferent about Controladora Vuela Compañía de Aviación, S.A.B. de C.V.'s (BMV:VOLARA) P/S ratio of 0.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Controladora Vuela Compañía de Aviación. de

What Does Controladora Vuela Compañía de Aviación. de's Recent Performance Look Like?

Recent times haven't been great for Controladora Vuela Compañía de Aviación. de as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Controladora Vuela Compañía de Aviación. de's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Controladora Vuela Compañía de Aviación. de's to be considered reasonable.

Retrospectively, the last year delivered a decent 9.5% gain to the company's revenues. Pleasingly, revenue has also lifted 218% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 13% during the coming year according to the analysts following the company. Meanwhile, the broader industry is forecast to expand by 19%, which paints a poor picture.

With this information, we find it concerning that Controladora Vuela Compañía de Aviación. de is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Controladora Vuela Compañía de Aviación. de's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It appears that Controladora Vuela Compañía de Aviación. de currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Controladora Vuela Compañía de Aviación. de you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:VOLAR A

Controladora Vuela Compañía de Aviación. de

Controladora Vuela Compañía de Aviación, S.A.B.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success