- Mexico

- /

- Infrastructure

- /

- BMV:ASUR B

Market Still Lacking Some Conviction On Grupo Aeroportuario del Sureste, S. A. B. de C. V. (BMV:ASURB)

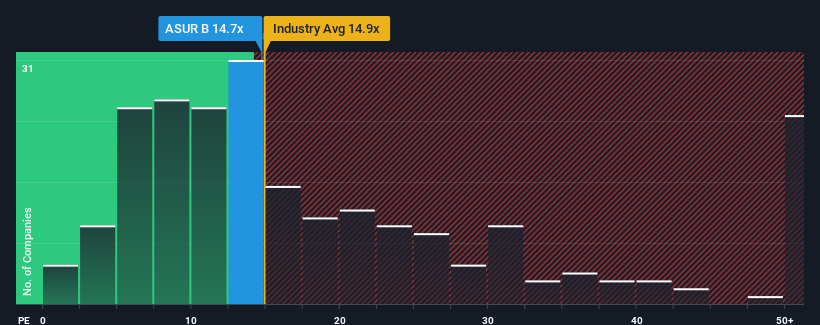

There wouldn't be many who think Grupo Aeroportuario del Sureste, S. A. B. de C. V.'s (BMV:ASURB) price-to-earnings (or "P/E") ratio of 14.7x is worth a mention when the median P/E in Mexico is similar at about 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's inferior to most other companies of late, Grupo Aeroportuario del Sureste S. A. B. de C. V has been relatively sluggish. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Grupo Aeroportuario del Sureste S. A. B. de C. V

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Grupo Aeroportuario del Sureste S. A. B. de C. V's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a decent 8.4% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 275% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 12% per annum during the coming three years according to the analysts following the company. With the market only predicted to deliver 9.5% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Grupo Aeroportuario del Sureste S. A. B. de C. V's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Grupo Aeroportuario del Sureste S. A. B. de C. V's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Grupo Aeroportuario del Sureste S. A. B. de C. V (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:ASUR B

Grupo Aeroportuario del Sureste S. A. B. de C. V

Grupo Aeroportuario del Sureste, S. A. B.

Flawless balance sheet with solid track record and pays a dividend.