3 Stocks That May Be Trading Below Estimated Value In January 2025

Reviewed by Simply Wall St

As global markets navigate a turbulent start to the year, characterized by inflation concerns and political uncertainty, investors are witnessing significant fluctuations across major indices. With U.S. equities experiencing declines and small-cap stocks underperforming, the search for undervalued opportunities becomes increasingly relevant. In such a volatile environment, identifying stocks that may be trading below their estimated value requires careful consideration of fundamentals and market sentiment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.18 | TRY78.31 | 50% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1115.85 | ₹2228.29 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.00 | CLP578.96 | 49.9% |

| MLG Oz (ASX:MLG) | A$0.57 | A$1.14 | 50% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Dino Polska (WSE:DNP) | PLN433.60 | PLN863.86 | 49.8% |

| Cicor Technologies (SWX:CICN) | CHF59.60 | CHF118.58 | 49.7% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.95 | CN¥27.87 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5869.00 | ¥11708.96 | 49.9% |

| Prodways Group (ENXTPA:PWG) | €0.608 | €1.21 | 49.9% |

Let's review some notable picks from our screened stocks.

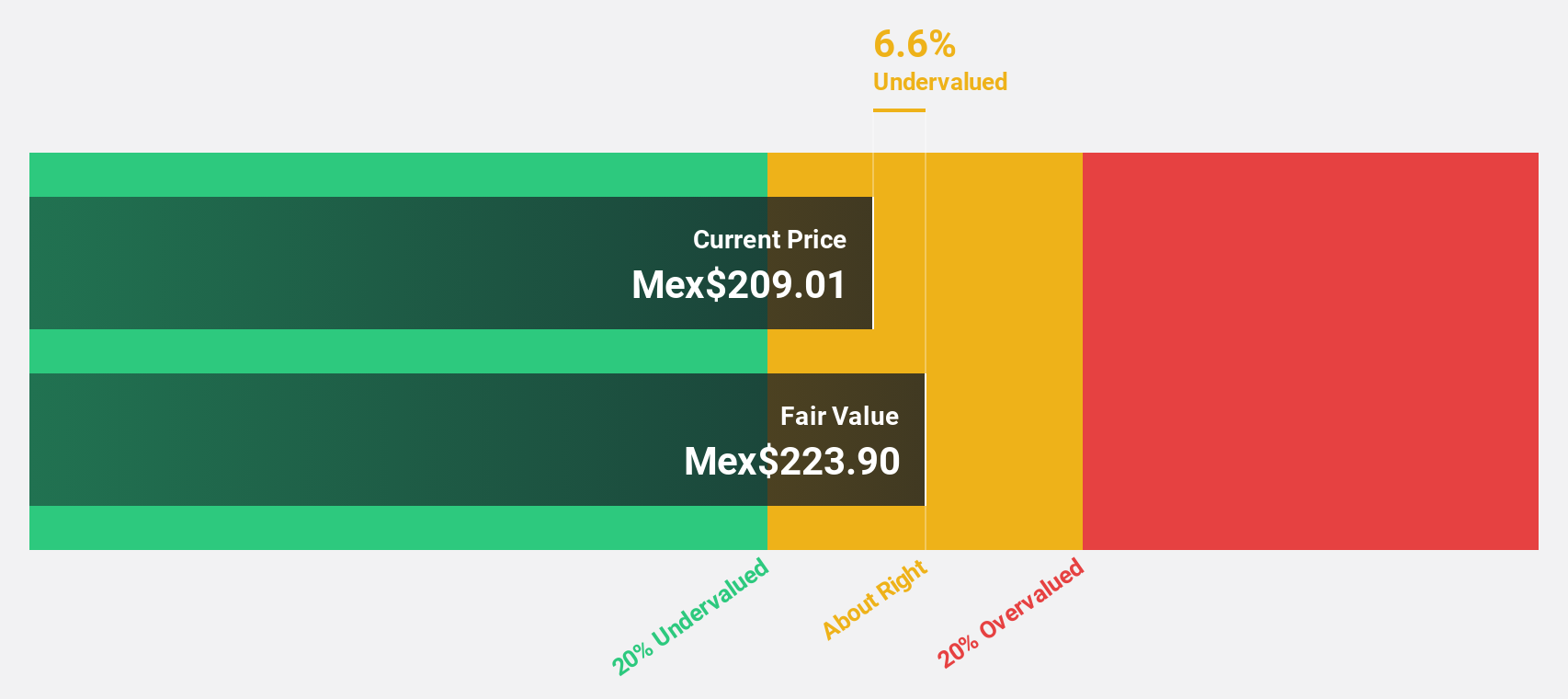

Quálitas Controladora. de (BMV:Q *)

Overview: Quálitas Controladora, S.A.B. de C.V. operates in the automobile insurance sector through its subsidiaries across Mexico, El Salvador, Costa Rica, Peru, and the United States with a market cap of MX$64.28 billion.

Operations: Quálitas Controladora's revenue is primarily generated from providing insurance, coinsurance, and reinsurance services in the automotive industry across Mexico, El Salvador, Costa Rica, Peru, and the United States.

Estimated Discount To Fair Value: 21.8%

Quálitas Controladora is trading at MX$170.92, 21.8% below its estimated fair value of MX$218.5, indicating potential undervaluation based on cash flows. The company reported a substantial net income increase to MXN 3.76 billion for the first nine months of 2024, up from MXN 2.66 billion a year earlier. Despite high earnings growth and forecasted profit growth outpacing the market, its dividend yield of 4.68% isn't well covered by free cash flows.

- Our expertly prepared growth report on Quálitas Controladora. de implies its future financial outlook may be stronger than recent results.

- Take a closer look at Quálitas Controladora. de's balance sheet health here in our report.

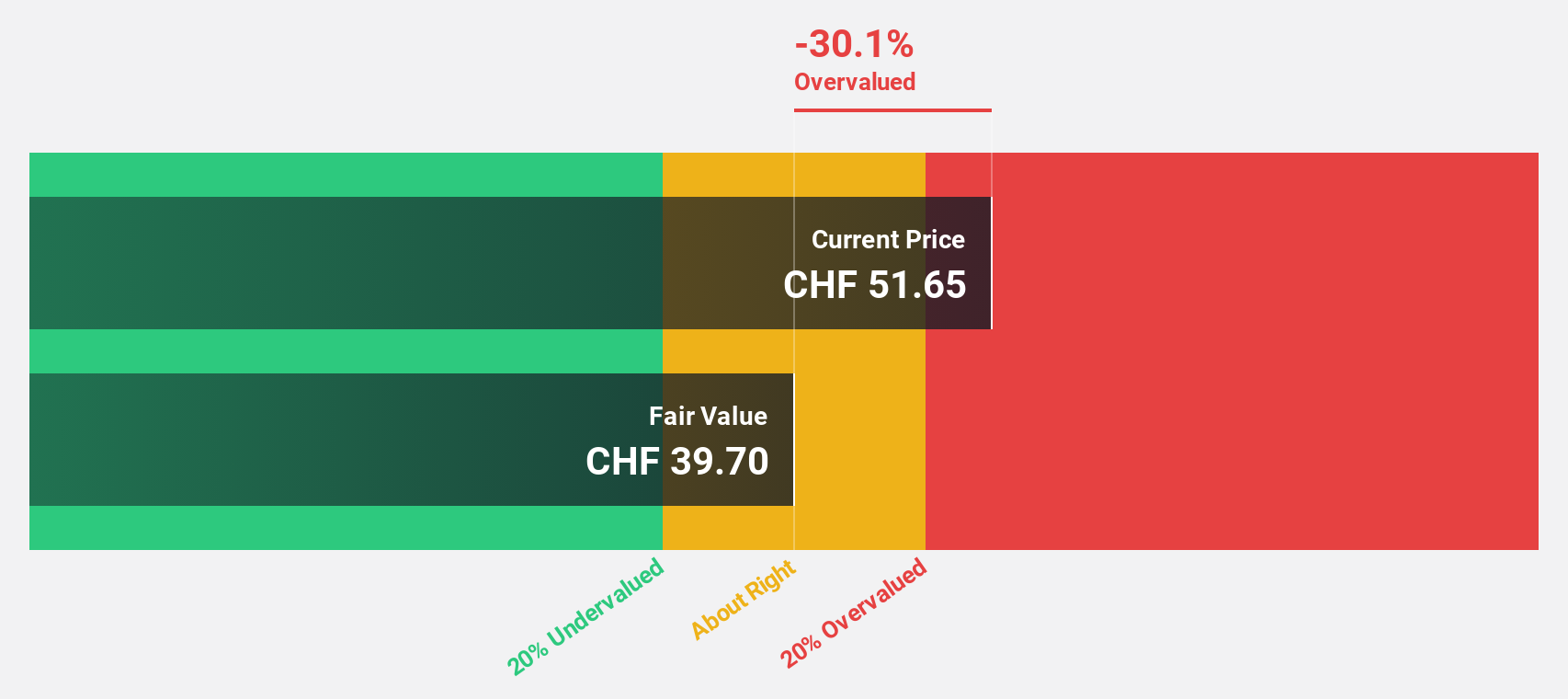

Accelleron Industries (SWX:ACLN)

Overview: Accelleron Industries AG specializes in developing, manufacturing, selling, and servicing turbochargers and digital solutions on a global scale, with a market cap of CHF4.32 billion.

Operations: The company's revenue is derived from two main segments: High Speed, contributing $245.87 million, and Medium & Low Speed, accounting for $725.83 million.

Estimated Discount To Fair Value: 15.9%

Accelleron Industries, trading at CHF46.04, is priced below its fair value of CHF54.74. Earnings grew by 39.3% last year and are expected to increase annually by 13.5%, surpassing Swiss market projections of 11.1%. Despite a high debt level, future revenue growth of 4.7% per year slightly exceeds the market's rate of 4.2%. The company's Return on Equity is forecasted to be very high at 54.1% in three years.

- Our growth report here indicates Accelleron Industries may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Accelleron Industries.

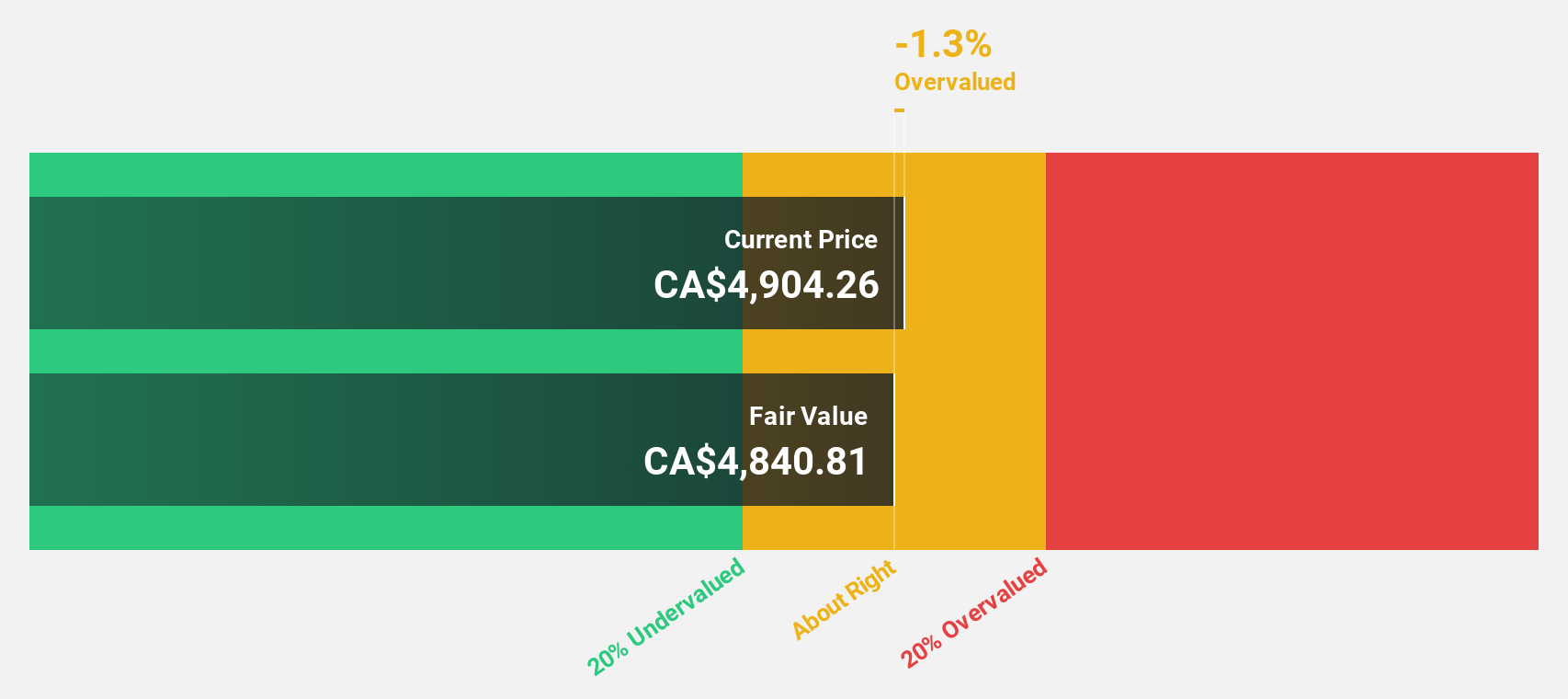

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$90.37 billion.

Operations: The company's revenue segment is primarily from Software & Programming, amounting to $9.68 billion.

Estimated Discount To Fair Value: 19.8%

Constellation Software, trading at CA$4,340.82, is valued below its fair value of CA$5,414.96. Despite a high debt level, the company shows robust earnings growth potential at 24.6% annually over the next three years—outpacing Canadian market expectations of 15.3%. Recent earnings reports show revenue growth from US$2.13 billion to US$2.54 billion year-over-year for Q3 2024, though net income decreased to US$164 million from US$227 million previously.

- The growth report we've compiled suggests that Constellation Software's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Constellation Software's balance sheet health report.

Make It Happen

- Navigate through the entire inventory of 880 Undervalued Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Quálitas Controladora. de might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:Q *

Quálitas Controladora. de

Through its subsidiaries, provides insurance, coinsurance, and reinsurance services in the personal accident, health, and automobile areas in Mexico, El Salvador, Costa Rica, Peru, and the United States.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)