Fibra UNO (BMV:FUNO11) Shareholders Received A Total Return Of Negative 12% In The Last Five Years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in Fibra UNO (BMV:FUNO11), since the last five years saw the share price fall 38%. Unhappily, the share price slid 2.0% in the last week.

Check out our latest analysis for Fibra UNO

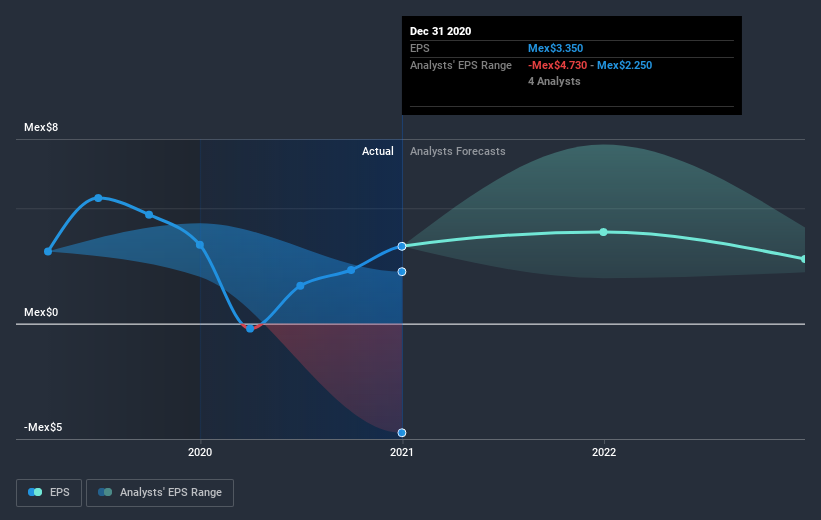

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Fibra UNO's share price and EPS declined; the latter at a rate of 1.7% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 9% per year, over the period. So it seems the market was too confident about the business, in the past. The low P/E ratio of 7.16 further reflects this reticence.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Fibra UNO's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Fibra UNO the TSR over the last 5 years was -12%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Fibra UNO shareholders are down 1.5% for the year (even including dividends), but the market itself is up 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 2% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Fibra UNO better, we need to consider many other factors. Take risks, for example - Fibra UNO has 4 warning signs (and 2 which are a bit concerning) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MX exchanges.

If you decide to trade Fibra UNO, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:FUNO 11

Fibra UNO

Fibra Uno (Mexbol: FUNO11; Bloomberg: FUNO11:MM) is the first and largest FIBRA in the Mexican market.

Good value slight.