- Mexico

- /

- Metals and Mining

- /

- BMV:PE&OLES *

Industrias Peñoles. de (BMV:PE&OLES) Has A Somewhat Strained Balance Sheet

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Industrias Peñoles, S.A.B. de C.V. (BMV:PE&OLES) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Industrias Peñoles. de

What Is Industrias Peñoles. de's Debt?

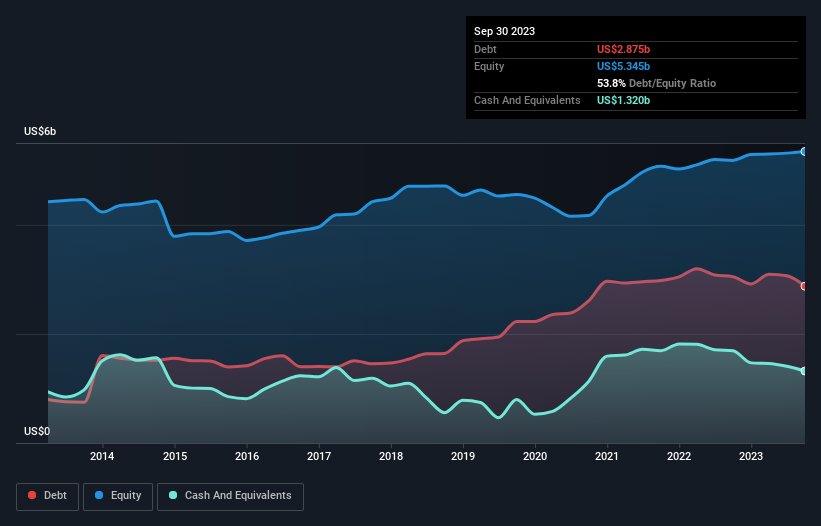

As you can see below, Industrias Peñoles. de had US$2.88b of debt at September 2023, down from US$3.05b a year prior. However, it does have US$1.32b in cash offsetting this, leading to net debt of about US$1.55b.

How Healthy Is Industrias Peñoles. de's Balance Sheet?

According to the last reported balance sheet, Industrias Peñoles. de had liabilities of US$1.60b due within 12 months, and liabilities of US$3.40b due beyond 12 months. Offsetting this, it had US$1.32b in cash and US$681.7m in receivables that were due within 12 months. So it has liabilities totalling US$3.00b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of US$5.00b, so it does suggest shareholders should keep an eye on Industrias Peñoles. de's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Industrias Peñoles. de has a quite reasonable net debt to EBITDA multiple of 2.1, its interest cover seems weak, at 0.63. The main reason for this is that it has such high depreciation and amortisation. While companies often boast that these charges are non-cash, most such businesses will therefore require ongoing investment (that is not expensed.) Either way there's no doubt the stock is using meaningful leverage. Importantly, Industrias Peñoles. de's EBIT fell a jaw-dropping 87% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Industrias Peñoles. de can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Industrias Peñoles. de's free cash flow amounted to 23% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

To be frank both Industrias Peñoles. de's interest cover and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. We're quite clear that we consider Industrias Peñoles. de to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Industrias Peñoles. de that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:PE&OLES *

Industrias Peñoles. de

Engages in the exploration, extraction, and sale of mineral concentrates and ores in Mexico, Europe, Asia, North America, South America, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives