- Mexico

- /

- Metals and Mining

- /

- BMV:ICH B

Industrias CH S. A. B. de C. V's (BMV:ICHB) investors will be pleased with their solid 123% return over the last five years

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For example, the Industrias CH, S. A. B. de C. V. (BMV:ICHB) share price has soared 114% in the last half decade. Most would be very happy with that. The last week saw the share price soften some 2.1%.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for Industrias CH S. A. B. de C. V

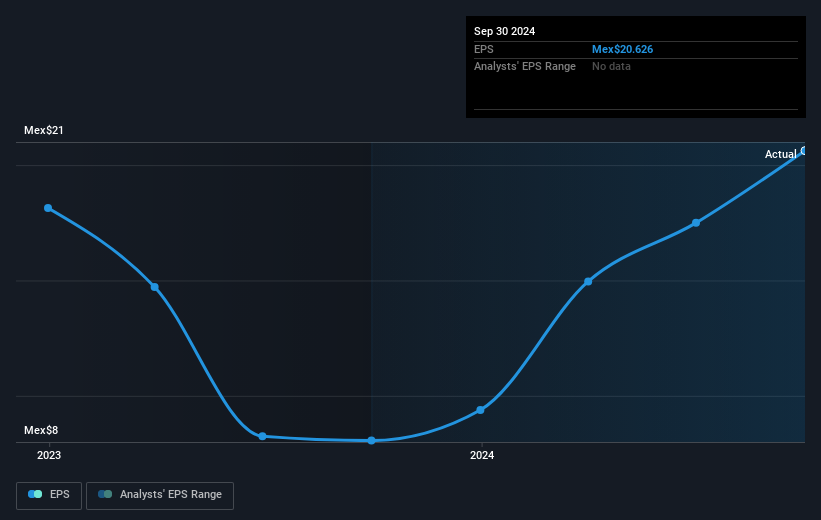

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Industrias CH S. A. B. de C. V achieved compound earnings per share (EPS) growth of 40% per year. This EPS growth is higher than the 16% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock. This cautious sentiment is reflected in its (fairly low) P/E ratio of 8.70.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Industrias CH S. A. B. de C. V has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Industrias CH S. A. B. de C. V's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Industrias CH S. A. B. de C. V's TSR of 123% over the last 5 years is better than the share price return.

A Different Perspective

Industrias CH S. A. B. de C. V shareholders are down 5.1% for the year, but the market itself is up 6.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 17%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Is Industrias CH S. A. B. de C. V cheap compared to other companies? These 3 valuation measures might help you decide.

We will like Industrias CH S. A. B. de C. V better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Mexican exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:ICH B

Industrias CH S. A. B. de C. V

Through its subsidiaries, engages in the production and processing of steel in Mexico and North America.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.