Quálitas Controladora, S.A.B. de C.V.'s (BMV:Q) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

With its stock down 18% over the past three months, it is easy to disregard Quálitas Controladora. de (BMV:Q). However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. Specifically, we decided to study Quálitas Controladora. de's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Quálitas Controladora. de

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Quálitas Controladora. de is:

22% = Mex$4.8b ÷ Mex$21b (Based on the trailing twelve months to June 2024).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each MX$1 of shareholders' capital it has, the company made MX$0.22 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Quálitas Controladora. de's Earnings Growth And 22% ROE

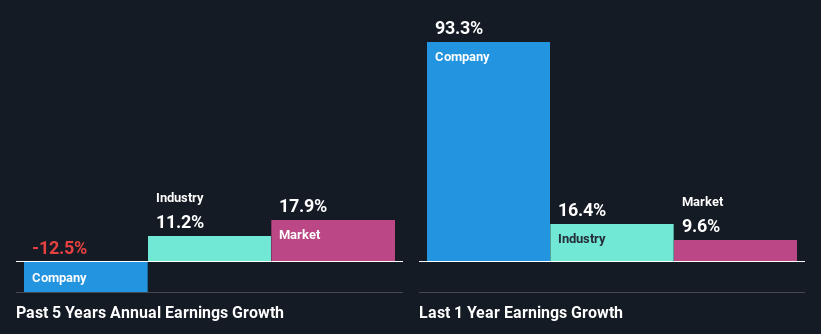

To start with, Quálitas Controladora. de's ROE looks acceptable. Further, the company's ROE compares quite favorably to the industry average of 19%. Needless to say, we are quite surprised to see that Quálitas Controladora. de's net income shrunk at a rate of 12% over the past five years. Therefore, there might be some other aspects that could explain this. For example, it could be that the company has a high payout ratio or the business has allocated capital poorly, for instance.

That being said, we compared Quálitas Controladora. de's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 11% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. What is Q * worth today? The intrinsic value infographic in our free research report helps visualize whether Q * is currently mispriced by the market.

Is Quálitas Controladora. de Efficiently Re-investing Its Profits?

With a high three-year median payout ratio of 77% (implying that 23% of the profits are retained), most of Quálitas Controladora. de's profits are being paid to shareholders, which explains the company's shrinking earnings. The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run.

In addition, Quálitas Controladora. de has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 69%. Accordingly, forecasts suggest that Quálitas Controladora. de's future ROE will be 26% which is again, similar to the current ROE.

Conclusion

In total, it does look like Quálitas Controladora. de has some positive aspects to its business. Although, we are disappointed to see a lack of growth in earnings even in spite of a high ROE. Bear in mind, the company reinvests a small portion of its profits, which means that investors aren't reaping the benefits of the high rate of return. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if Quálitas Controladora. de might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:Q *

Quálitas Controladora. de

Through its subsidiaries, provides insurance, coinsurance, and reinsurance services in the personal accident, health, and automobile areas in Mexico, El Salvador, Costa Rica, Peru, and the United States.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026