- Mexico

- /

- Household Products

- /

- BMV:KIMBER A

Kimberly-Clark de México, S. A. B. de C. V.'s (BMV:KIMBERA) Popularity With Investors Is Under Threat From Overpricing

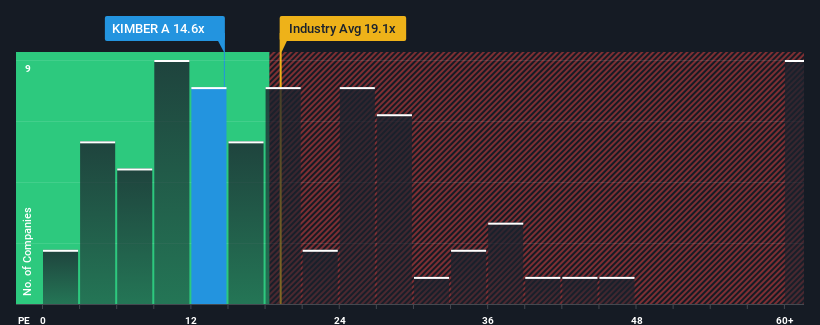

With a median price-to-earnings (or "P/E") ratio of close to 14x in Mexico, you could be forgiven for feeling indifferent about Kimberly-Clark de México, S. A. B. de C. V.'s (BMV:KIMBERA) P/E ratio of 14.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Kimberly-Clark de México S. A. B. de C. V as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Kimberly-Clark de México S. A. B. de C. V

Does Growth Match The P/E?

In order to justify its P/E ratio, Kimberly-Clark de México S. A. B. de C. V would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 38%. As a result, it also grew EPS by 22% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 7.2% each year during the coming three years according to the eight analysts following the company. That's shaping up to be materially lower than the 13% per annum growth forecast for the broader market.

With this information, we find it interesting that Kimberly-Clark de México S. A. B. de C. V is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Kimberly-Clark de México S. A. B. de C. V's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Kimberly-Clark de México S. A. B. de C. V has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Kimberly-Clark de México S. A. B. de C. V, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kimberly-Clark de México S. A. B. de C. V might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:KIMBER A

Kimberly-Clark de México S. A. B. de C. V

Manufactures, distributes, and sells disposable products in Mexico.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives