- Mexico

- /

- Diversified Financial

- /

- BMV:UNIFIN A

0.01% earnings growth over 5 years has not materialized into gains for Unifin Financiera S. A. B. de C. V (BMV:UNIFINA) shareholders over that period

The main aim of stock picking is to find the market-beating stocks. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Unifin Financiera, S. A. B. de C. V. (BMV:UNIFINA), since the last five years saw the share price fall 53%. Shareholders have had an even rougher run lately, with the share price down 42% in the last 90 days.

If the past week is anything to go by, investor sentiment for Unifin Financiera S. A. B. de C. V isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Unifin Financiera S. A. B. de C. V

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

While the share price declined over five years, Unifin Financiera S. A. B. de C. V actually managed to increase EPS by an average of 0.07% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Based on these numbers, we'd venture that the market may have been over-optimistic about forecast growth, half a decade ago. Looking to other metrics might better explain the share price change.

The revenue fall of 0.9% per year for five years is neither good nor terrible. But if the market expected durable top line growth, then that could explain the share price weakness.

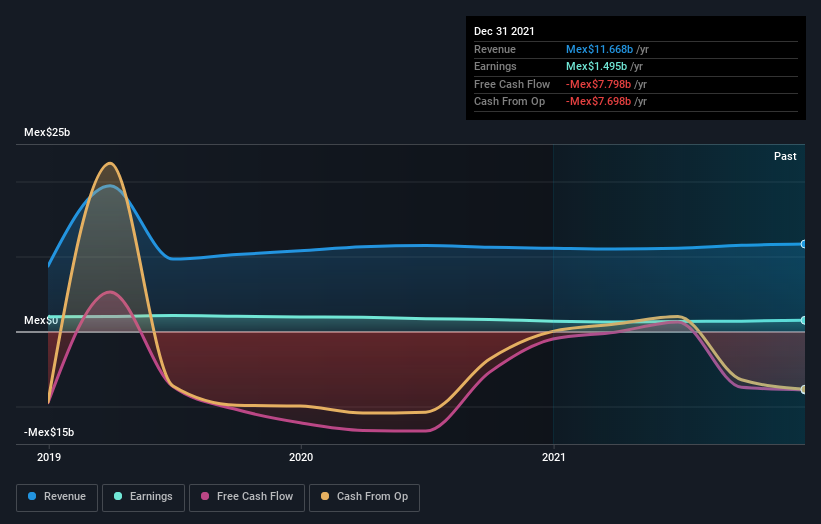

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Unifin Financiera S. A. B. de C. V's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Unifin Financiera S. A. B. de C. V's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Unifin Financiera S. A. B. de C. V shareholders, and that cash payout explains why its total shareholder loss of 50%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While the broader market gained around 21% in the last year, Unifin Financiera S. A. B. de C. V shareholders lost 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Unifin Financiera S. A. B. de C. V you should be aware of, and 2 of them don't sit too well with us.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MX exchanges.

If you're looking to trade Unifin Financiera S. A. B. de C. V, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:UNIFIN A

Unifin Financiera S. A. B. de C. V

Unifin Financiera, S. A. B. de C. V. operates as a leasing company in Mexico.

Good value with acceptable track record.

Market Insights

Community Narratives