- Taiwan

- /

- Real Estate

- /

- TWSE:2520

Three Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets respond to the shifting landscape of the incoming Trump administration, investors are witnessing a mix of sector performances influenced by potential policy changes and economic indicators such as inflation and interest rates. Amidst this backdrop, dividend stocks remain an attractive option for those seeking steady income streams, with their appeal often heightened during times of market uncertainty due to their potential for providing regular payouts and stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.59% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.15% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.76% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.37% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.59% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.49% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

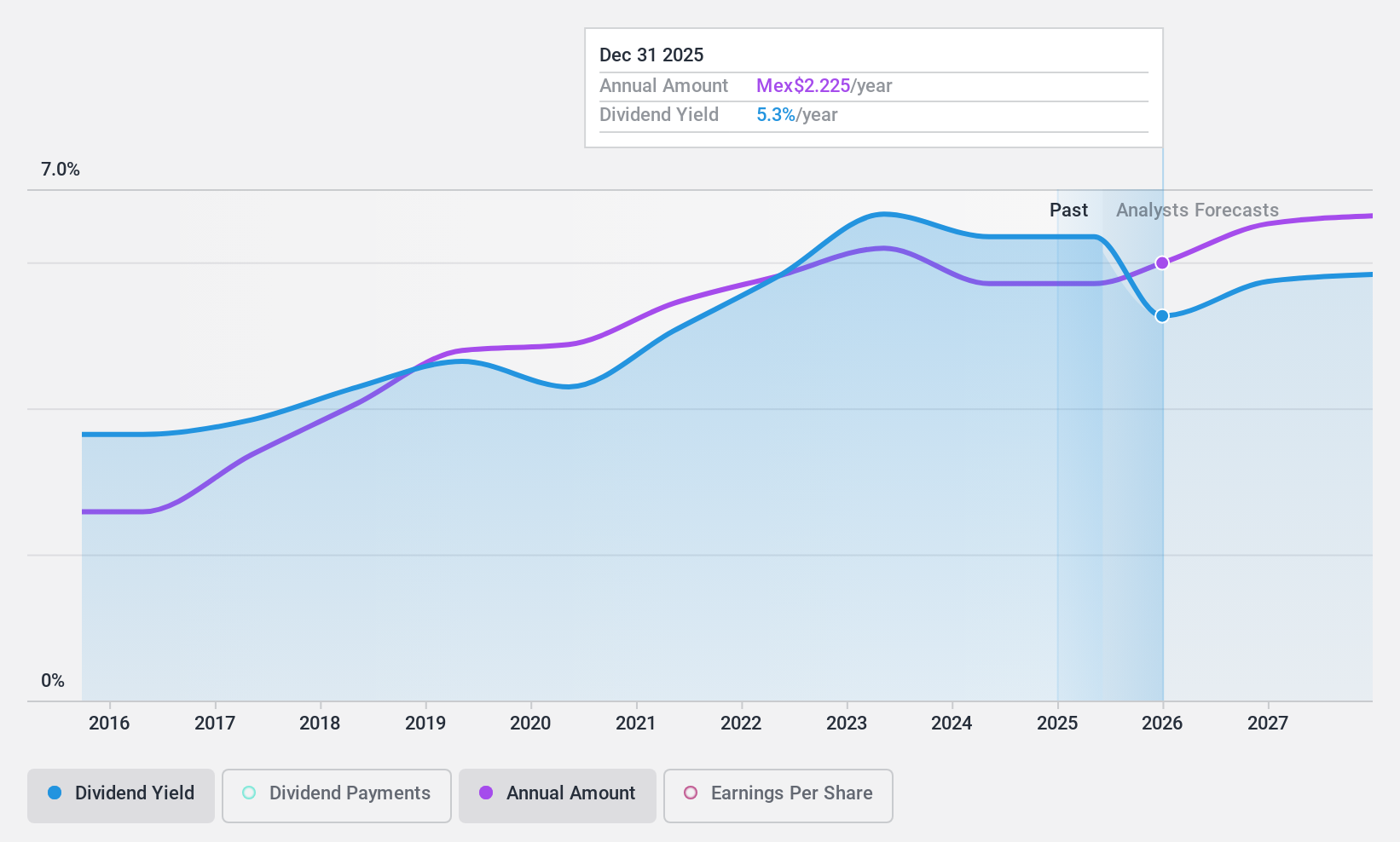

Bolsa Mexicana de Valores. de (BMV:BOLSA A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bolsa Mexicana de Valores, S.A.B. de C.V. operates as the primary stock exchange in Mexico and has a market cap of MX$18.10 billion.

Operations: Bolsa Mexicana de Valores, S.A.B. de C.V. generates revenue through its core operations as the leading stock exchange in Mexico.

Dividend Yield: 6.2%

Bolsa Mexicana de Valores has demonstrated reliable and stable dividend payments over the past decade, with consistent growth. The company's dividends are well-covered by both earnings (payout ratio of 80.4%) and cash flows (cash payout ratio of 66.5%). Despite a dividend yield of 6.24%, which is lower than the top tier in the Mexican market, recent earnings growth supports its sustainability, as evidenced by increased Q3 net income to MXN 409.9 million from MXN 329.53 million year-over-year.

- Click here and access our complete dividend analysis report to understand the dynamics of Bolsa Mexicana de Valores. de.

- Our valuation report unveils the possibility Bolsa Mexicana de Valores. de's shares may be trading at a premium.

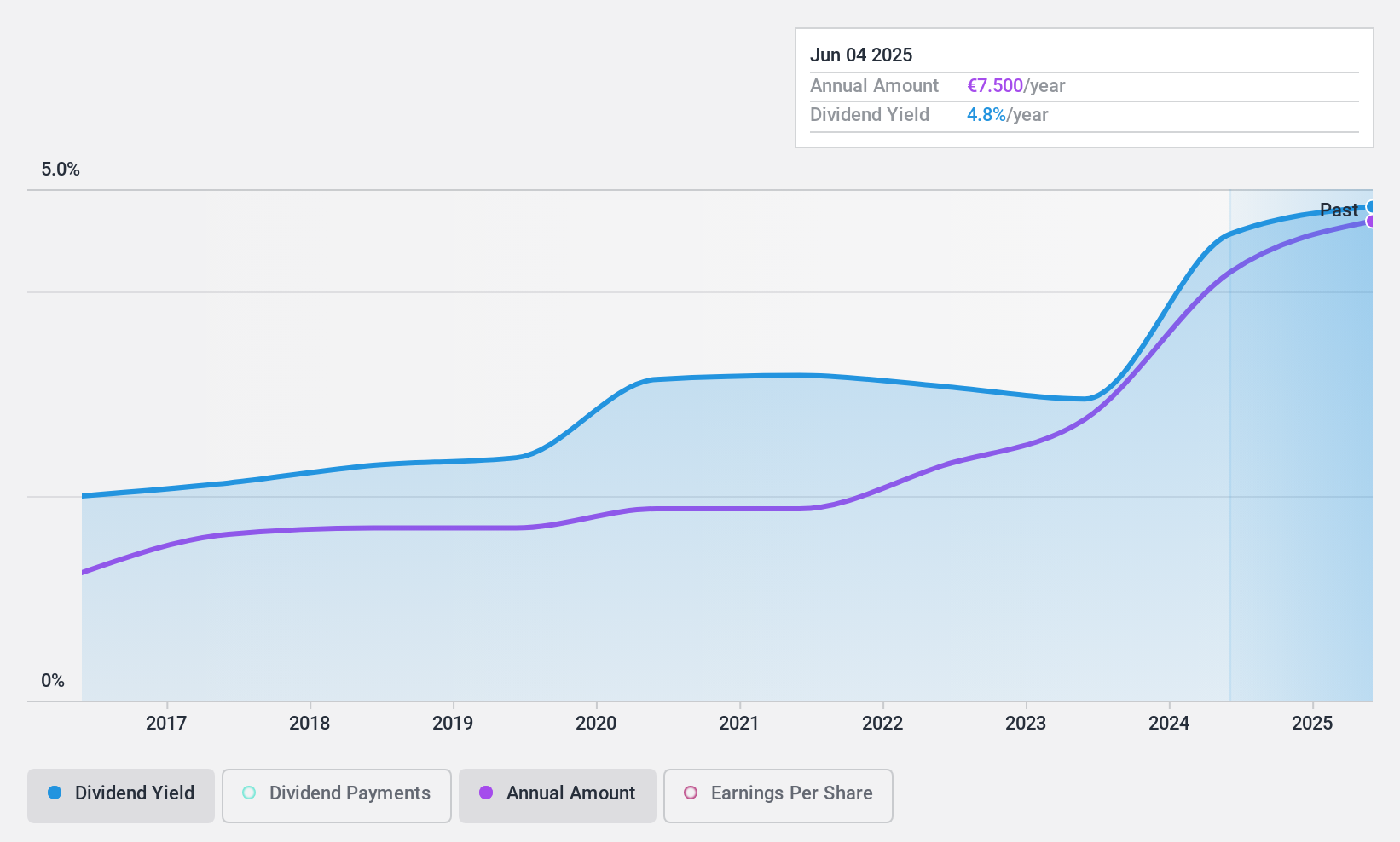

Exacompta Clairefontaine (ENXTPA:ALEXA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exacompta Clairefontaine S.A. is involved in the production, finishing, and formatting of papers across France, Europe, and internationally with a market cap of €173.12 million.

Operations: Exacompta Clairefontaine S.A.'s revenue is primarily derived from its Paper segment, generating €354.56 million, and its Conversion segment, contributing €597.58 million.

Dividend Yield: 4.4%

Exacompta Clairefontaine's dividends are well-supported, with a payout ratio of 35.4% and a cash payout ratio of 10.7%, indicating strong earnings and cash flow coverage. Despite recent declines in sales (€408.42 million) and net income (€16.5 million), the company maintains stable dividend payments over the past decade, although its yield of 4.38% is below the top tier in France (5.46%). The stock trades significantly below estimated fair value, enhancing its attractiveness for value-focused investors.

- Unlock comprehensive insights into our analysis of Exacompta Clairefontaine stock in this dividend report.

- Our expertly prepared valuation report Exacompta Clairefontaine implies its share price may be lower than expected.

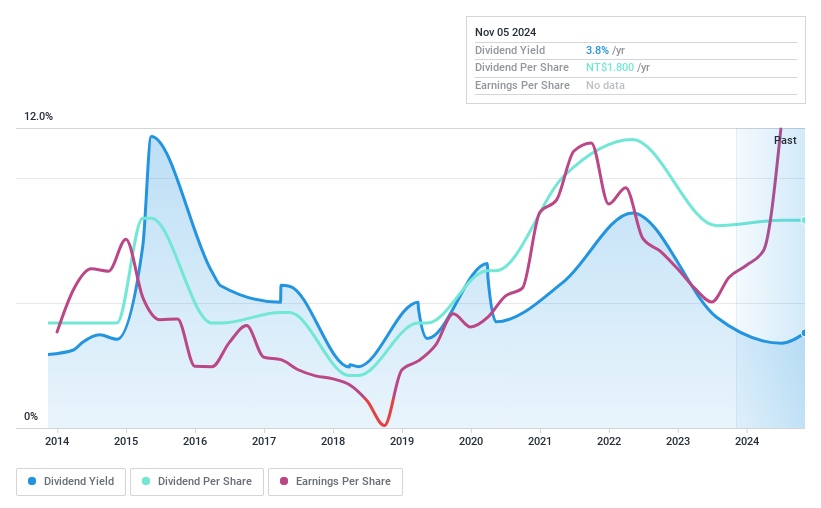

Kindom Development (TWSE:2520)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kindom Development Co., Ltd., along with its subsidiaries, engages in the construction, development, and sale of real estate properties in Taiwan and has a market cap of approximately NT$29.67 billion.

Operations: Kindom Development Co., Ltd. generates its revenue primarily from its Manufacturing segment (NT$15.39 billion), Construction Segments (NT$13.98 billion), and Department Store operations (NT$1.76 billion).

Dividend Yield: 3.3%

Kindom Development's dividends are well-covered by earnings and cash flows, with payout ratios of 17.9% and 9.6%, respectively. Despite a volatile dividend history over the past decade, recent earnings growth—net income rose to TWD 4.49 billion for the first nine months of 2024—suggests potential stability improvements. However, its current yield of 3.29% is lower than top-tier payers in Taiwan (4.53%). The stock trades significantly below fair value estimates, attracting value investors' interest.

- Delve into the full analysis dividend report here for a deeper understanding of Kindom Development.

- Upon reviewing our latest valuation report, Kindom Development's share price might be too pessimistic.

Seize The Opportunity

- Investigate our full lineup of 1960 Top Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kindom Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2520

Kindom Development

Kindom Development Co., Ltd., together with its subsidiaries, constructs, develops, and sells real estate properties in Taiwan.

Outstanding track record with flawless balance sheet and pays a dividend.