Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Hoteles City Express, S.A.B. de C.V. (BMV:HCITY) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Hoteles City Express. de

How Much Debt Does Hoteles City Express. de Carry?

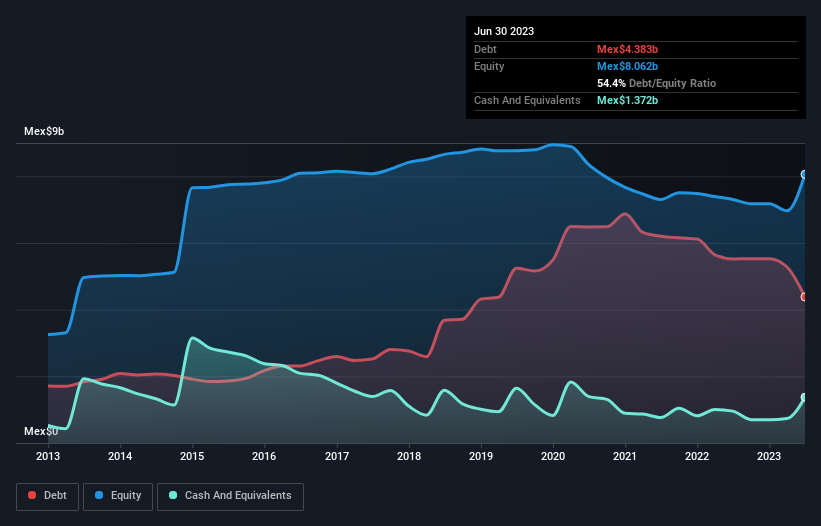

As you can see below, Hoteles City Express. de had Mex$4.38b of debt at June 2023, down from Mex$5.52b a year prior. However, it does have Mex$1.37b in cash offsetting this, leading to net debt of about Mex$3.01b.

How Strong Is Hoteles City Express. de's Balance Sheet?

We can see from the most recent balance sheet that Hoteles City Express. de had liabilities of Mex$1.55b falling due within a year, and liabilities of Mex$4.54b due beyond that. Offsetting these obligations, it had cash of Mex$1.37b as well as receivables valued at Mex$439.7m due within 12 months. So its liabilities total Mex$4.28b more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of Mex$3.13b, we think shareholders really should watch Hoteles City Express. de's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Hoteles City Express. de's debt to EBITDA ratio (2.8) suggests that it uses some debt, its interest cover is very weak, at 0.98, suggesting high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. However, it should be some comfort for shareholders to recall that Hoteles City Express. de actually grew its EBIT by a hefty 244%, over the last 12 months. If it can keep walking that path it will be in a position to shed its debt with relative ease. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Hoteles City Express. de's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, Hoteles City Express. de actually produced more free cash flow than EBIT over the last two years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

We feel some trepidation about Hoteles City Express. de's difficulty interest cover, but we've got positives to focus on, too. For example, its conversion of EBIT to free cash flow and EBIT growth rate give us some confidence in its ability to manage its debt. Looking at all the angles mentioned above, it does seem to us that Hoteles City Express. de is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. While Hoteles City Express. de didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away. Click here to see if its earnings are heading in the right direction, over the medium term.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you're looking to trade Hoteles City Express. de, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hoteles City Express. de might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:HCITY *

Hoteles City Express. de

Develops and operates a chain of limited-service hotels in Mexico, Costa Rica, Colombia, and Chile.

Good value with reasonable growth potential.

Market Insights

Community Narratives