- Mexico

- /

- Hospitality

- /

- BMV:ALSEA *

November 2024's Top Insider-Owned Growth Companies

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are closely watching sector performance and inflation data to gauge future economic trends. Amidst this backdrop, companies with strong insider ownership often stand out as potential growth opportunities, as insiders' vested interests can align with shareholder value creation.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 84.9% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

We'll examine a selection from our screener results.

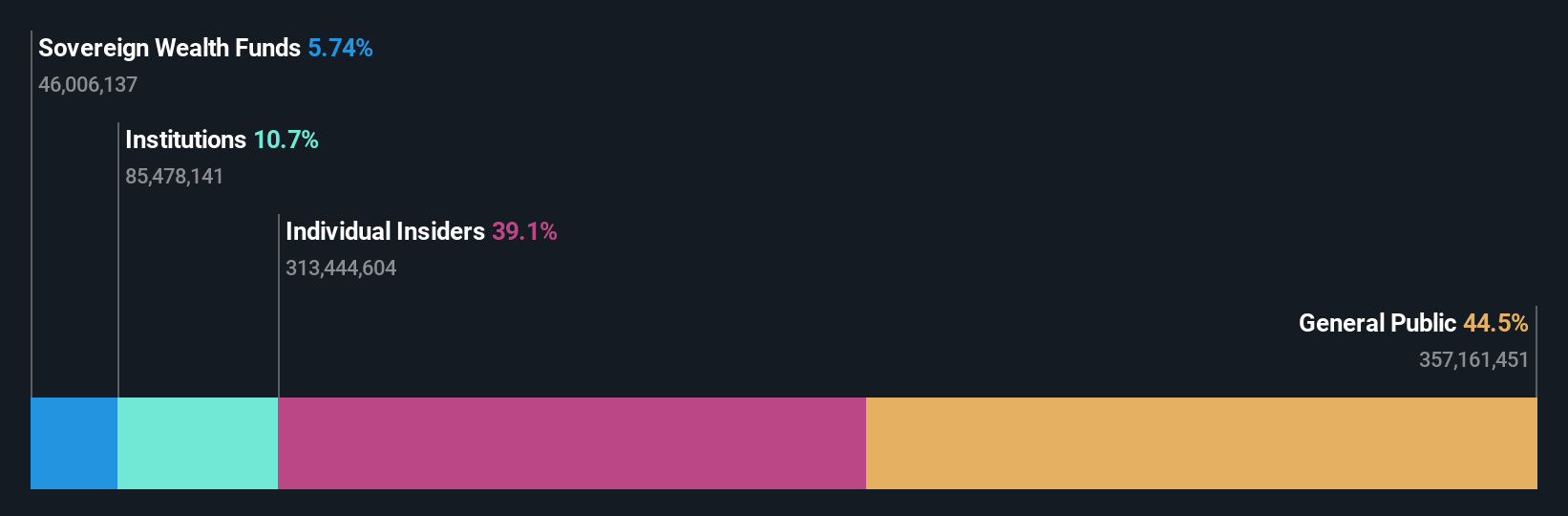

Alsea. de (BMV:ALSEA *)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alsea, S.A.B. de C.V. operates restaurants across Latin America and Europe, with a market cap of MX$38.55 billion.

Operations: Alsea's revenue segments include its restaurant operations across Latin America and Europe.

Insider Ownership: 38.5%

Earnings Growth Forecast: 23.2% p.a.

Alsea, S.A.B. de C.V. is positioned for growth with earnings forecasted to rise significantly at 23.2% annually, outpacing the MX market's 11.5%. Despite a strong earnings growth outlook and a favorable price-to-earnings ratio of 13.4x compared to industry peers, Alsea faces challenges with interest coverage and reported lower net income in recent quarters despite increased sales. The company's high return on equity forecast (33.6%) indicates potential long-term profitability improvements.

- Take a closer look at Alsea. de's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Alsea. de is trading behind its estimated value.

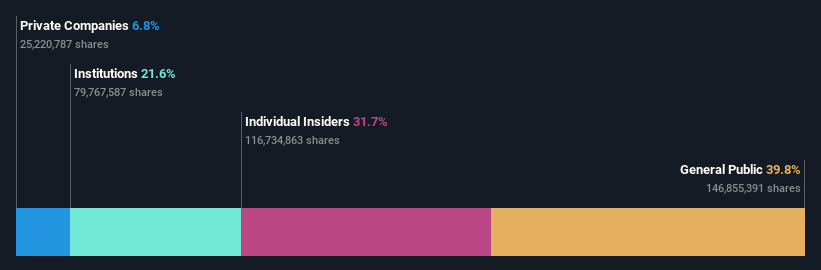

Zhejiang XCC GroupLtd (SHSE:603667)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang XCC Group Co., Ltd is involved in the research, development, manufacture, and sale of bearings across various international markets including the United States, Japan, Korea, and Brazil with a market cap of approximately CN¥6.79 billion.

Operations: Zhejiang XCC Group Co., Ltd generates its revenue through the research, development, manufacture, and sale of bearings across diverse international markets such as the United States, Japan, Korea, and Brazil.

Insider Ownership: 31.7%

Earnings Growth Forecast: 28.5% p.a.

Zhejiang XCC Group Ltd. is set for significant earnings growth at 28.5% annually, surpassing the CN market's 26%. However, its revenue growth forecast of 14.2% lags behind the ideal threshold of 20%. Recent earnings reports show a decline in net income to CNY 98.23 million from CNY 122.77 million year-on-year, indicating challenges despite high insider ownership which can align management and shareholder interests effectively for long-term growth potential.

- Delve into the full analysis future growth report here for a deeper understanding of Zhejiang XCC GroupLtd.

- The valuation report we've compiled suggests that Zhejiang XCC GroupLtd's current price could be inflated.

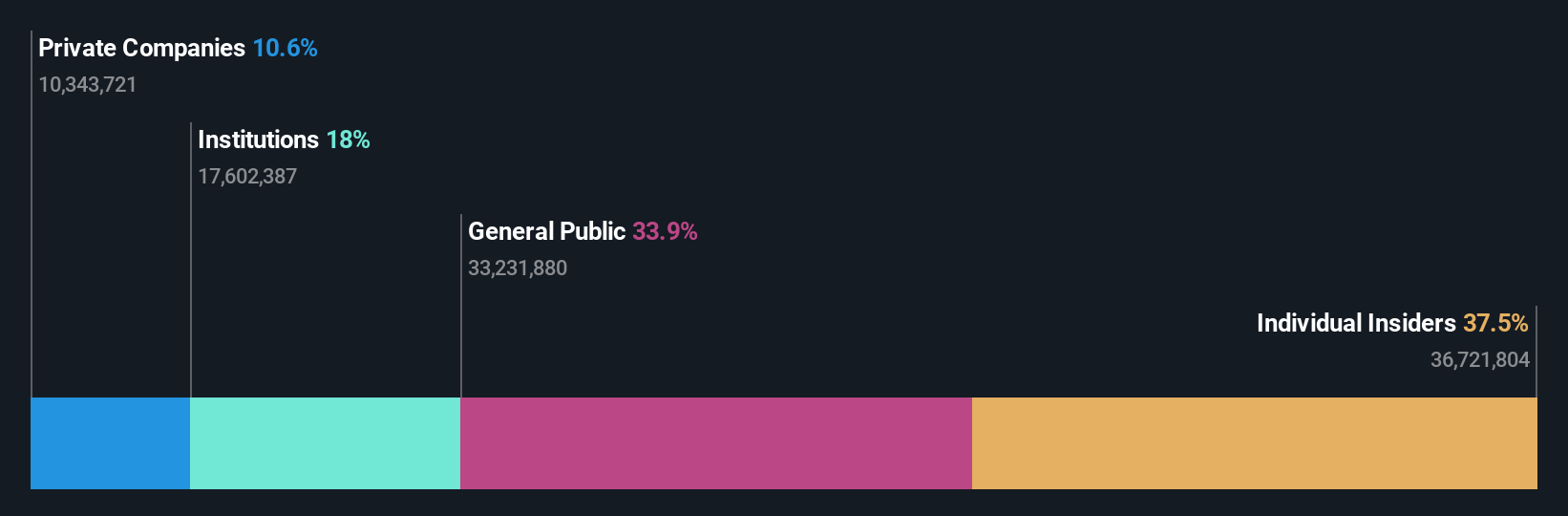

Xi'an Sinofuse Electric (SZSE:301031)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xi'an Sinofuse Electric Co., Ltd. focuses on the research, development, production, and sale of circuit protection devices and fuses, with a market cap of CN¥7.33 billion.

Operations: Xi'an Sinofuse Electric Co., Ltd. generates revenue primarily from the development and sale of circuit protection devices, fuses, and related accessories.

Insider Ownership: 36.8%

Earnings Growth Forecast: 45.5% p.a.

Xi'an Sinofuse Electric is poised for strong growth, with earnings expected to increase by 45.45% annually, significantly outpacing the CN market's 26%. Revenue is also forecasted to grow at 29.4% per year. Recent earnings reports show a rise in net income to CNY 119.98 million from CNY 85.46 million year-on-year, reflecting robust performance amid high insider ownership that could align management and shareholder interests effectively for sustainable growth potential.

- Navigate through the intricacies of Xi'an Sinofuse Electric with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Xi'an Sinofuse Electric is trading beyond its estimated value.

Key Takeaways

- Delve into our full catalog of 1533 Fast Growing Companies With High Insider Ownership here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:ALSEA *

High growth potential with solid track record.