- Mexico

- /

- Food and Staples Retail

- /

- BMV:SORIANA B

Organización Soriana S. A. B. de C. V (BMV:SORIANAB) Has A Somewhat Strained Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Organización Soriana, S. A. B. de C. V. (BMV:SORIANAB) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Organización Soriana S. A. B. de C. V

How Much Debt Does Organización Soriana S. A. B. de C. V Carry?

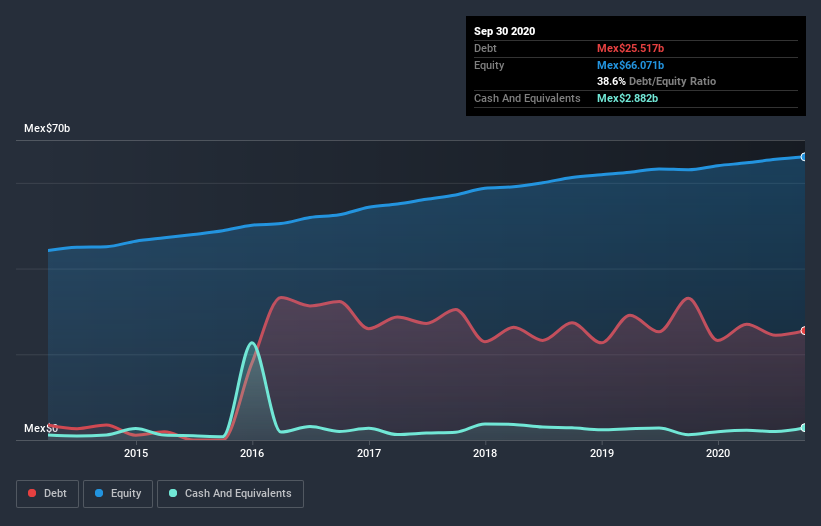

The image below, which you can click on for greater detail, shows that Organización Soriana S. A. B. de C. V had debt of Mex$25.5b at the end of September 2020, a reduction from Mex$33.0b over a year. However, it does have Mex$2.88b in cash offsetting this, leading to net debt of about Mex$22.6b.

How Strong Is Organización Soriana S. A. B. de C. V's Balance Sheet?

The latest balance sheet data shows that Organización Soriana S. A. B. de C. V had liabilities of Mex$41.5b due within a year, and liabilities of Mex$32.5b falling due after that. Offsetting this, it had Mex$2.88b in cash and Mex$7.69b in receivables that were due within 12 months. So it has liabilities totalling Mex$63.4b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the Mex$34.1b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Organización Soriana S. A. B. de C. V would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Organización Soriana S. A. B. de C. V's net debt is sitting at a very reasonable 2.0 times its EBITDA, while its EBIT covered its interest expense just 2.9 times last year. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Organización Soriana S. A. B. de C. V grew its EBIT by 5.7% in the last year. Whilst that hardly knocks our socks off it is a positive when it comes to debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Organización Soriana S. A. B. de C. V's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, Organización Soriana S. A. B. de C. V recorded free cash flow worth 71% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

We'd go so far as to say Organización Soriana S. A. B. de C. V's level of total liabilities was disappointing. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Once we consider all the factors above, together, it seems to us that Organización Soriana S. A. B. de C. V's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. Over time, share prices tend to follow earnings per share, so if you're interested in Organización Soriana S. A. B. de C. V, you may well want to click here to check an interactive graph of its earnings per share history.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Organización Soriana S. A. B. de C. V, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:SORIANA B

Organización Soriana S. A. B. de C. V

Operates various formats of stores in Mexico.

Excellent balance sheet and good value.