- Mexico

- /

- Food and Staples Retail

- /

- BMV:FRAGUA B

Investors Give Corporativo Fragua, S.A.B. de C.V. (BMV:FRAGUAB) Shares A 28% Hiding

To the annoyance of some shareholders, Corporativo Fragua, S.A.B. de C.V. (BMV:FRAGUAB) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 23%.

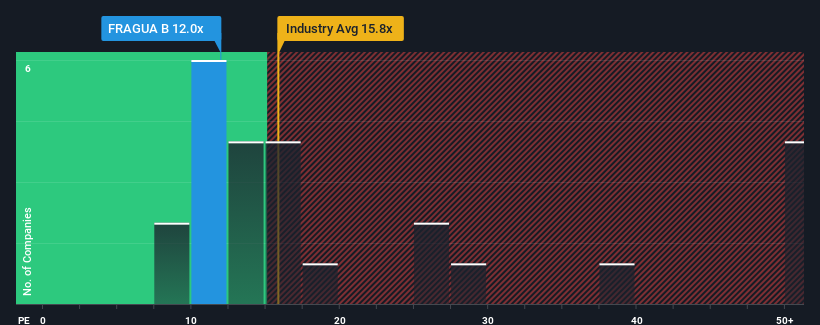

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Corporativo Fragua. de's P/E ratio of 12x, since the median price-to-earnings (or "P/E") ratio in Mexico is also close to 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Corporativo Fragua. de has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

View our latest analysis for Corporativo Fragua. de

Does Growth Match The P/E?

Corporativo Fragua. de's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 22% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 110% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 18% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that Corporativo Fragua. de's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Corporativo Fragua. de's P/E

Following Corporativo Fragua. de's share price tumble, its P/E is now hanging on to the median market P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Corporativo Fragua. de currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Corporativo Fragua. de with six simple checks.

You might be able to find a better investment than Corporativo Fragua. de. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:FRAGUA B

Corporativo Fragua. de

Operates pharmacy stores under the Superfarmacia name in Mexico.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives