- Malta

- /

- Hospitality

- /

- MTSE:IHI

Here's Why International Hotel Investments (MTSE:IHI) Has A Meaningful Debt Burden

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that International Hotel Investments p.l.c. (MTSE:IHI) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for International Hotel Investments

What Is International Hotel Investments's Debt?

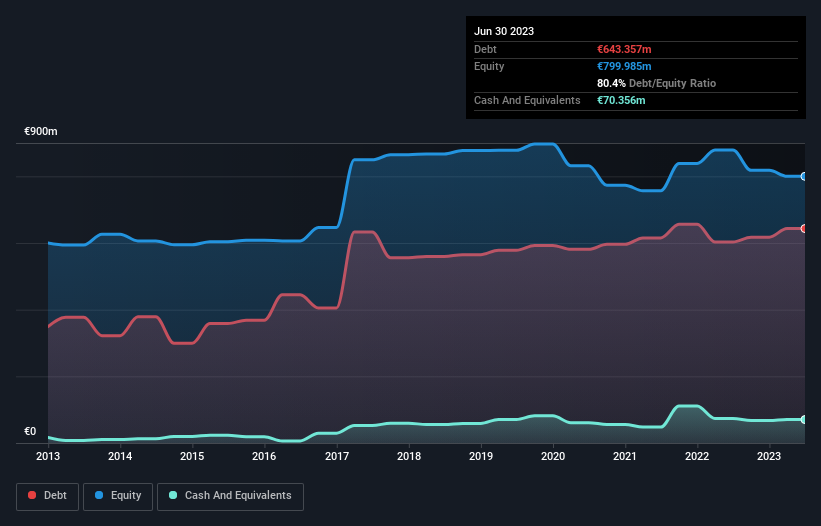

As you can see below, at the end of June 2023, International Hotel Investments had €643.4m of debt, up from €603.0m a year ago. Click the image for more detail. However, it does have €70.4m in cash offsetting this, leading to net debt of about €573.0m.

A Look At International Hotel Investments' Liabilities

According to the last reported balance sheet, International Hotel Investments had liabilities of €358.0m due within 12 months, and liabilities of €525.2m due beyond 12 months. Offsetting these obligations, it had cash of €70.4m as well as receivables valued at €51.2m due within 12 months. So its liabilities total €761.6m more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the €264.7m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, International Hotel Investments would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 0.79 times and a disturbingly high net debt to EBITDA ratio of 11.4 hit our confidence in International Hotel Investments like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. The good news is that International Hotel Investments grew its EBIT a smooth 56% over the last twelve months. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since International Hotel Investments will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent two years, International Hotel Investments recorded free cash flow of 46% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

To be frank both International Hotel Investments's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Looking at the bigger picture, it seems clear to us that International Hotel Investments's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - International Hotel Investments has 2 warning signs we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About MTSE:IHI

International Hotel Investments

Engages in the ownership, development, and operation of hotels, leisure facilities, and other activities related to the tourism industry and commercial centres.

Slightly overvalued with worrying balance sheet.