- Luxembourg

- /

- Media

- /

- BDL:SESGL

How SES’s (BDL:SESGL) Latest Tech Partnerships Are Shaping Its Satellite Connectivity Narrative

Reviewed by Sasha Jovanovic

- SES recently announced collaborations to advance its medium Earth orbit (MEO) network with K2 Space, began testing Cailabs’ optical ground stations for laser communications, and reported successful deployments of its O3b mPOWER service with the French Navy.

- These developments underscore SES’s ongoing push to innovate secure, high-speed connectivity options for both government and enterprise clients, signaling potential for broader applications in critical communications technology.

- We’ll explore how SES’s focus on pioneering high-throughput network technologies is shaping its investment narrative in the satellite communications sector.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is SES' Investment Narrative?

For SES shareholders, the big picture centres on the belief that innovation in secure, high-throughput connectivity will drive long-term value, especially as governments and enterprises demand more resilient communications. Recent advances, such as the collaboration with K2 Space on the next-generation MEO network and Cailabs’ optical ground station tests, reinforce this forward-looking story. These technology milestones, together with visible use cases like the French Navy deployment, may sharpen near-term catalysts around contract wins and commercial rollouts. At the same time, the board refresh and continued dividend affirmations indicate a heightened focus on governance and shareholder engagement. However, risks remain in the company’s unprofitable position, thin net margins, and sustained dividend outflows that are not currently covered by earnings. Investors will want to watch how these breakthroughs interact with short-term financial pressures and whether recent moves can translate innovation into sustainable profitability.

However, the dividend's lack of earnings coverage is a key issue that may concern some investors.

Exploring Other Perspectives

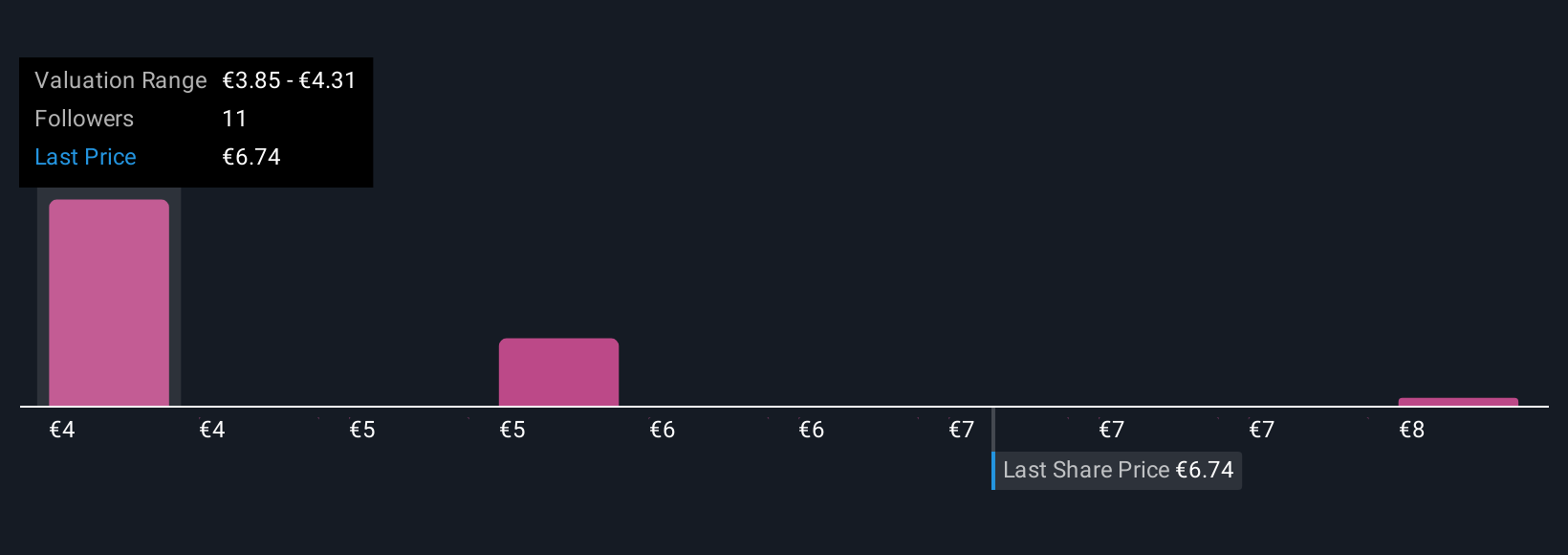

Explore 4 other fair value estimates on SES - why the stock might be worth 39% less than the current price!

Build Your Own SES Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SES research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free SES research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SES' overall financial health at a glance.

No Opportunity In SES?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BDL:SESGL

SES

Provides satellite-based data transmission capacity and ancillary services worldwide.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives