- Japan

- /

- Trade Distributors

- /

- TSE:8015

Global Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

Amid recent geopolitical tensions and consumer spending concerns, global markets have experienced a volatile week, with major U.S. indices ending lower despite midweek highs. As investors navigate these uncertainties, dividend stocks can offer a measure of stability and income potential, providing a cushion during turbulent times while contributing to long-term portfolio growth.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.73% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.09% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.19% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

| Chudenko (TSE:1941) | 3.85% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.60% | ★★★★★★ |

Click here to see the full list of 1424 stocks from our Top Global Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

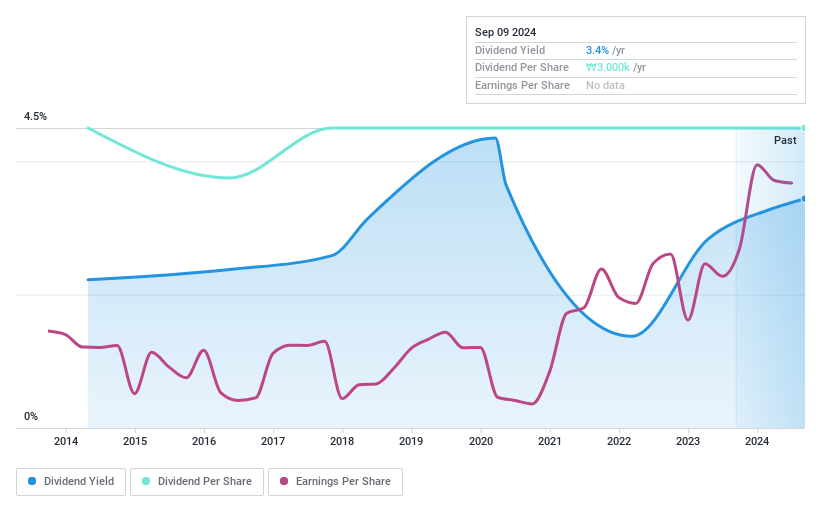

SamchullyLtd (KOSE:A004690)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samchully Co., Ltd. operates in the natural gas supply industry across South Korea and the United States, with a market capitalization of ₩308.16 billion.

Operations: Samchully Co., Ltd. generates revenue through its operations in the natural gas supply sector within South Korea and the United States.

Dividend Yield: 3.2%

Samchully Ltd. offers a dividend yield of 3.22%, which is below the top quartile in the Korean market, but its dividends are well-covered by both earnings and cash flows, with payout ratios of 9.3% and 5.8%, respectively. Despite stable dividends over the past decade, growth has been absent, making them less attractive for those seeking increasing income streams. The stock trades significantly below estimated fair value, suggesting potential undervaluation for investors prioritizing capital appreciation alongside dividends.

- Delve into the full analysis dividend report here for a deeper understanding of SamchullyLtd.

- In light of our recent valuation report, it seems possible that SamchullyLtd is trading behind its estimated value.

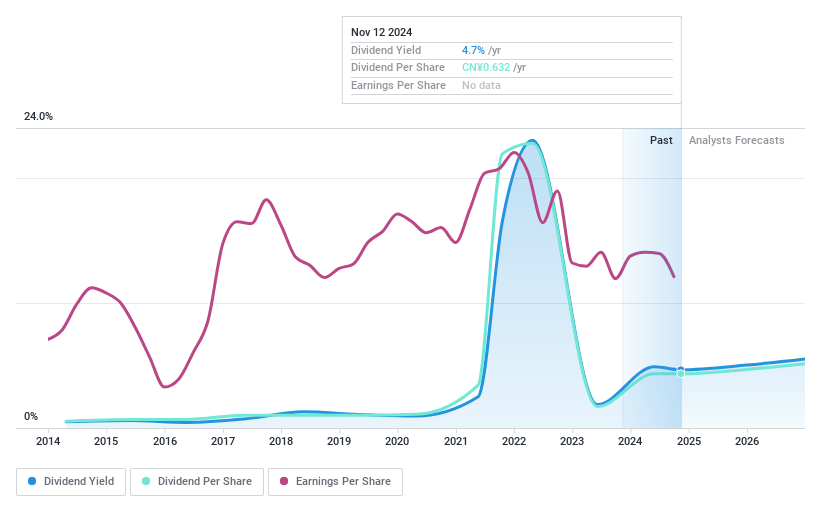

Ningbo Huaxiang Electronic (SZSE:002048)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ningbo Huaxiang Electronic Co., Ltd. designs, develops, produces, and sells auto parts both in the People’s Republic of China and internationally, with a market cap of CN¥10.04 billion.

Operations: The primary revenue segment for Ningbo Huaxiang Electronic Co., Ltd. is Automobile Accessories, contributing CN¥24.97 billion.

Dividend Yield: 4.6%

Ningbo Huaxiang Electronic offers a dividend yield of 4.6%, placing it in the top quartile of the Chinese market. However, its dividends have been volatile and are not well-covered by cash flows, with a high cash payout ratio of 264.8%. The company's earnings growth forecast is promising at 21.45% annually. A recent share buyback program worth CNY 50 million could indicate management's confidence but requires shareholder approval to proceed.

- Click to explore a detailed breakdown of our findings in Ningbo Huaxiang Electronic's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ningbo Huaxiang Electronic shares in the market.

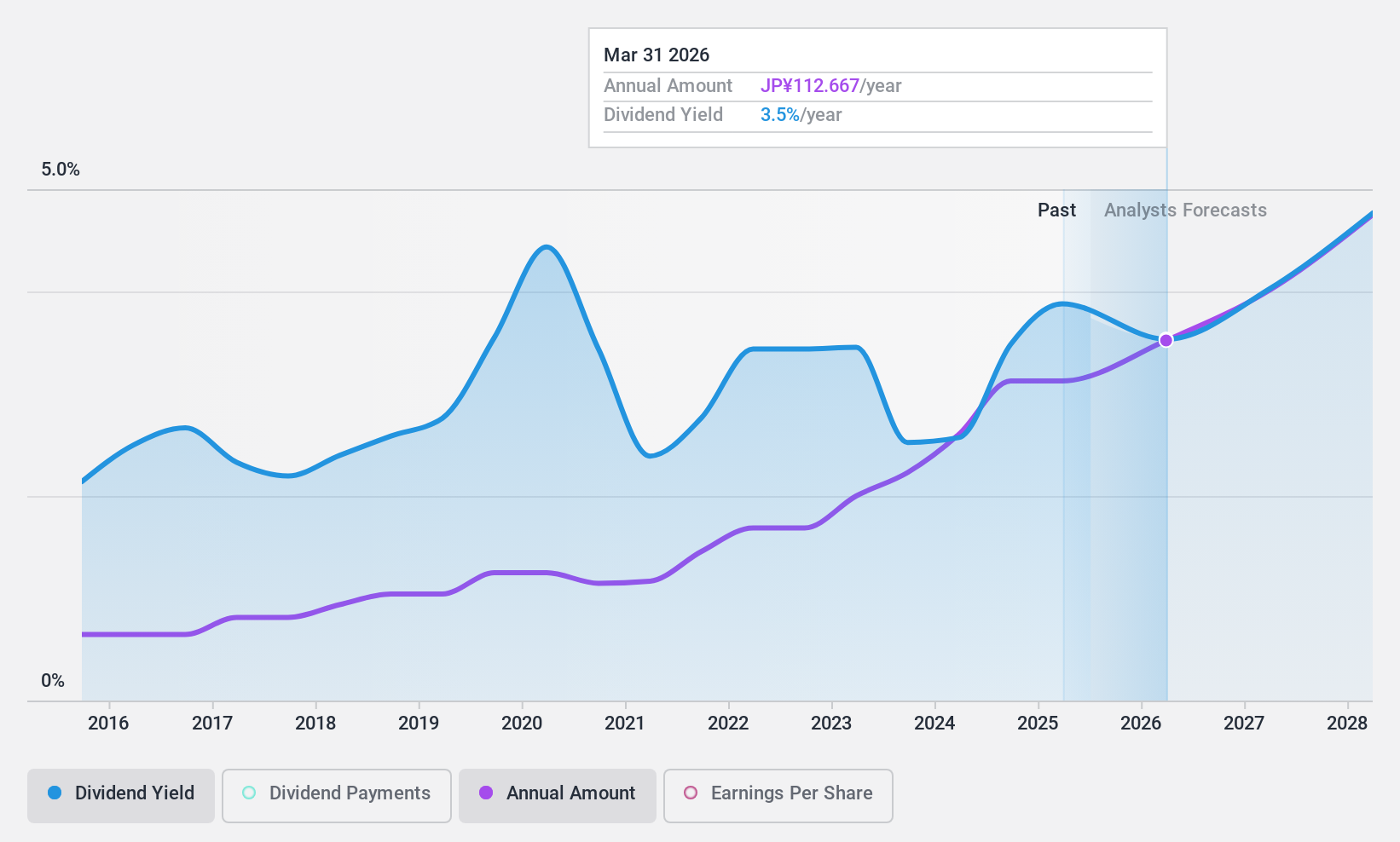

Toyota Tsusho (TSE:8015)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyota Tsusho Corporation operates globally across various sectors including metals, parts and logistics, mobility, machinery, energy and projects, chemicals and electronics, as well as food and consumer services with a market cap of ¥2.61 trillion.

Operations: Toyota Tsusho Corporation's revenue is derived from its operations in metals, parts and logistics, mobility, machinery, energy and project sectors, chemicals and electronics, along with food and consumer services.

Dividend Yield: 4%

Toyota Tsusho's dividend yield of 3.97% ranks it in the top 25% of Japanese dividend payers, supported by a low payout ratio of 44.7%, ensuring coverage by earnings and cash flows. Despite this, dividends have been volatile over the past decade with occasional significant drops. The company trades at a favorable price-to-earnings ratio of 7.9x compared to the market average, although its high debt level is a concern for long-term sustainability.

- Click here to discover the nuances of Toyota Tsusho with our detailed analytical dividend report.

- Our valuation report here indicates Toyota Tsusho may be undervalued.

Where To Now?

- Unlock our comprehensive list of 1424 Top Global Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Tsusho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8015

Toyota Tsusho

Engages in the metals, parts and logistics, mobility, machinery, energy and project, chemicals and electronics, and food and consumer services businesses worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives