- Sweden

- /

- Real Estate

- /

- OM:EAST

SOCAR And 2 Other Growth Stocks Insiders Are Betting On

Reviewed by Simply Wall St

As global markets navigate a mix of economic signals, with U.S. consumer confidence dipping and major stock indexes showing moderate gains, investors are keeping a close eye on growth stocks that insiders are backing. In such an environment, companies with high insider ownership can be particularly appealing as they suggest strong internal confidence in the business's potential for success amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

SOCAR (KOSE:A403550)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SOCAR Inc. is a mobility company based in South Korea with a market capitalization of approximately ₩597.35 billion.

Operations: The company's revenue is derived from car sharing (₩375.02 billion), micro mobility (₩24.87 billion), and platform parking services (₩8.45 billion).

Insider Ownership: 14.0%

Earnings Growth Forecast: 108.9% p.a.

SOCAR is forecasted to become profitable within three years, with earnings expected to grow significantly at 108.87% annually, surpassing the market average. Despite trading at 87.7% below its estimated fair value and analysts predicting a 46.5% stock price increase, its Return on Equity is projected to be low at 5.9%. Recent quarterly results show improved sales of KRW 117 billion and a net income turnaround from a previous loss, indicating positive momentum for the company.

- Take a closer look at SOCAR's potential here in our earnings growth report.

- Our valuation report here indicates SOCAR may be undervalued.

Eastnine (OM:EAST)

Simply Wall St Growth Rating: ★★★★★☆

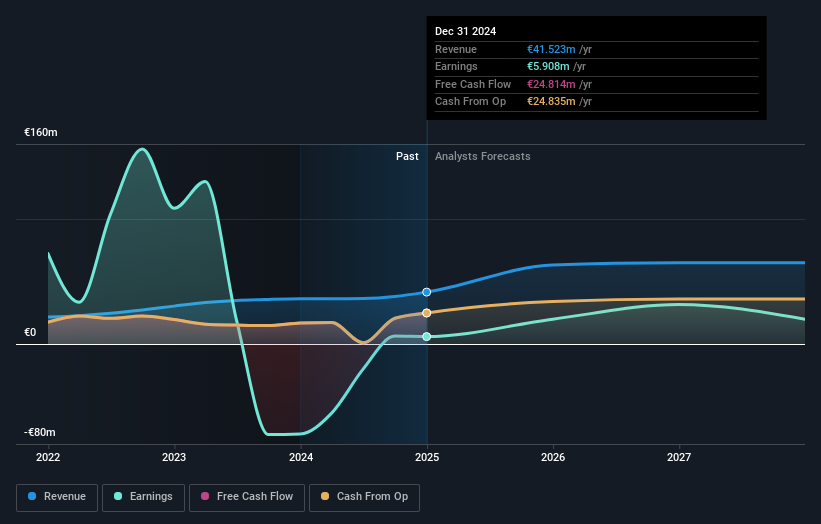

Overview: Eastnine AB (publ) is a real estate investment firm with a market cap of SEK4.16 billion.

Operations: The firm's revenue segments include €3.65 million from properties in Latvia, €10.49 million from properties in Poland, and €23.94 million from properties in Lithuania.

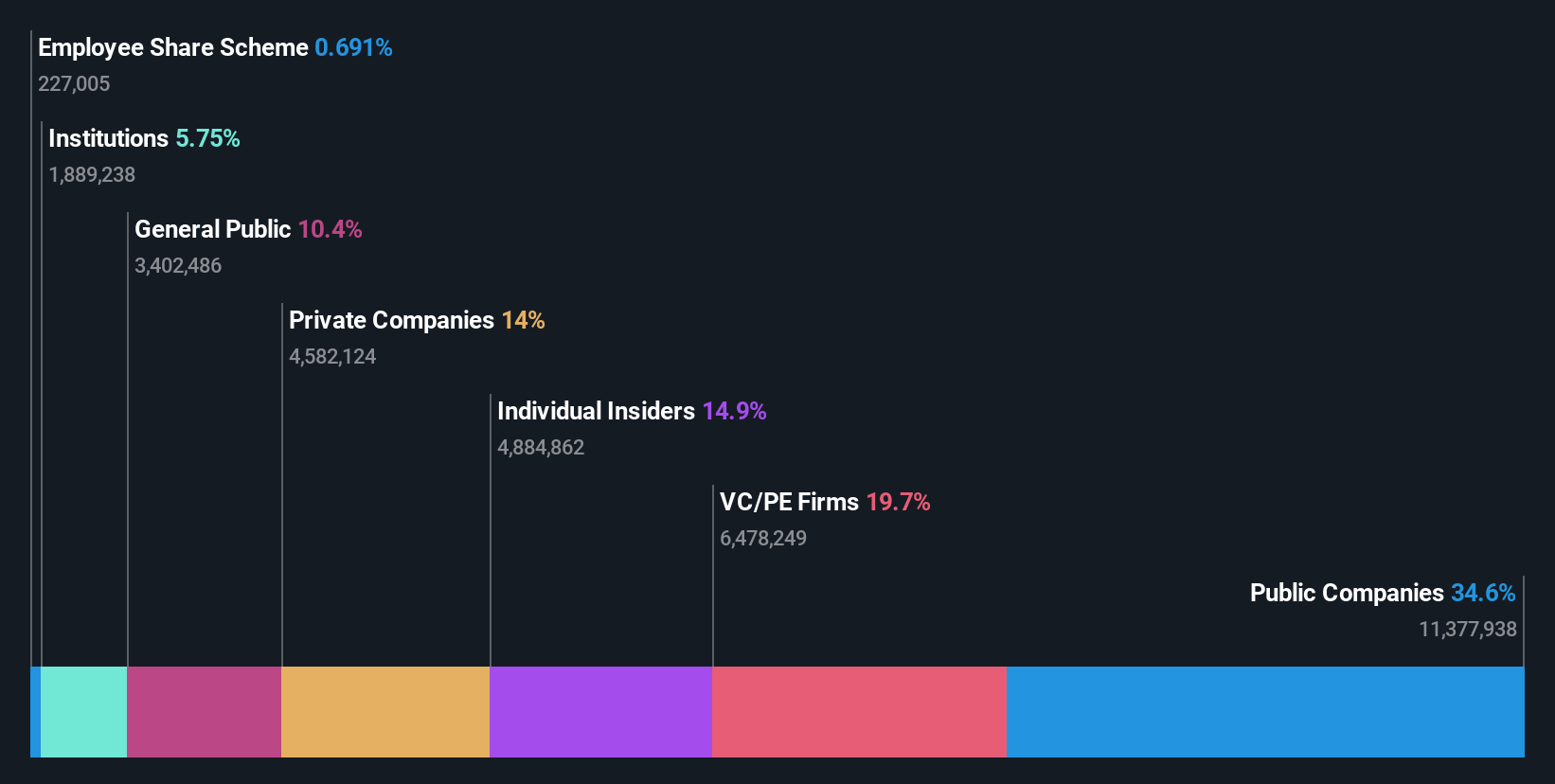

Insider Ownership: 19.9%

Earnings Growth Forecast: 62.9% p.a.

Eastnine's recent acquisition of the Warsaw Unit office tower for EUR 280 million enhances its position in Europe's growing office property market, boosting profit from property management per share by 18%. The company has seen substantial insider buying over the past three months, indicating confidence in its future. Forecasts suggest Eastnine's earnings will grow significantly at 62.92% annually, outpacing the Swedish market. However, its Return on Equity is expected to remain low at 5.7%.

- Click here to discover the nuances of Eastnine with our detailed analytical future growth report.

- Our expertly prepared valuation report Eastnine implies its share price may be too high.

Maharah for Human Resources (SASE:1831)

Simply Wall St Growth Rating: ★★★☆☆☆

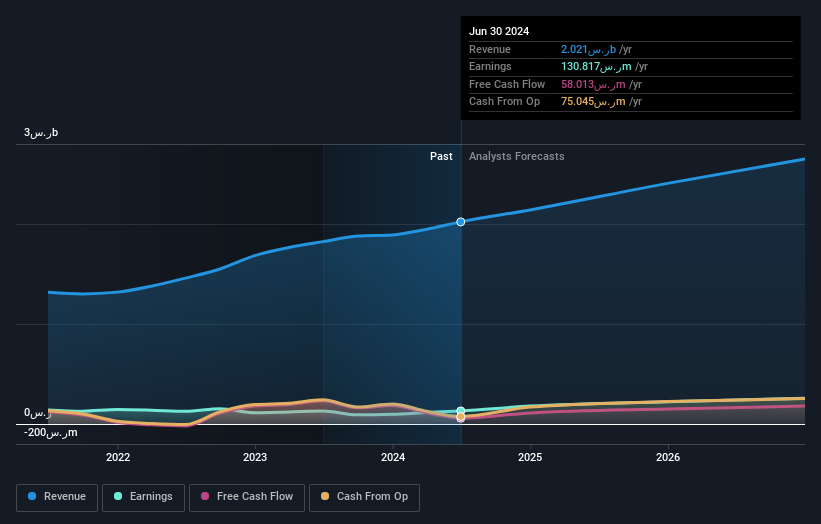

Overview: Maharah for Human Resources Company offers manpower services to both public and private sectors in Saudi Arabia and the United Arab Emirates, with a market cap of SAR2.71 billion.

Operations: The company's revenue segments include Corporate services at SAR1.54 billion, Individual services at SAR433.54 million, and Facility Management at SAR113.02 million.

Insider Ownership: 26.3%

Earnings Growth Forecast: 14.4% p.a.

Maharah for Human Resources reported Q3 2024 sales of SAR 558.4 million, up from SAR 471.49 million a year ago, while net income remained stable at SAR 24.37 million. The company’s revenue is forecast to grow at 10.7% annually, outpacing the Saudi market's decline but slower than high-growth benchmarks. Analysts expect a stock price increase of 30.6%. Despite a favorable P/E ratio of 20.5x compared to the market, interest coverage remains weak and dividend sustainability is questionable due to free cash flow constraints.

- Get an in-depth perspective on Maharah for Human Resources' performance by reading our analyst estimates report here.

- The analysis detailed in our Maharah for Human Resources valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Embark on your investment journey to our 1507 Fast Growing Companies With High Insider Ownership selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Eastnine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EAST

Good value second-rate dividend payer.

Market Insights

Community Narratives