- South Korea

- /

- Marine and Shipping

- /

- KOSE:A011200

HMM Co.,Ltd's (KRX:011200) Share Price Matching Investor Opinion

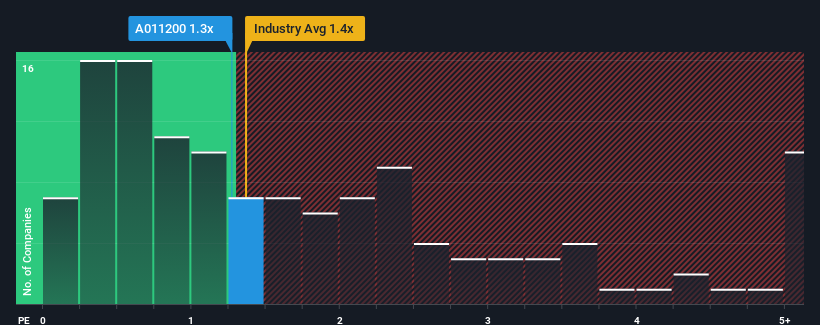

When you see that almost half of the companies in the Shipping industry in Korea have price-to-sales ratios (or "P/S") below 0.4x, HMM Co.,Ltd (KRX:011200) looks to be giving off some sell signals with its 1.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for HMMLtd

What Does HMMLtd's Recent Performance Look Like?

HMMLtd has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HMMLtd.What Are Revenue Growth Metrics Telling Us About The High P/S?

HMMLtd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 55%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 31% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 23% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 5.7%, which is noticeably less attractive.

With this in mind, it's not hard to understand why HMMLtd's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From HMMLtd's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that HMMLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Shipping industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for HMMLtd that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if HMMLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011200

HMMLtd

An integrated logistics company, provides shipping and logistics services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives