- South Korea

- /

- Infrastructure

- /

- KOSE:A004140

While shareholders of Dongbang Transport Logistics (KRX:004140) are in the red over the last three years, underlying earnings have actually grown

Dongbang Transport Logistics Co., Ltd. (KRX:004140) shareholders should be happy to see the share price up 11% in the last week. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 31% in the last three years, significantly under-performing the market.

On a more encouraging note the company has added ₩11b to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for Dongbang Transport Logistics

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, Dongbang Transport Logistics actually saw its earnings per share (EPS) improve by 19% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The modest 0.9% dividend yield is unlikely to be guiding the market view of the stock. Revenue is actually up 11% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Dongbang Transport Logistics more closely, as sometimes stocks fall unfairly. This could present an opportunity.

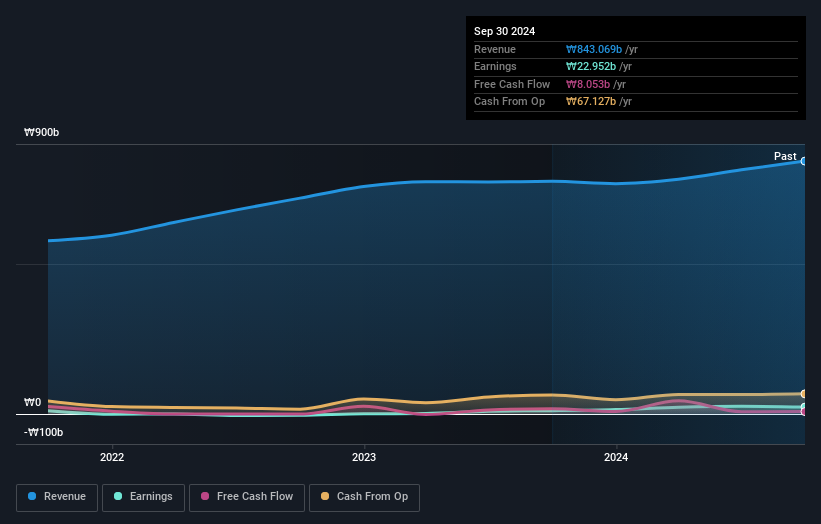

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Dongbang Transport Logistics' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Dongbang Transport Logistics shareholders have received a total shareholder return of 8.3% over one year. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 3% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Dongbang Transport Logistics (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A004140

Dongbang Transport Logistics

Engages in the operation of ports in South Korea and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives