- South Korea

- /

- Logistics

- /

- KOSE:A002320

Hanjin Transportation Co., Ltd. (KRX:002320) Will Pay A ₩500 Dividend In Four Days

It looks like Hanjin Transportation Co., Ltd. (KRX:002320) is about to go ex-dividend in the next four days. Ex-dividend means that investors that purchase the stock on or after the 29th of December will not receive this dividend, which will be paid on the 24th of April.

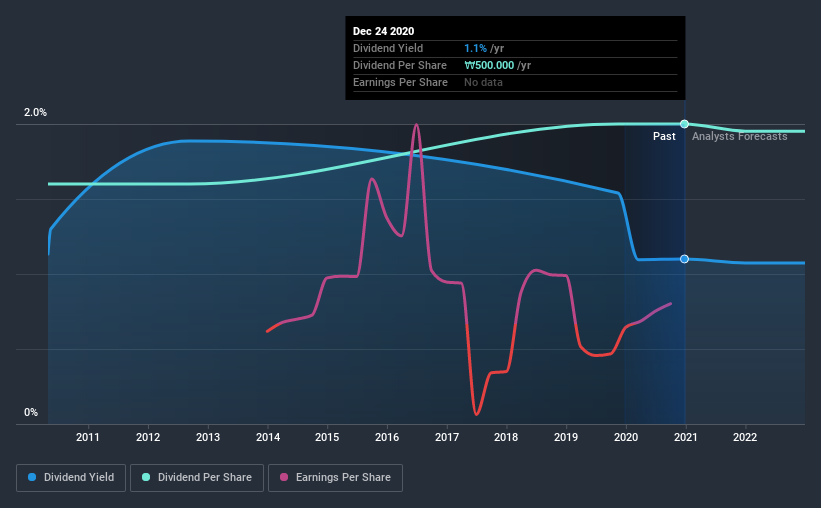

Hanjin Transportation's next dividend payment will be ₩500 per share. Last year, in total, the company distributed ₩500 to shareholders. Based on the last year's worth of payments, Hanjin Transportation stock has a trailing yield of around 1.1% on the current share price of ₩45450. If you buy this business for its dividend, you should have an idea of whether Hanjin Transportation's dividend is reliable and sustainable. So we need to investigate whether Hanjin Transportation can afford its dividend, and if the dividend could grow.

View our latest analysis for Hanjin Transportation

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. That's why it's good to see Hanjin Transportation paying out a modest 31% of its earnings. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. The good news is it paid out just 20% of its free cash flow in the last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. Readers will understand then, why we're concerned to see Hanjin Transportation's earnings per share have dropped 15% a year over the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last 10 years, Hanjin Transportation has lifted its dividend by approximately 2.3% a year on average.

To Sum It Up

Is Hanjin Transportation worth buying for its dividend? Hanjin Transportation has comfortably low cash and profit payout ratios, which may mean the dividend is sustainable even in the face of a sharp decline in earnings per share. Still, we consider declining earnings to be a warning sign. All things considered, we are not particularly enthused about Hanjin Transportation from a dividend perspective.

While it's tempting to invest in Hanjin Transportation for the dividends alone, you should always be mindful of the risks involved. To that end, you should learn about the 3 warning signs we've spotted with Hanjin Transportation (including 1 which shouldn't be ignored).

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Hanjin Transportation, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Hanjin Transportation, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hanjin Transportation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A002320

Hanjin Transportation

Provides transportation and logistics services in South Korea and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives