- South Korea

- /

- Industrials

- /

- KOSDAQ:A052300

Here's Why We Don't Think W Holding Company's (KOSDAQ:052300) Statutory Earnings Reflect Its Underlying Earnings Potential

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding W Holding Company (KOSDAQ:052300).

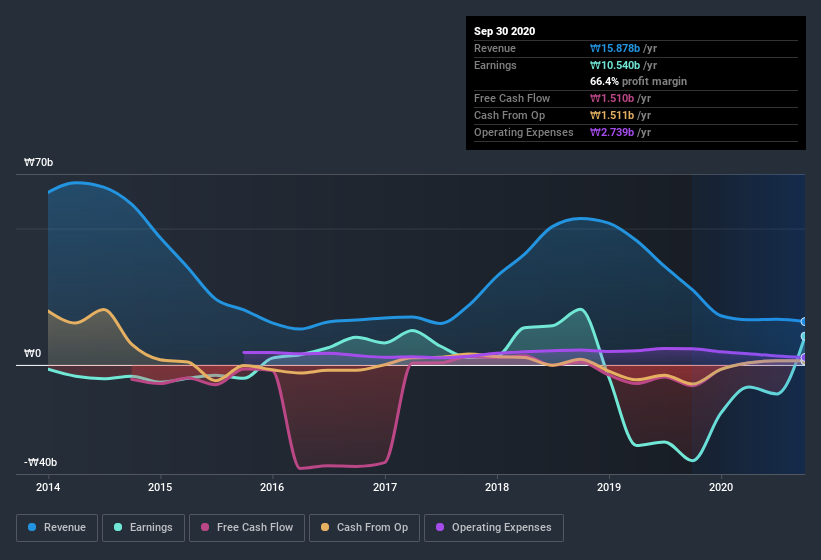

While W Holding Company was able to generate revenue of ₩15.9b in the last twelve months, we think its profit result of ₩10.5b was more important.

Check out our latest analysis for W Holding Company

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. Therefore, today we will consider the nature of W Holding Company's statutory earnings with reference to its dilution of shareholders and the impact of unusual items. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of W Holding Company.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. W Holding Company expanded the number of shares on issue by 59% over the last year. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of W Holding Company's EPS by clicking here.

How Is Dilution Impacting W Holding Company's Earnings Per Share? (EPS)

We don't have any data on the company's profits from three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. So you can see that the dilution has had a fairly significant impact on shareholders.

If W Holding Company's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that W Holding Company's profit was boosted by unusual items worth ₩34b in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. W Holding Company had a rather significant contribution from unusual items relative to its profit to September 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On W Holding Company's Profit Performance

To sum it all up, W Holding Company got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. On reflection, the above-mentioned factors give us the strong impression that W Holding Company'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. If you want to do dive deeper into W Holding Company, you'd also look into what risks it is currently facing. Be aware that W Holding Company is showing 4 warning signs in our investment analysis and 1 of those is potentially serious...

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade W Holding Company, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A052300

Ocean In WLtd

Engages in the glass, logistics, and real estate leasing businesses.

Flawless balance sheet and fair value.