- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A007660

Why Investors Shouldn't Be Surprised By ISU Petasys Co., Ltd.'s (KRX:007660) 26% Share Price Surge

The ISU Petasys Co., Ltd. (KRX:007660) share price has done very well over the last month, posting an excellent gain of 26%. The last month tops off a massive increase of 223% in the last year.

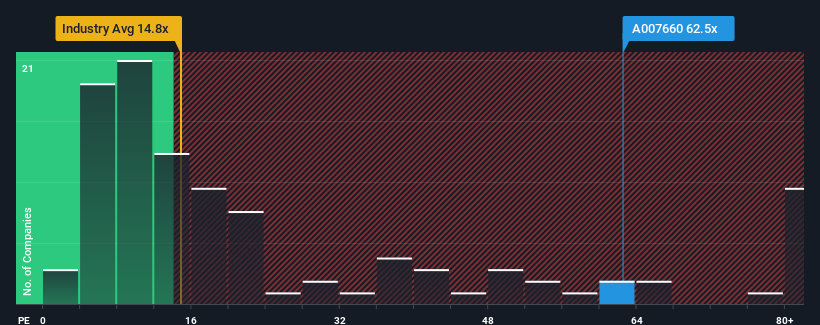

Following the firm bounce in price, ISU Petasys' price-to-earnings (or "P/E") ratio of 62.5x might make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 12x and even P/E's below 6x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

ISU Petasys has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for ISU Petasys

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like ISU Petasys' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 52%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 368% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 53% per year over the next three years. With the market only predicted to deliver 18% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that ISU Petasys' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On ISU Petasys' P/E

Shares in ISU Petasys have built up some good momentum lately, which has really inflated its P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of ISU Petasys' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with ISU Petasys (at least 1 which can't be ignored), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on ISU Petasys, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A007660

ISU Petasys

Manufactures and sells printed circuit boards (PCBs) worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives