- China

- /

- Tech Hardware

- /

- SZSE:000066

High Growth Tech Stocks In Asia To Watch May 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by easing trade tensions and mixed economic indicators, Asia's tech sector remains a focal point for investors seeking growth opportunities. With small- and mid-cap indexes showing resilience, identifying promising high-growth tech stocks in the region requires careful consideration of companies' ability to adapt to shifting trade policies and their potential to capitalize on emerging technological trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.00% | 28.07% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 28.40% | 29.29% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 21.74% | 25.00% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| HFR | 33.91% | 111.76% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★☆

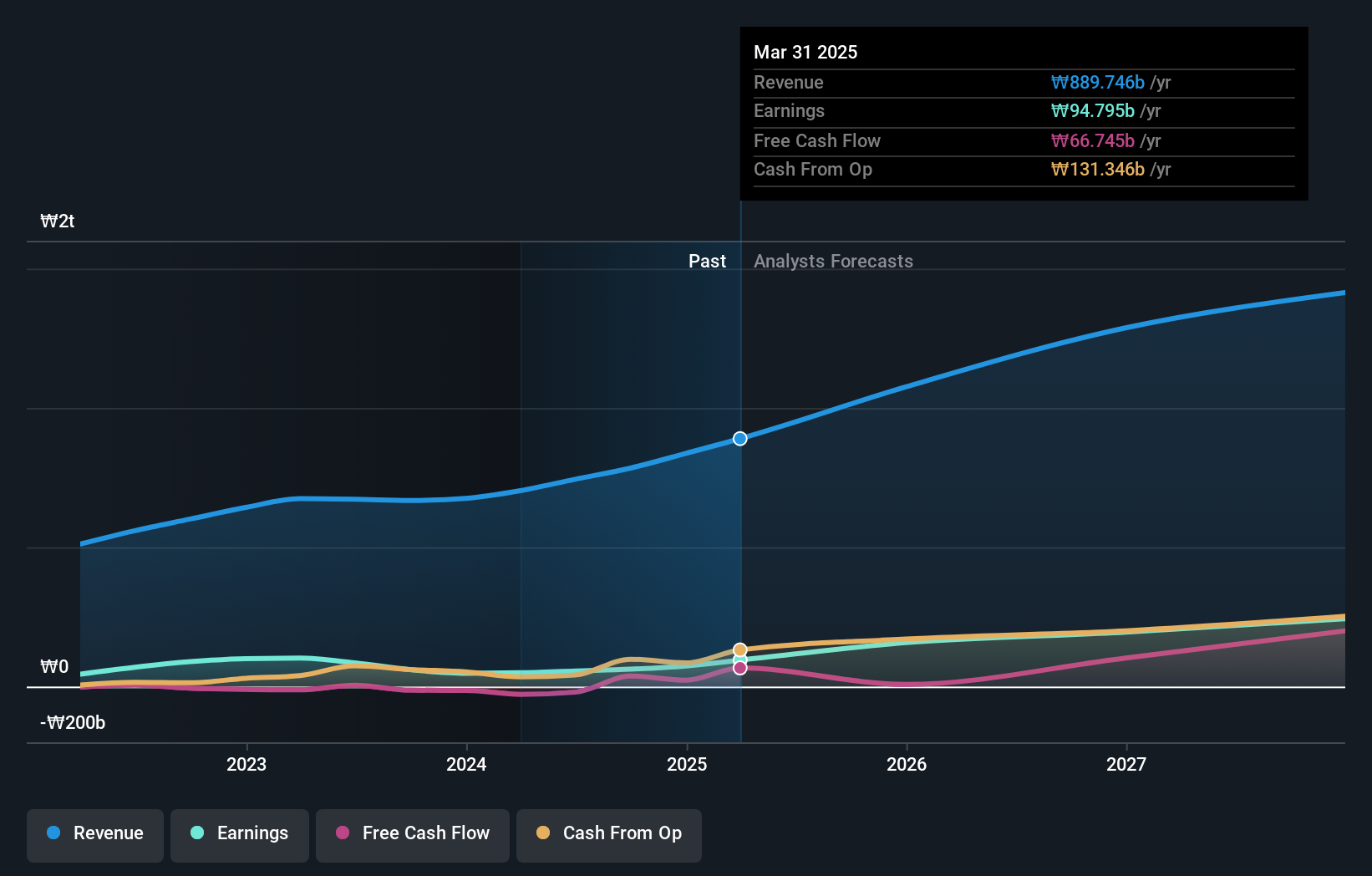

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs) with a market capitalization of ₩2.32 trillion.

Operations: ISU Petasys focuses on the manufacture and sale of printed circuit boards (PCBs), generating revenue of approximately ₩836.87 billion.

ISU Petasys, a dynamic player in the tech sector, recently bolstered its financial muscle through a substantial equity offering amounting to KRW 282.53 billion, earmarked for strategic expansions and ESOP initiatives. This move underscores its aggressive growth strategy, complemented by an impressive annual earnings growth forecast of 34.1%, significantly outpacing the broader Korean market's 21.2%. Despite a high debt level which poses challenges, the company has demonstrated robust financial health with a notable earnings increase of 55.1% over the past year and positive free cash flow. Furthermore, ISU Petasys's commitment to enhancing investor relations is evident from its active engagement in conferences and investor calls, positioning it well for sustained growth amidst volatile market conditions.

China Greatwall Technology Group (SZSE:000066)

Simply Wall St Growth Rating: ★★★★☆☆

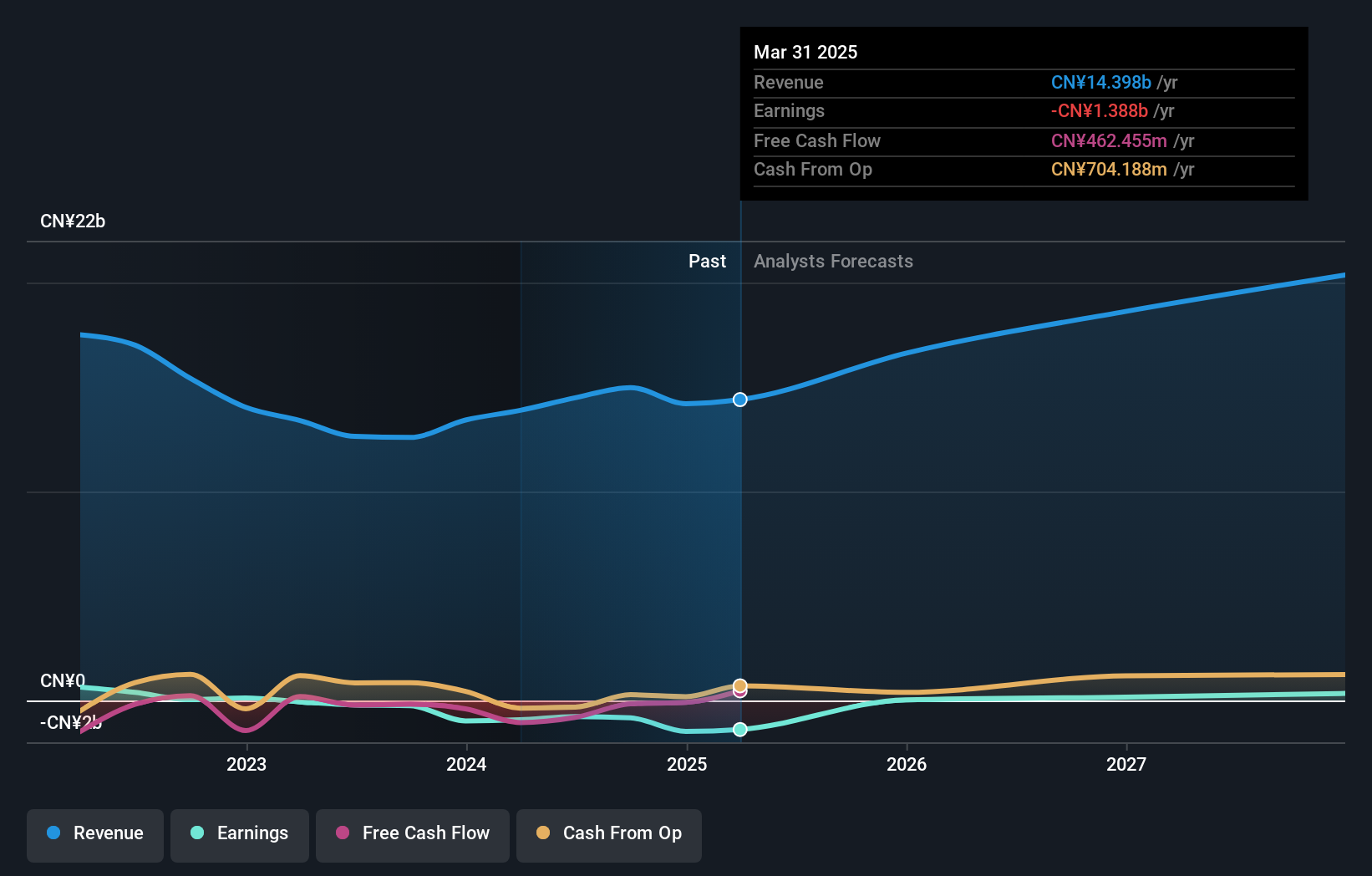

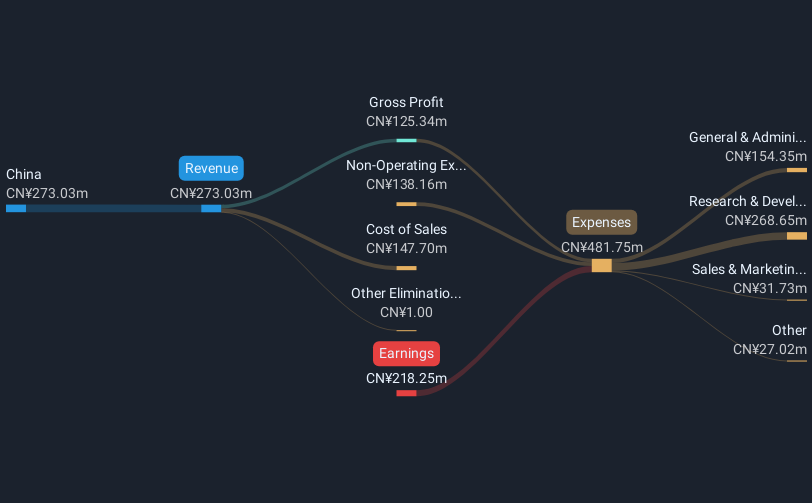

Overview: China Greatwall Technology Group Co., Ltd. is a prominent player in the technology sector with a market cap of CN¥47.16 billion, focusing on providing integrated IT solutions and services.

Operations: The company generates revenue primarily through the sale of IT products and services, leveraging its expertise in integrated solutions. With a market cap of CN¥47.16 billion, it plays a significant role in the technology industry.

Despite recent challenges, China Greatwall Technology Group shows signs of resilience and potential in the tech sector. In 2024, the company's sales increased to CNY 14.2 billion from CNY 13.42 billion the previous year, indicating a growth trajectory amidst a net loss reduction in Q1 2025 compared to the same period last year—from CNY 249.82 million to CNY 159.52 million. This improvement aligns with an aggressive share repurchase strategy where it bought back shares worth CNY 166.19 million, reflecting confidence in its future prospects and commitment to enhancing shareholder value.

Jushri Technologies (SZSE:300762)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jushri Technologies, INC. specializes in the development, production, and after-sales service of communication equipment and has a market capitalization of CN¥12.84 billion.

Operations: Jushri Technologies focuses on communication equipment, generating revenue through development, production, and after-sales services. The company has a market capitalization of CN¥12.84 billion.

Jushri Technologies has demonstrated robust growth with a notable 47.9% annual increase in revenue, outpacing the broader Chinese market's growth of 12.6%. This surge is coupled with an impressive earnings forecast, set to climb by 86.9% annually. The firm's commitment to innovation is evident from its strategic allocation of funds towards R&D, which stands at CNY 20 million this year, making up approximately 16% of their total revenue—a significant investment indicating a strong focus on future technologies and market leadership. Moreover, the recent first-quarter results for 2025 showed a turnaround from a net loss last year to a net income of CNY 13.23 million, underscoring potential for sustained profitability and investor confidence in its operational strategies and market position.

Where To Now?

- Access the full spectrum of 486 Asian High Growth Tech and AI Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade China Greatwall Technology Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000066

China Greatwall Technology Group

China Greatwall Technology Group Co., Ltd.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives