- China

- /

- Electronic Equipment and Components

- /

- SZSE:000636

High Growth Tech Stocks in Asia for October 2025

Reviewed by Simply Wall St

As global markets navigate a volatile landscape marked by easing monetary policies and fluctuating trade tensions, Asian tech stocks continue to capture investor interest with their potential for high growth. In this environment, identifying promising tech stocks involves assessing factors such as innovation in artificial intelligence and resilience amidst economic uncertainties.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 34.27% | 44.80% | ★★★★★★ |

| Eoptolink Technology | 38.08% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| ASROCK Incorporation | 28.31% | 29.76% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

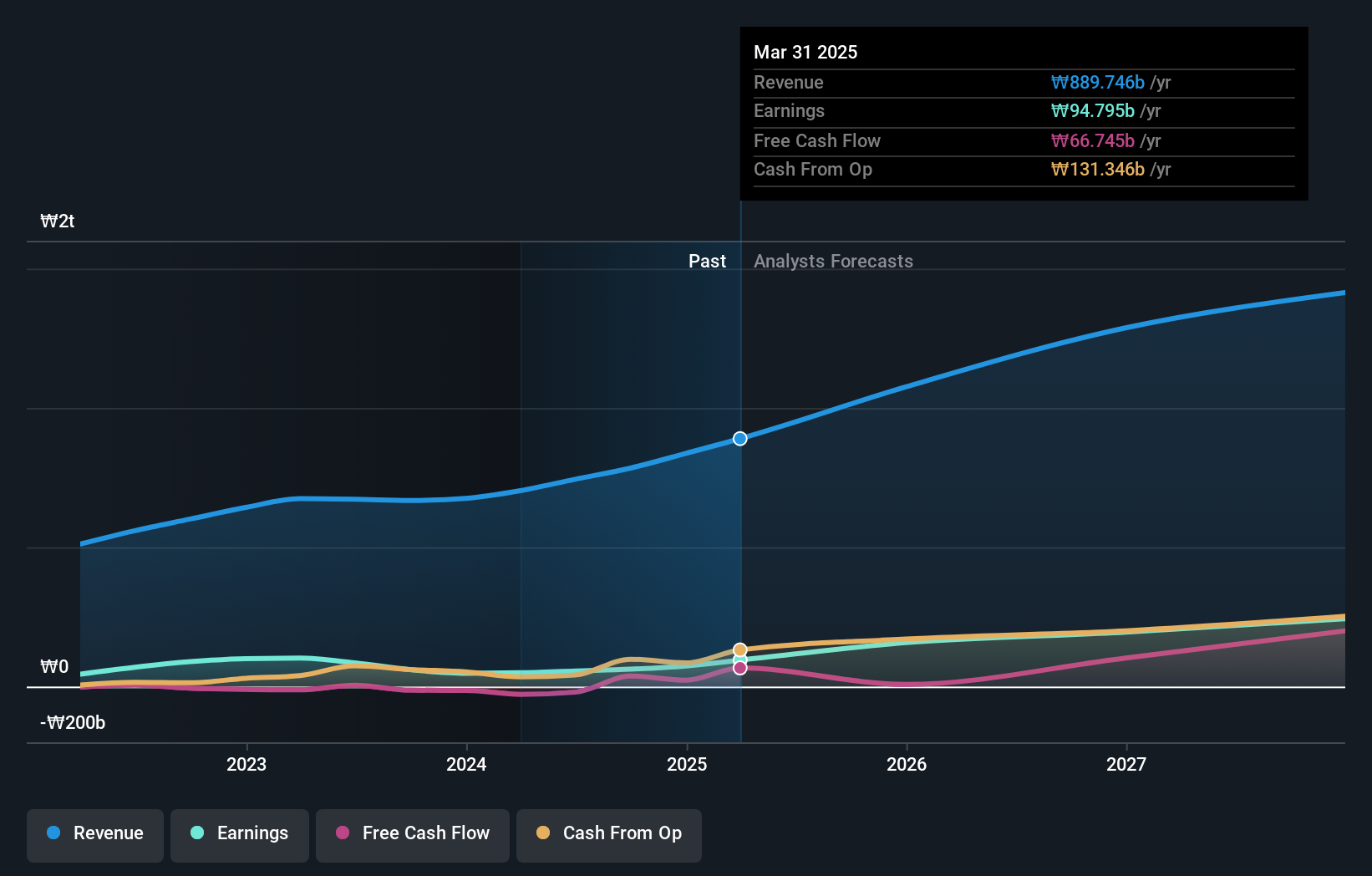

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★★

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs) with a market capitalization of ₩6.23 trillion.

Operations: ISU Petasys focuses on the production and distribution of printed circuit boards (PCBs) globally, generating revenue of ₩926.43 billion from this segment.

ISU Petasys, a standout in the Asian tech landscape, has demonstrated robust growth with its earnings surging by 85.9% over the past year. The company's commitment to innovation is evident from its R&D investments, crucial for maintaining its competitive edge in the fast-evolving electronics sector. With annual revenue and earnings forecasted to grow at 20% and 31.7% respectively, ISU Petasys not only outpaces the Korean market average but also shows potential for substantial market share expansion. Recent strategic discussions during their Q2 business review highlighted shifts towards enhancing product offerings which could further solidify their position in high-tech industries. Looking ahead, with a projected Return on Equity of 29.9%, ISU Petasys appears well-poised for continued success in a challenging yet lucrative market environment.

- Dive into the specifics of ISU Petasys here with our thorough health report.

Assess ISU Petasys' past performance with our detailed historical performance reports.

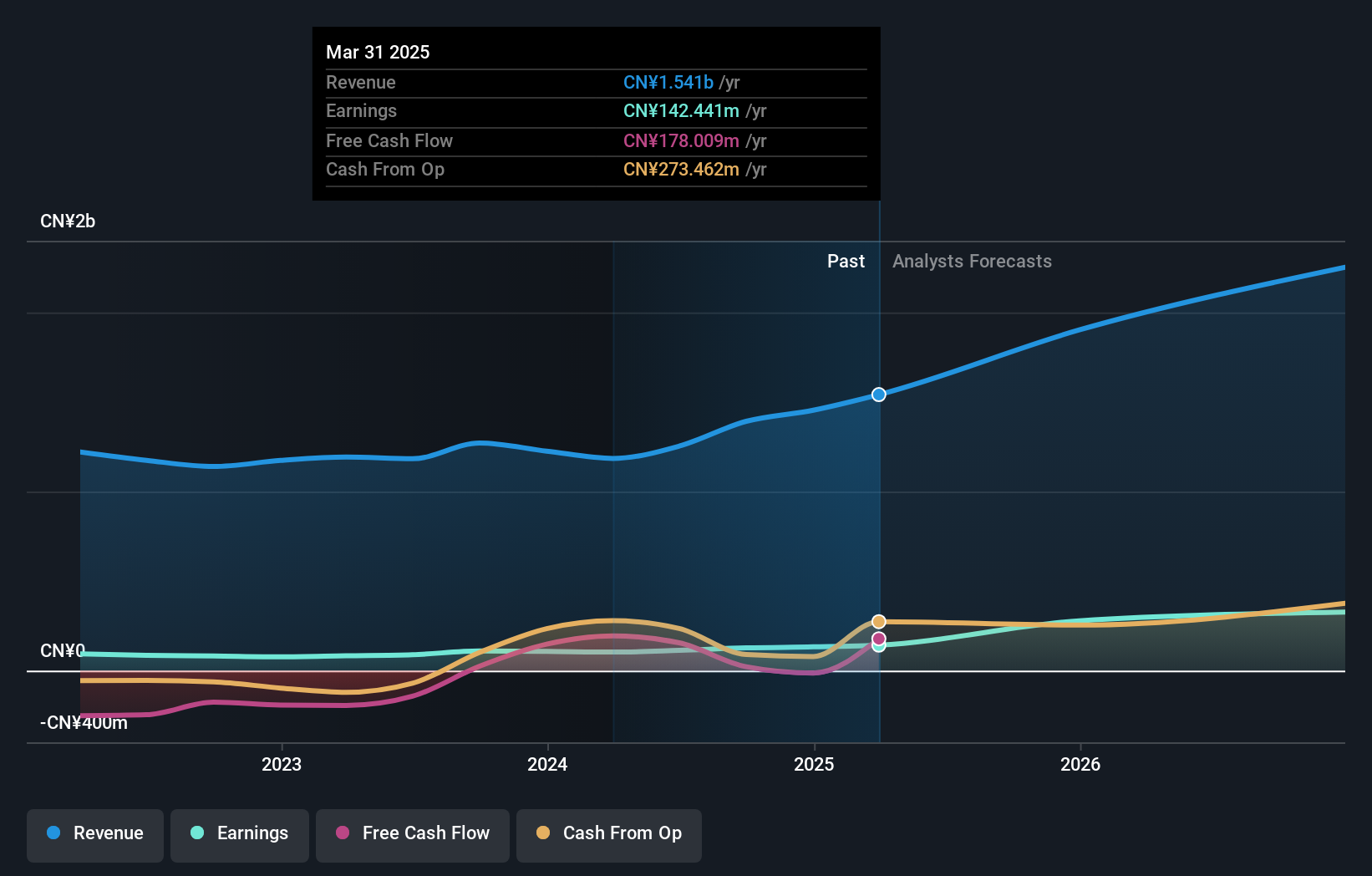

Shenzhen JPT Opto-Electronics (SHSE:688025)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen JPT Opto-Electronics Co., Ltd. focuses on the R&D, production, sale, and technical services of laser, intelligent equipment, and optical devices with a market cap of CN¥12.50 billion.

Operations: JPT Opto-Electronics generates revenue primarily from its Computer Communications and Other Electronic Equipment segment, reporting CN¥1.74 billion in this area. The company's focus on laser technology and optical devices supports its operations across these sectors.

Shenzhen JPT Opto-Electronics has shown impressive growth, with a 53% increase in earnings over the past year, outpacing the electronic industry's average of 4.2%. This surge is supported by significant R&D investments that have fueled innovations in opto-electronic solutions. Despite a volatile share price recently, their financial performance includes a robust half-year revenue jump to CNY 880.61 million from CNY 593.63 million, alongside net income rising to CNY 95.21 million from CNY 54.77 million previously. These figures underscore their potential in a competitive sector where technological advancement is critical.

Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangdong Fenghua Advanced Technology (Holding) Co., Ltd. is a company involved in the production and distribution of electronic components and parts, with a market capitalization of approximately CN¥17.07 billion.

Operations: The company generates revenue primarily from the electronic components and parts segment, totaling approximately CN¥5.32 billion.

Guangdong Fenghua Advanced Technology has demonstrated resilience with a notable 17.9% increase in revenue, reaching CNY 2.77 billion this half-year, up from CNY 2.39 billion previously. Despite a slight dip in net income to CNY 166.83 million from CNY 207.24 million, the company's commitment to innovation is evident in its strategic board changes and project investments aimed at enhancing technological capabilities. With earnings expected to grow by an impressive 34% annually, Fenghua's focus on R&D and operational adjustments positions it well within the competitive tech landscape of Asia.

Next Steps

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 183 more companies for you to explore.Click here to unveil our expertly curated list of 186 Asian High Growth Tech and AI Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000636

Guangdong Fenghua Advanced Technology (Holding)

Guangdong Fenghua Advanced Technology (Holding) Co., Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)