- Thailand

- /

- Specialty Stores

- /

- SET:MRDIYT

Asian Market Value Stocks Estimated Below Intrinsic Worth In December 2025

Reviewed by Simply Wall St

As global markets closely watch the Federal Reserve's final meeting of the year, Asian indices have been navigating a complex landscape marked by mixed economic signals and evolving monetary policies. In this context, identifying undervalued stocks becomes crucial as investors seek opportunities that may be trading below their intrinsic worth, offering potential for growth amid uncertain market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥154.22 | CN¥302.65 | 49% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥83.18 | CN¥161.78 | 48.6% |

| Sinolong New Materials (SZSE:301565) | CN¥28.14 | CN¥55.48 | 49.3% |

| Meitu (SEHK:1357) | HK$7.47 | HK$14.60 | 48.8% |

| Last One MileLtd (TSE:9252) | ¥3530.00 | ¥6867.62 | 48.6% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩29250.00 | ₩56972.54 | 48.7% |

| East Buy Holding (SEHK:1797) | HK$20.44 | HK$40.26 | 49.2% |

| COVER (TSE:5253) | ¥1562.00 | ¥3094.02 | 49.5% |

| China Ruyi Holdings (SEHK:136) | HK$2.41 | HK$4.80 | 49.8% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.28 | CN¥55.83 | 49.3% |

Let's take a closer look at a couple of our picks from the screened companies.

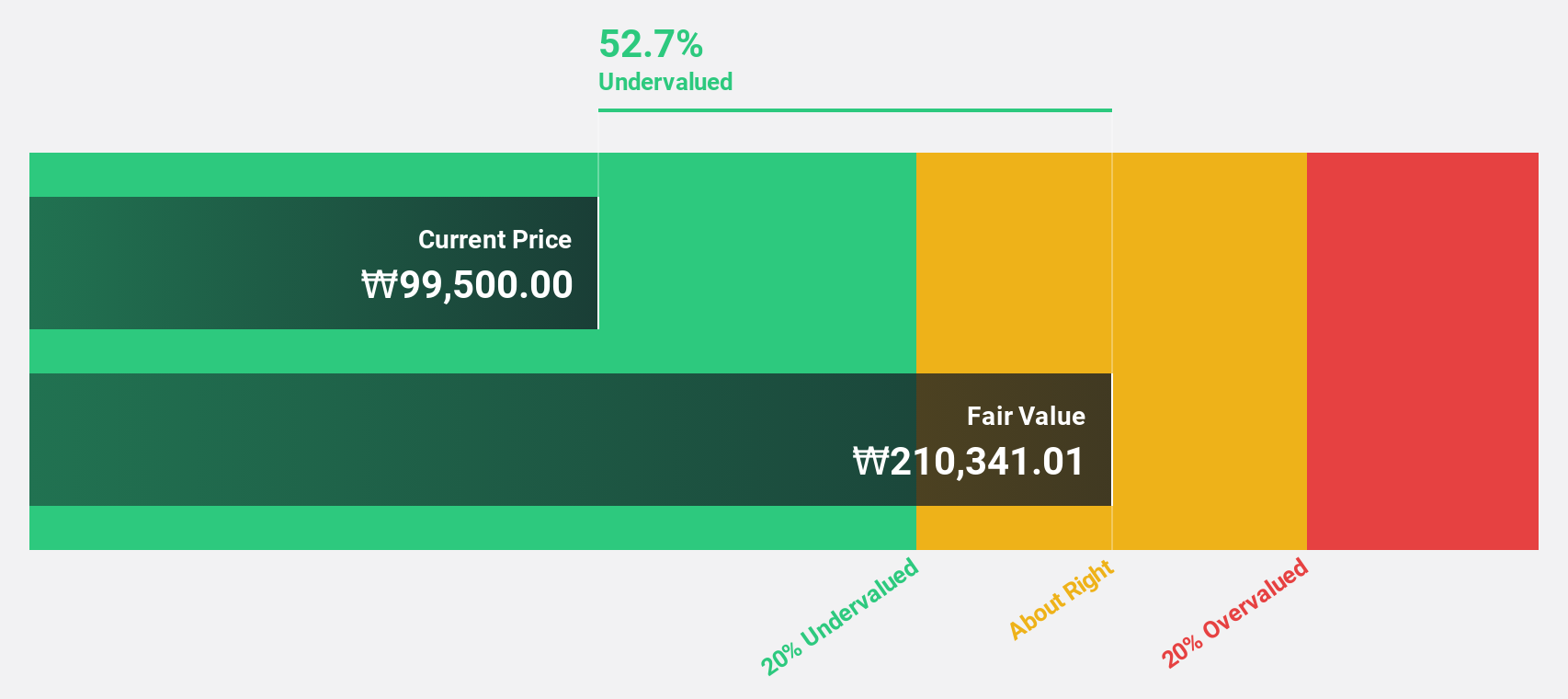

Samsung Electronics (KOSE:A005930)

Overview: Samsung Electronics Co., Ltd. operates globally in consumer electronics, information technology and mobile communications, and device solutions, with a market cap of ₩716.36 trillion.

Operations: The company's revenue segments include Device Experience (DX) at ₩184.19 billion, Device Solutions (DS) at ₩116.22 billion, SDC at ₩28.47 million, and Harman at ₩15.13 million.

Estimated Discount To Fair Value: 44.5%

Samsung Electronics is trading at ₩109,500, significantly below its estimated fair value of ₩197,471.64. The company's earnings are projected to grow at 31.6% annually, outpacing the Korean market's average growth rate of 28.9%. Despite recent legal challenges resulting in substantial financial penalties and a dividend decrease to KRW 363 per share for Q1 2026, Samsung's strategic alliances with NVIDIA and OpenAI highlight its robust position in AI-driven semiconductor manufacturing and technology development.

- The analysis detailed in our Samsung Electronics growth report hints at robust future financial performance.

- Click here to discover the nuances of Samsung Electronics with our detailed financial health report.

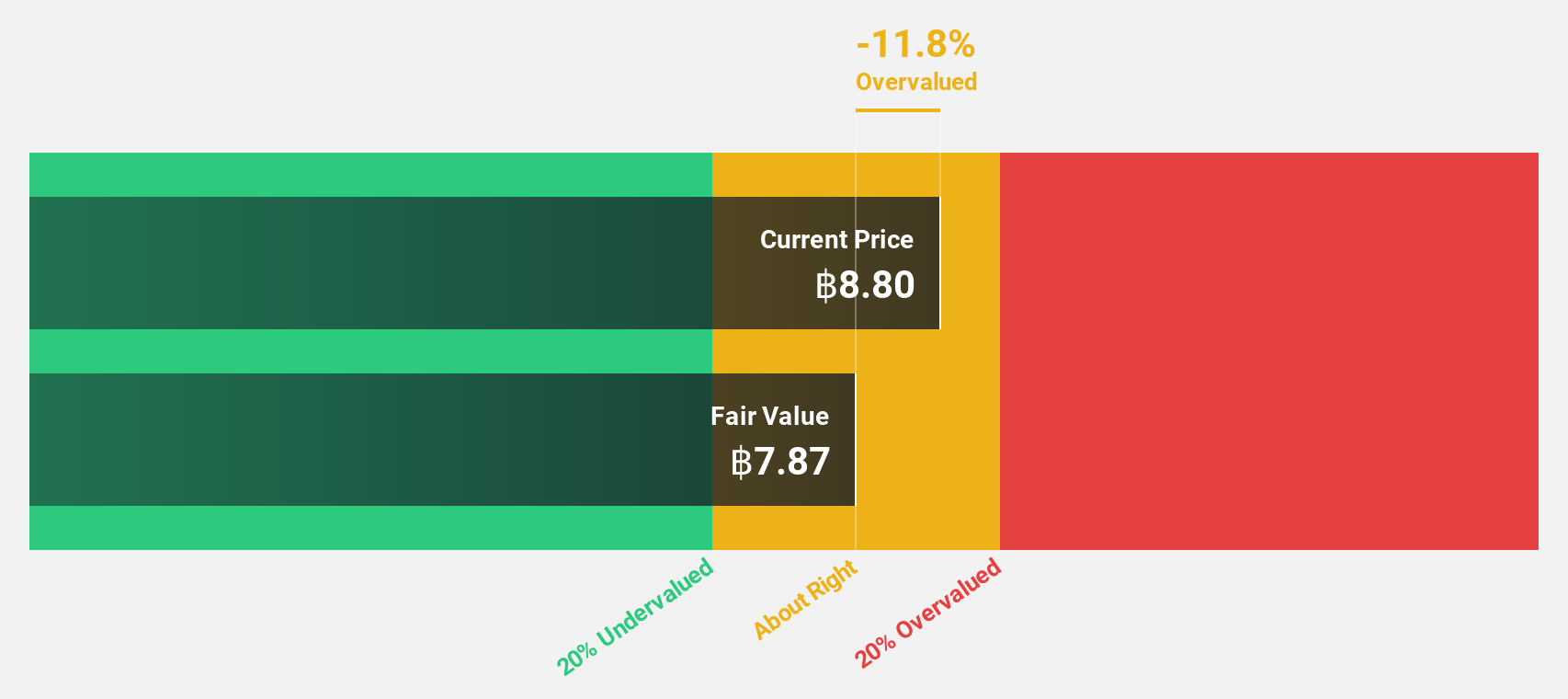

MR. D.I.Y. Holding (Thailand) (SET:MRDIYT)

Overview: MR. D.I.Y. Holding (Thailand) Public Company Limited operates as a home improvement and lifestyle retailer in Thailand, with a market capitalization of approximately THB55.96 billion.

Operations: The company generates revenue primarily from its retail segment in consumer products, totaling THB19.07 billion.

Estimated Discount To Fair Value: 18.4%

MR. D.I.Y. Holding (Thailand) is trading at THB 9.3, below its estimated fair value of THB 11.4, suggesting it may be undervalued based on cash flows. The company's earnings grew by 50.9% over the past year and are forecast to grow at 17.4% annually, outpacing the Thai market's growth rate of 12.7%. Recent earnings reports show increased sales and net income compared to last year, indicating strong operational performance despite high share illiquidity.

- The growth report we've compiled suggests that MR. D.I.Y. Holding (Thailand)'s future prospects could be on the up.

- Navigate through the intricacies of MR. D.I.Y. Holding (Thailand) with our comprehensive financial health report here.

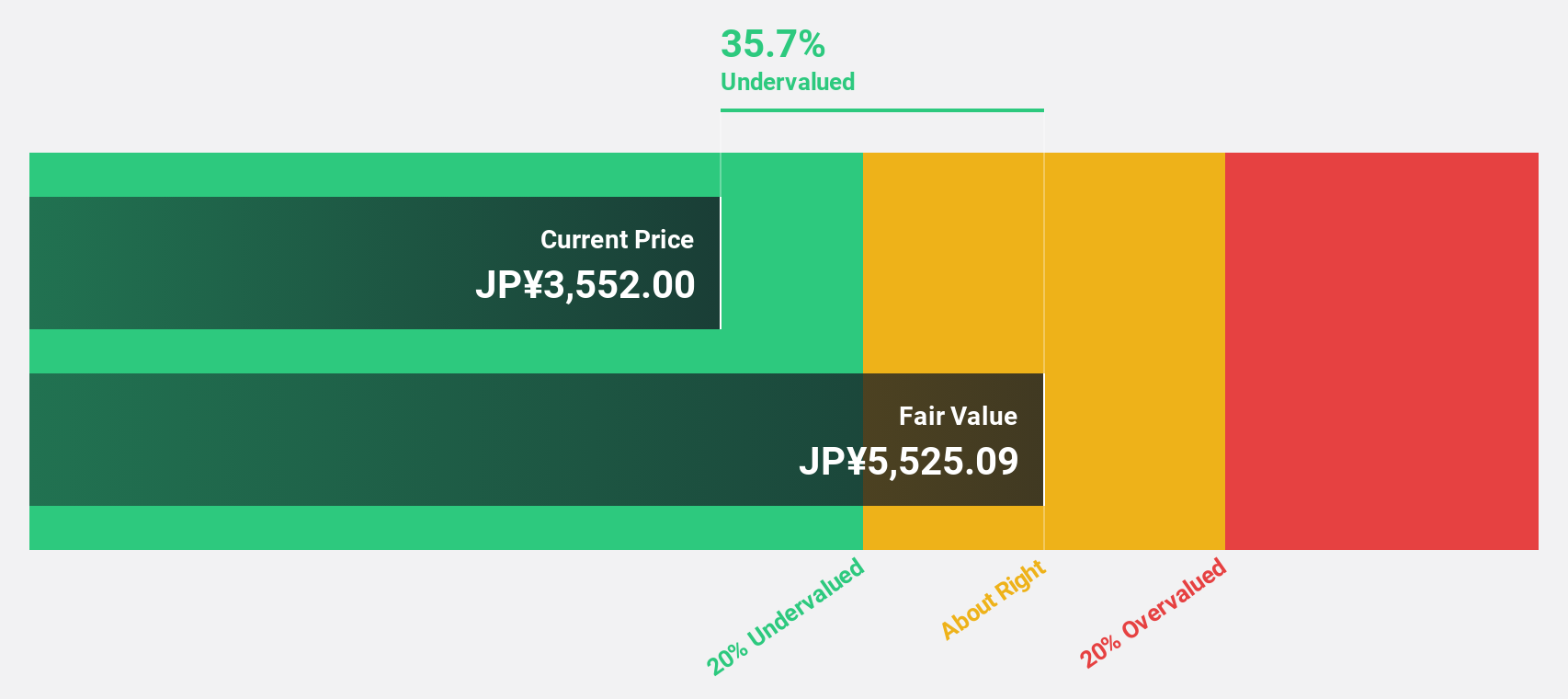

Fuji Media Holdings (TSE:4676)

Overview: Fuji Media Holdings, Inc. operates primarily in broadcasting activities in Japan through its subsidiaries and has a market cap of approximately ¥738.56 billion.

Operations: The company's revenue primarily comes from its Media Content Business, generating ¥346.44 billion, and its Urban Development/Tourism Business, contributing ¥178.43 billion.

Estimated Discount To Fair Value: 36.3%

Fuji Media Holdings is trading at ¥3,559, significantly below its estimated fair value of ¥5,587.5, highlighting potential undervaluation based on cash flows. The company has announced a share buyback program worth ¥50 billion to enhance shareholder returns and capital efficiency. Despite recent challenges in TV advertising revenue due to an incident at Fuji TV, the company's profitability is improving through cost control measures and recovering ad revenues. Earnings are forecasted to grow 34.95% annually over the next few years.

- In light of our recent growth report, it seems possible that Fuji Media Holdings' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Fuji Media Holdings' balance sheet health report.

Make It Happen

- Unlock our comprehensive list of 277 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:MRDIYT

MR. D.I.Y. Holding (Thailand)

Operates as a home improvement and lifestyle retailer in Thailand.

Outstanding track record with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>