- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A290740

We're Not So Sure You Should Rely on ActRO's (KOSDAQ:290740) Statutory Earnings

As a general rule, we think profitable companies are less risky than companies that lose money. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. This article will consider whether ActRO's (KOSDAQ:290740) statutory profits are a good guide to its underlying earnings.

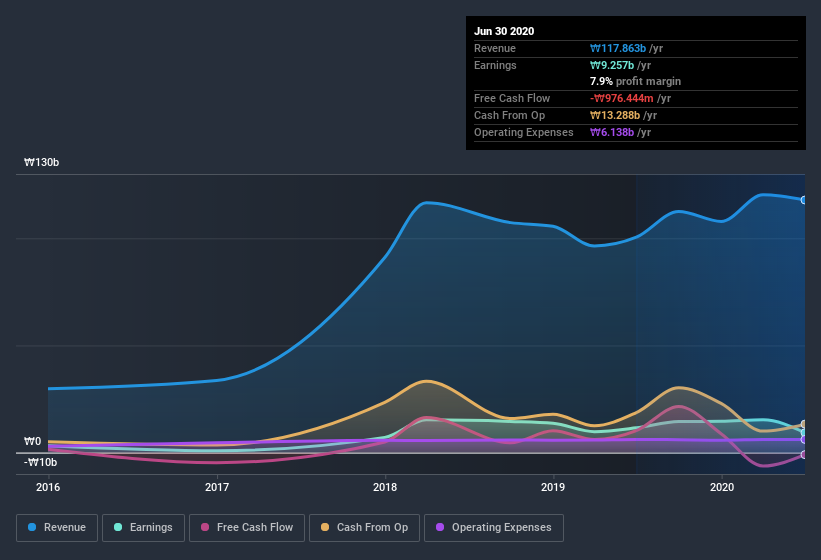

While ActRO was able to generate revenue of ₩117.9b in the last twelve months, we think its profit result of ₩9.26b was more important. Happily, it has grown both its profit and revenue over the last three years (though we note its profit is down over the last year).

Check out our latest analysis for ActRO

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. Therefore, we think it's worth taking a closer look at ActRO's cashflow, as well as examining the impact that a tax benefit and unusual items have had on its reported profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of ActRO.

A Closer Look At ActRO's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Over the twelve months to June 2020, ActRO recorded an accrual ratio of 0.31. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. In the last twelve months it actually had negative free cash flow, with an outflow of ₩976m despite its profit of ₩9.26b, mentioned above. We saw that FCF was ₩10b a year ago though, so ActRO has at least been able to generate positive FCF in the past. Having said that it seems that a recent tax benefit and some unusual items have impacted its profit (and this its accrual ratio).

How Do Unusual Items Influence Profit?

ActRO's profit suffered from unusual items, which reduced profit by ₩677m in the last twelve months. In the case where this was a non-cash charge it would have made it easier to have high cash conversion, so it's surprising that the accrual ratio tells a different story. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. Assuming those unusual expenses don't come up again, we'd therefore expect ActRO to produce a higher profit next year, all else being equal.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that ActRO received a tax benefit of ₩456m. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. The receipt of a tax benefit is obviously a good thing, on its own. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On ActRO's Profit Performance

Summing up, ActRO's unusual items suggest that its statutory earnings were temporarily depressed, while its tax benefit is having the opposite effect, and its accrual ratio indicates a lack of free cash flow relative to profit. Based on these factors, we think that ActRO's statutory profits probably make it seem better than it is on an underlying level. If you want to do dive deeper into ActRO, you'd also look into what risks it is currently facing. Be aware that ActRO is showing 5 warning signs in our investment analysis and 1 of those shouldn't be ignored...

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade ActRO, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A290740

ActRO

Manufactures optical image stabilizers (OIS) and voice coil motors that are applied in compact camera modules in South Korea.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026