- Taiwan

- /

- Tech Hardware

- /

- TPEX:3324

High Growth Tech Stocks to Watch in January 2025

Reviewed by Simply Wall St

As global markets navigate mixed signals with U.S. stocks closing a strong year despite recent slumps, and economic indicators like the Chicago PMI highlighting challenges, investors are keeping a keen eye on high growth tech stocks for potential opportunities. In this climate, identifying promising tech stocks involves looking at companies that demonstrate resilience and adaptability amid fluctuating economic conditions and shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1258 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

JNTC (KOSDAQ:A204270)

Simply Wall St Growth Rating: ★★★★★★

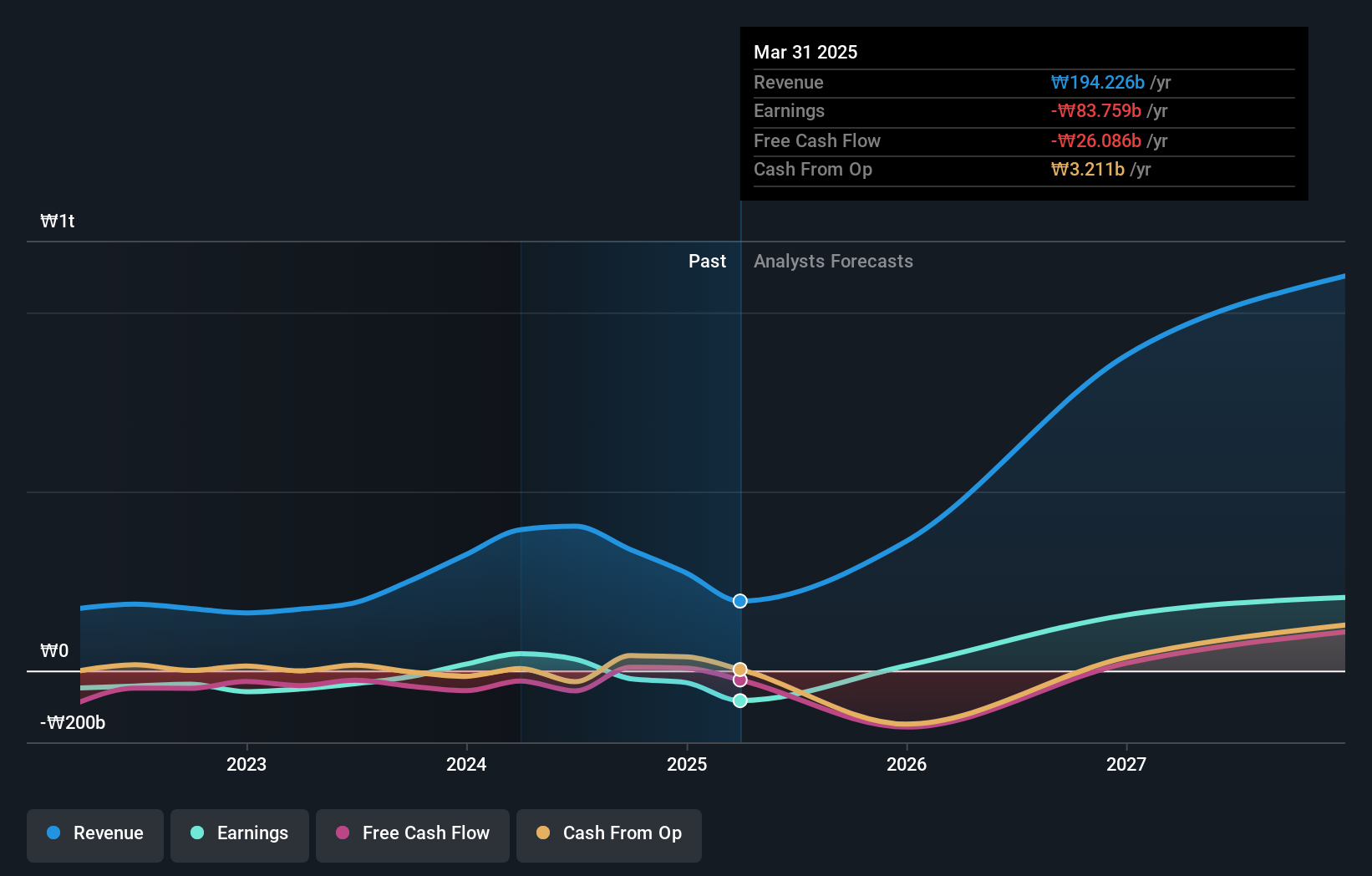

Overview: JNTC Co., Ltd. is a South Korean company specializing in the production of connectors, hinges, and tempered glass products with a market cap of ₩1.16 trillion.

Operations: JNTC generates revenue primarily from the manufacturing and sales of mobile parts, amounting to ₩337.88 billion.

JNTC's trajectory in the tech sector is underscored by its robust revenue growth, projected at 29.5% annually, outpacing the broader Korean market's 9.1%. This growth is complemented by an anticipated leap into profitability within three years, with earnings expected to surge by 104.4% per year. Notably, JNTC has committed significantly to innovation, channeling funds into R&D which now represents a substantial portion of its expenditures; this strategic focus not only fuels future capabilities but also aligns with industry shifts towards more advanced tech solutions. Moreover, the company's strategic foresight is evident as it navigates through market volatilities with a clear emphasis on expanding its technological footprint and enhancing shareholder value through calculated reinvestments and robust financial strategies.

- Navigate through the intricacies of JNTC with our comprehensive health report here.

Examine JNTC's past performance report to understand how it has performed in the past.

Auras Technology (TPEX:3324)

Simply Wall St Growth Rating: ★★★★★★

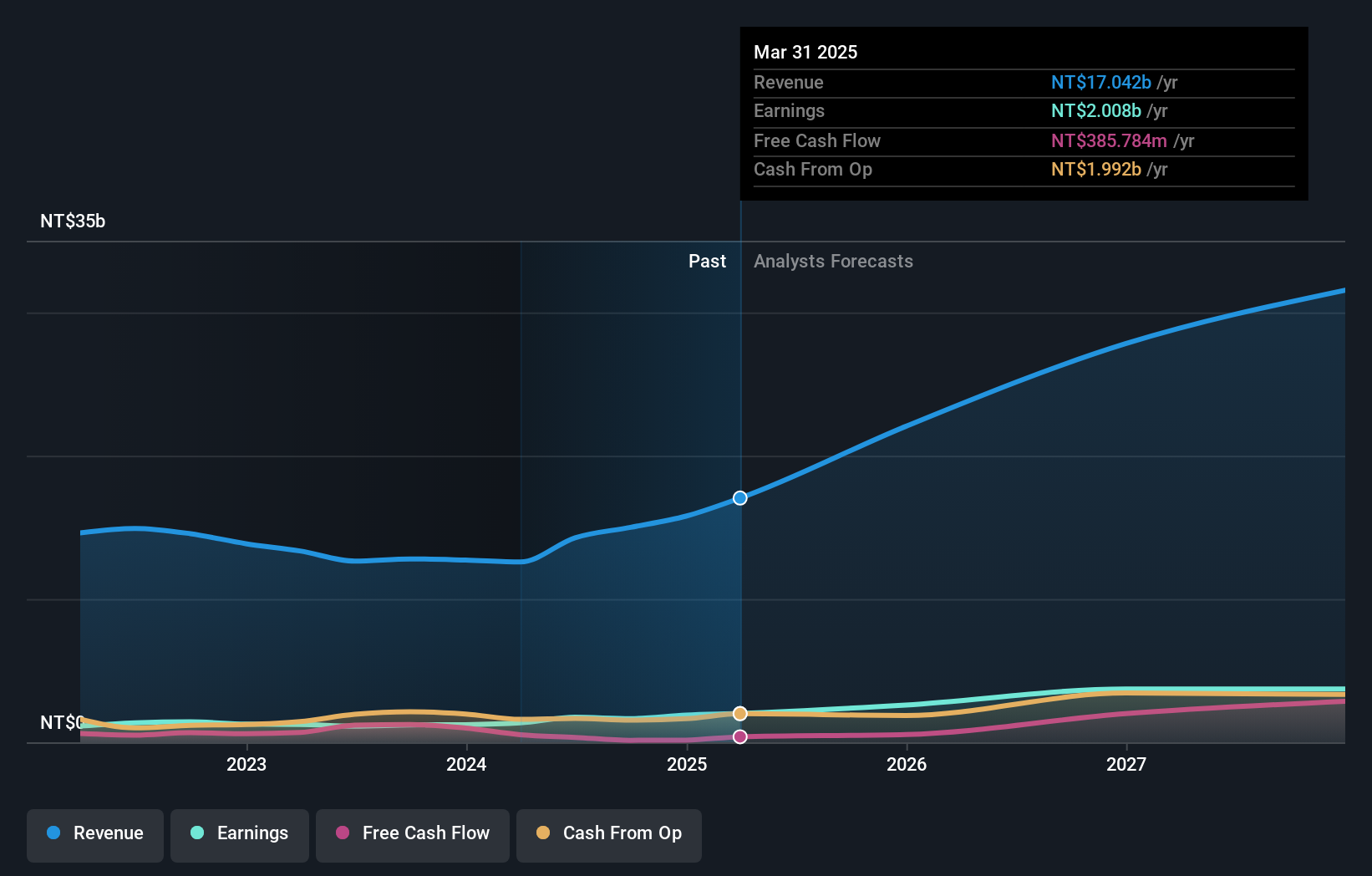

Overview: Auras Technology Co., Ltd. is involved in the manufacturing, processing, and retailing of electronic materials and computer cooling modules across China, Taiwan, Ireland, Singapore, the United States, and other international markets with a market cap of NT$63.65 billion.

Operations: Auras Technology generates revenue primarily from the electronic components and parts segment, amounting to NT$14.99 billion. The company's operations span multiple international markets, focusing on manufacturing and retailing activities within the electronics sector.

Auras Technology, with its recent earnings report showcasing a sales increase from TWD 3.49 billion to TWD 4.22 billion year-over-year, reflects a solid trajectory in revenue growth at 28.6% annually, outpacing the broader Taiwanese market's expansion of 12.3%. The firm's commitment to innovation is evident from its R&D investments, crucial for staying competitive in the tech landscape; however, it faces challenges like earnings volatility and shareholder dilution—net income dropped from TWD 491.83 million to TWD 398.24 million this quarter despite higher sales figures. This backdrop of robust sales growth coupled with strategic reinvestments and active participation in global tech conferences positions Auras as a dynamic player within the high-tech sector, albeit with areas requiring careful navigation moving forward.

- Click here to discover the nuances of Auras Technology with our detailed analytical health report.

Explore historical data to track Auras Technology's performance over time in our Past section.

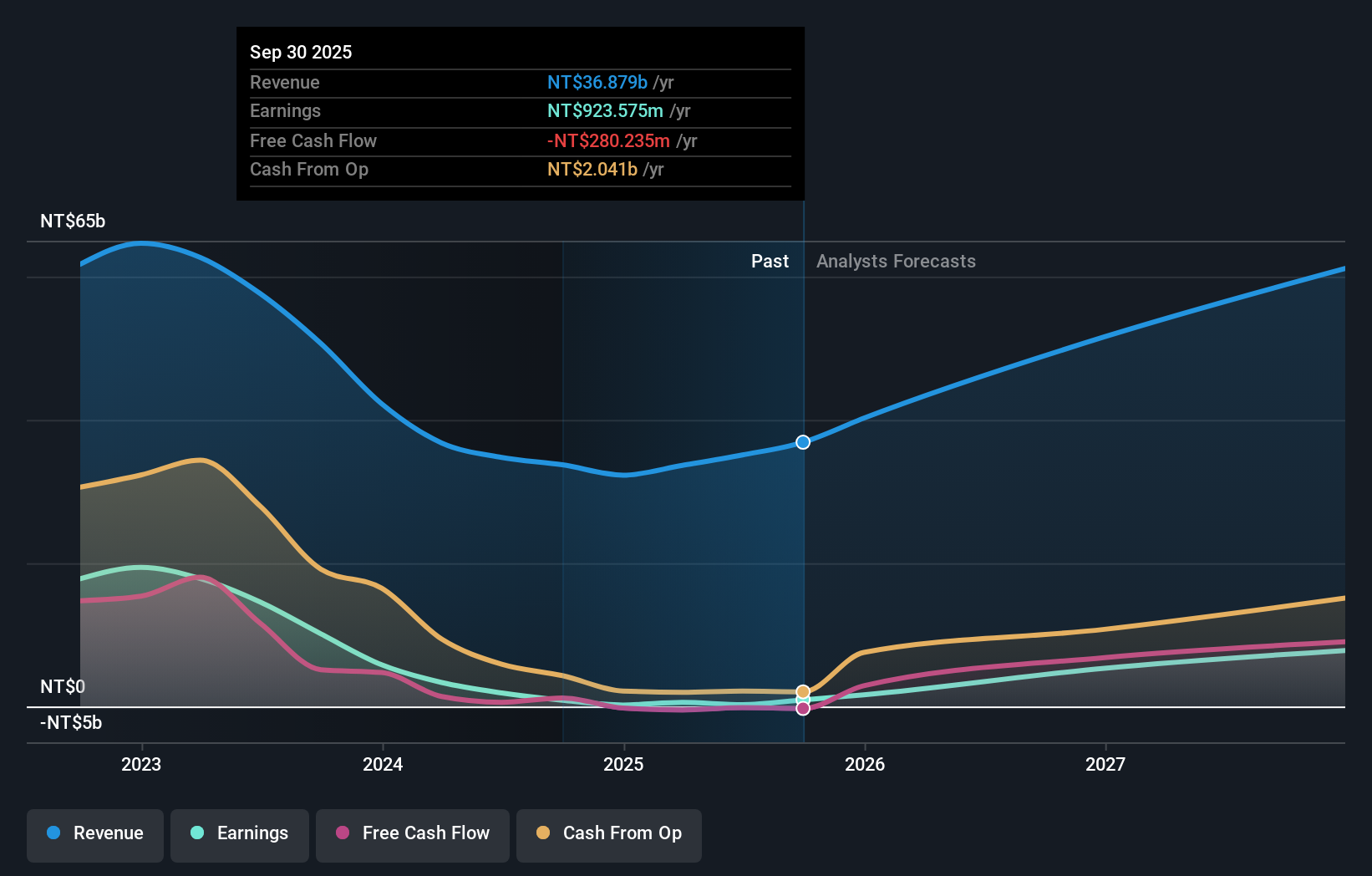

Nan Ya Printed Circuit Board (TWSE:8046)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nan Ya Printed Circuit Board Corporation engages in the manufacturing and sale of printed circuit boards across Taiwan, the United States, Mainland China, Korea, and other international markets with a market capitalization of NT$87.56 billion.

Operations: The company generates revenue primarily from the sale of printed circuit boards, with significant contributions from the Domestic market (NT$23.30 billion) and Asia (NT$14.60 billion). The American market contributes a smaller portion at NT$30.17 million.

Nan Ya Printed Circuit Board Corporation has navigated a challenging year, with its latest earnings report revealing a significant revenue drop from TWD 32.94 billion to TWD 24.41 billion over nine months. Despite this downturn, the company's commitment to R&D remains robust, maintaining expenditures crucial for long-term innovation in the competitive tech landscape. This strategic focus is reflected in its projected earnings growth of 95.3% annually, outstripping the broader Taiwanese market's forecast of 19.2%. With an emphasis on enhancing product offerings and optimizing operations, Nan Ya aims to leverage its technological advancements to regain momentum and secure a stronger position in the global electronics sector.

- Delve into the full analysis health report here for a deeper understanding of Nan Ya Printed Circuit Board.

Understand Nan Ya Printed Circuit Board's track record by examining our Past report.

Summing It All Up

- Discover the full array of 1258 High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3324

Auras Technology

Engages in the manufacturing, processing, and retailing of electronic materials and computer cooling modules in China, Taiwan, Ireland, Singapore, the United States, and internationally.

Exceptional growth potential with flawless balance sheet.