None Exchange Presents 3 Top Small Cap Gems with Strong Foundations

Reviewed by Simply Wall St

As global markets navigate a mixed landscape, with the S&P 500 closing out another strong year despite recent fluctuations and the Chicago PMI indicating challenges in manufacturing, small-cap stocks present intriguing opportunities for investors. In this environment, identifying small-cap companies with strong foundations becomes crucial as they offer potential resilience and growth amid broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Value Rating: ★★★★★★

Overview: Taaleem Holdings PJSC operates as a provider and investor in education services within the United Arab Emirates, with a market capitalization of AED4.12 billion.

Operations: Taaleem Holdings PJSC's primary revenue stream is from school operations, generating AED947.58 million. The company's market capitalization stands at AED4.12 billion.

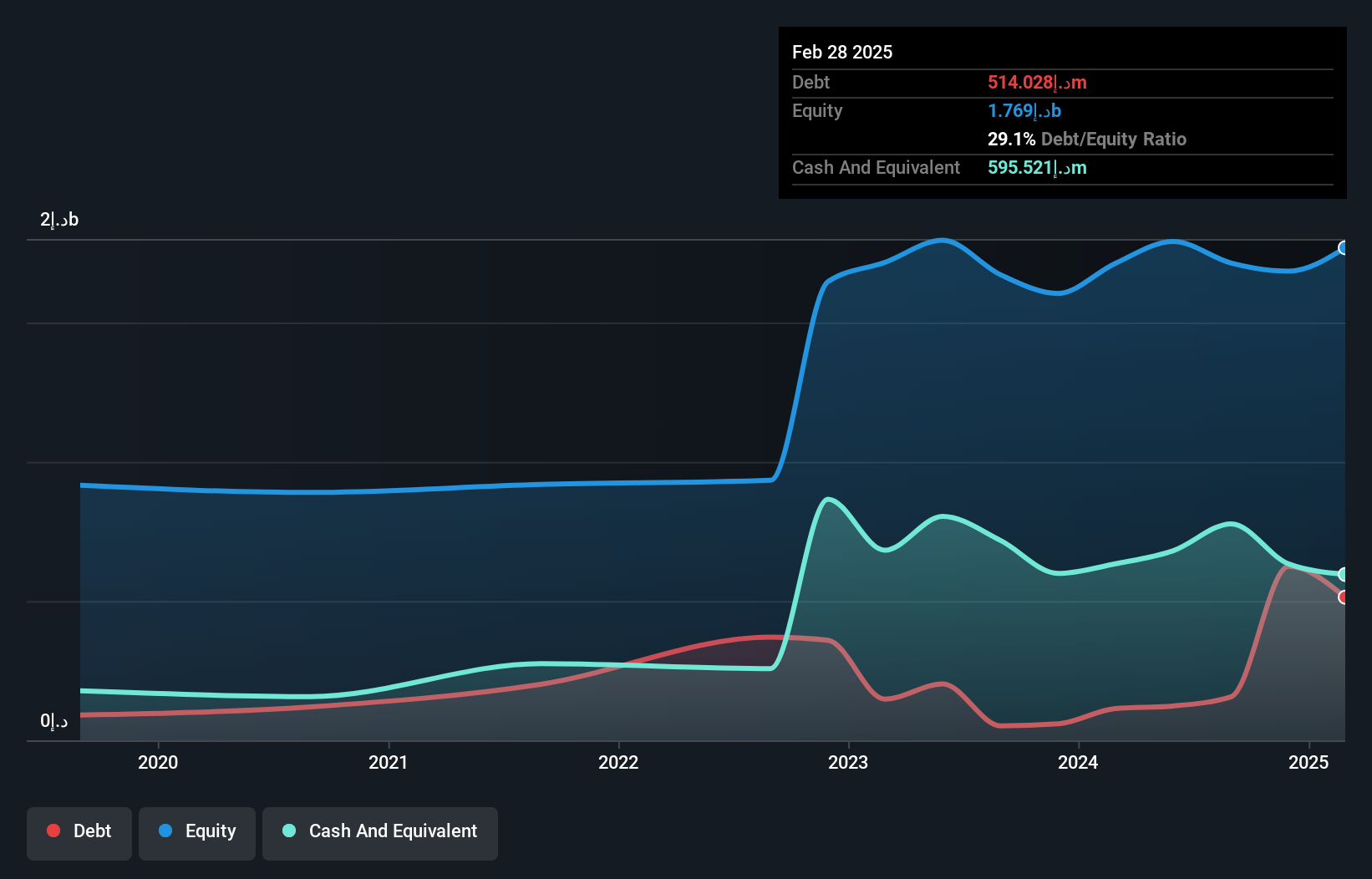

Taaleem Holdings PJSC, a notable player in the education sector, shows promising financial health with cash surpassing total debt and a reduced debt-to-equity ratio from 9.9% to 9.1% over five years. Earnings growth of 17.6% last year outpaced the industry average of 9.6%, hinting at strong operational performance and high-quality earnings. The company forecasts revenue growth of approximately 13%, aligning with its optimistic earnings guidance for the upcoming fiscal year. With positive free cash flow and robust interest coverage, Taaleem seems well-positioned for continued success in its market segment.

Qingdao Copton Technology (SHSE:603798)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qingdao Copton Technology Company Limited is engaged in the production and sale of lubricants and car care products in China, with a market capitalization of approximately CN¥2.40 billion.

Operations: Qingdao Copton Technology generates revenue primarily from its petrochemical segment, which accounts for CN¥1.14 billion.

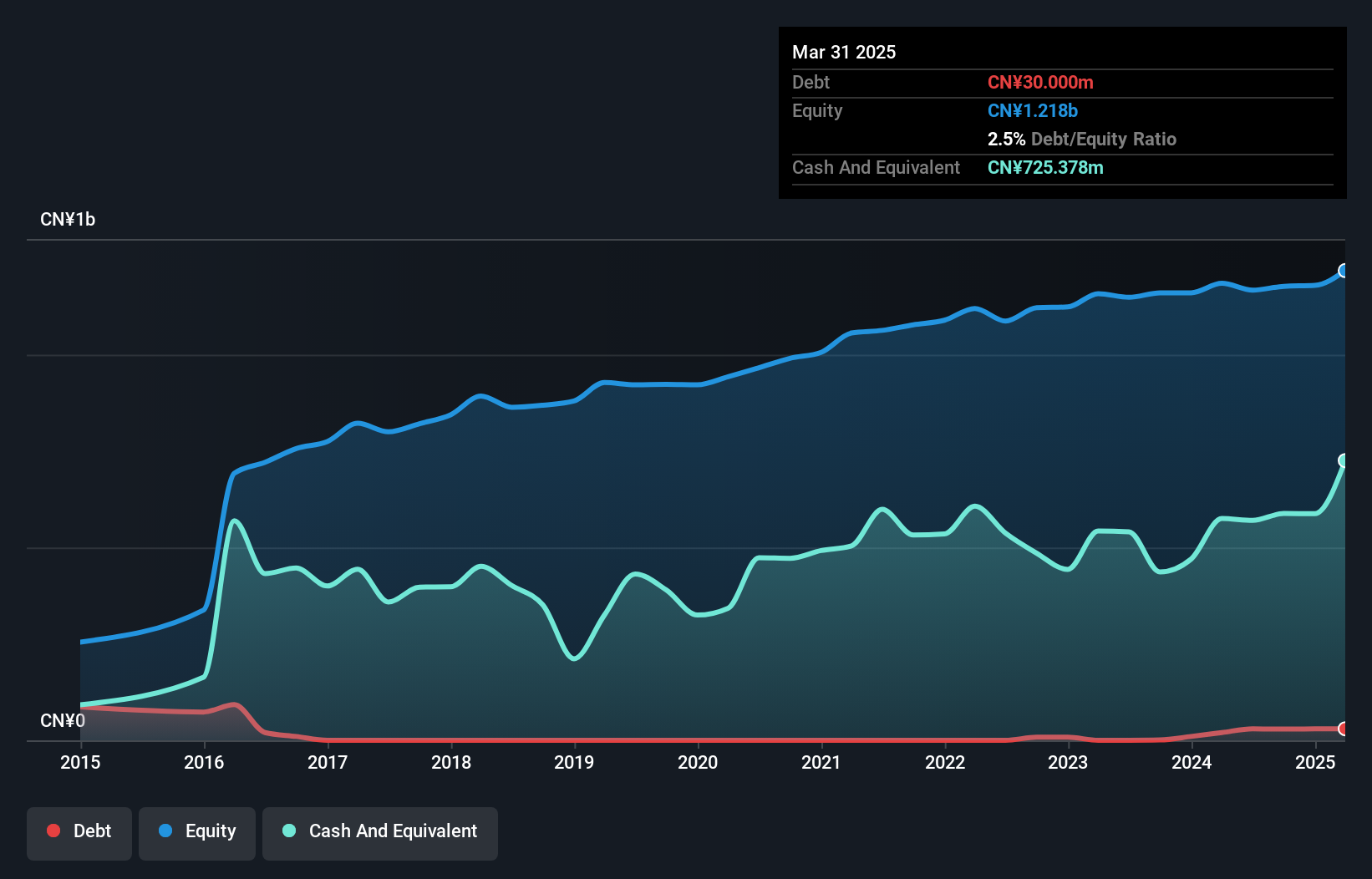

Qingdao Copton Technology, a player in the chemicals industry, has shown notable financial resilience despite some challenges. Over the past year, its earnings surged by 16.9%, outpacing the industry's -4.7% trend. The company reported net income of CN¥57.51M for nine months ending September 2024, up from CN¥48.11M the previous year, with basic earnings per share rising to CN¥0.23 from CN¥0.19. Although its debt-to-equity ratio increased to 2.5% over five years, it maintains more cash than total debt and trades at a significant discount of approximately 82% below estimated fair value due to one-off gains impacting results.

China Motor (TWSE:2204)

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Motor Corporation is involved in the manufacture and sale of automobiles and related parts both in Taiwan and internationally, with a market capitalization of NT$44.62 billion.

Operations: China Motor Corporation generates its revenue primarily from manufacturing, contributing NT$41.30 billion, and channel sales totaling NT$2.46 billion.

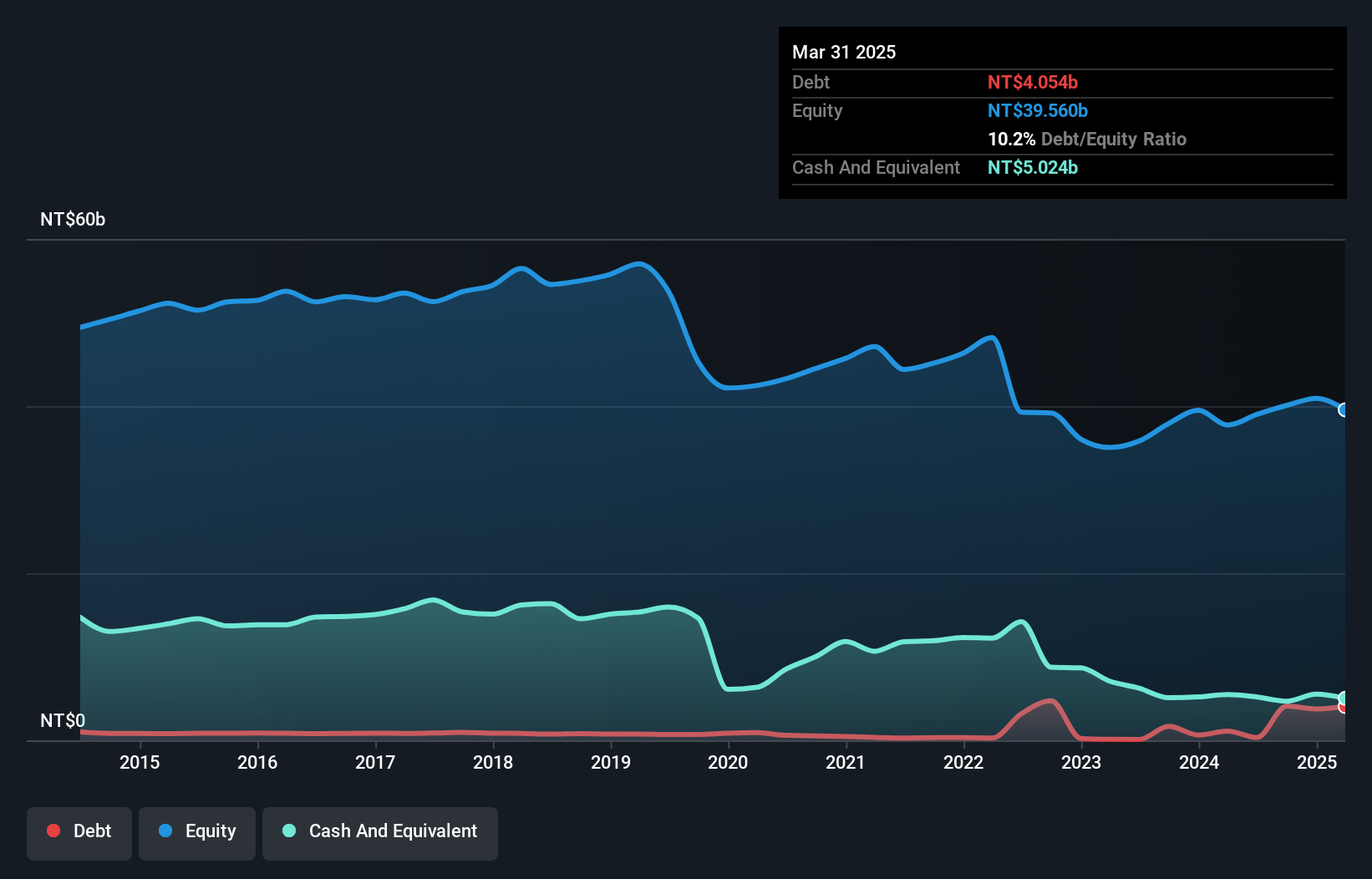

China Motor has been navigating a challenging landscape, as evidenced by its recent earnings report. The company saw its third-quarter sales dip to TWD 8.13 billion from TWD 8.91 billion the previous year, while net income fell to TWD 809.8 million from TWD 1.34 billion a year ago, indicating pressures on profitability despite an impressive earnings growth of 268.8% over the past year compared to the auto industry's -2.7%. With a price-to-earnings ratio of 9.7x, significantly below the TW market average of 21x, China Motor remains attractively valued for potential investors seeking opportunities in smaller companies with high-quality earnings and robust growth prospects amidst industry challenges.

- Delve into the full analysis health report here for a deeper understanding of China Motor.

Gain insights into China Motor's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Access the full spectrum of 4667 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2204

China Motor

Manufactures and sells automobiles, and related parts and components in Taiwan and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion