- Taiwan

- /

- Tech Hardware

- /

- TWSE:3231

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are navigating a complex landscape marked by mixed performances in key indices and economic indicators. Despite a recent slump, the S&P 500 Index capped off its best two-year stretch in decades with significant gains, while the Nasdaq Composite also posted strong annual growth. In this environment, high-growth tech stocks continue to capture investor interest due to their potential for rapid expansion and innovation-driven performance amidst fluctuating market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1258 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Victory Giant Technology (HuiZhou)Co.Ltd (SZSE:300476)

Simply Wall St Growth Rating: ★★★★★☆

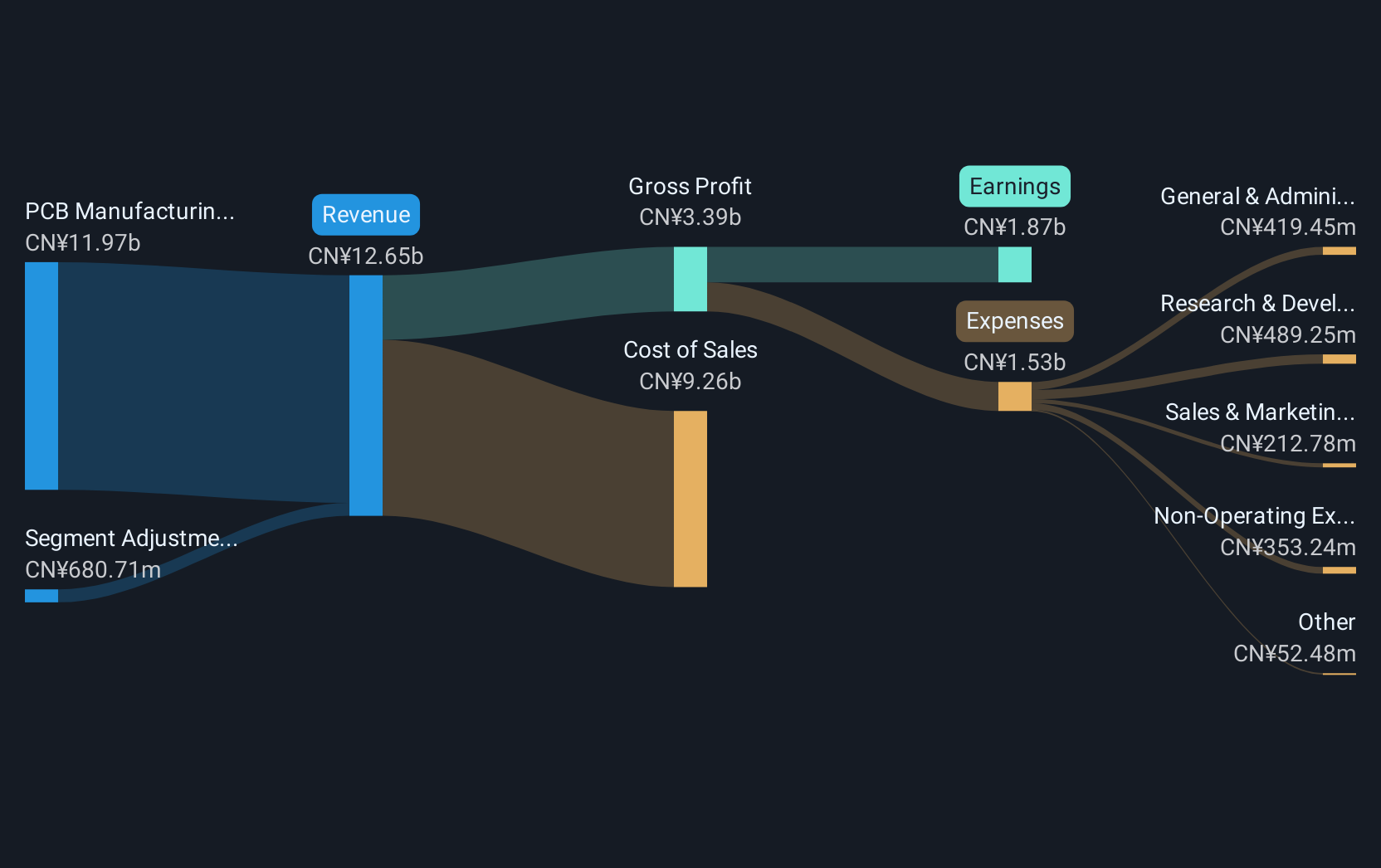

Overview: Victory Giant Technology (HuiZhou) Co., Ltd. is a company involved in the production of printed circuit boards and has a market capitalization of approximately CN¥38.91 billion.

Operations: Victory Giant Technology generates its revenue primarily from PCB manufacturing, contributing CN¥9.41 billion to its income. The company has a market capitalization of approximately CN¥38.91 billion.

Victory Giant Technology (HuiZhou)Co.Ltd. has demonstrated robust financial performance with a notable 38.68% forecasted annual earnings growth over the next three years and a 23.6% annual revenue growth rate, surpassing the broader Chinese market's average. The company recently completed a share repurchase of 698,500 shares for CNY 30.43 million, reflecting confidence in its financial health and commitment to shareholder value. Additionally, their strategic initiatives include a private placement aiming to raise CNY 1.98 billion, underscoring aggressive expansion plans and investment in innovation to stay ahead in the competitive tech landscape.

Wistron (TWSE:3231)

Simply Wall St Growth Rating: ★★★★☆☆

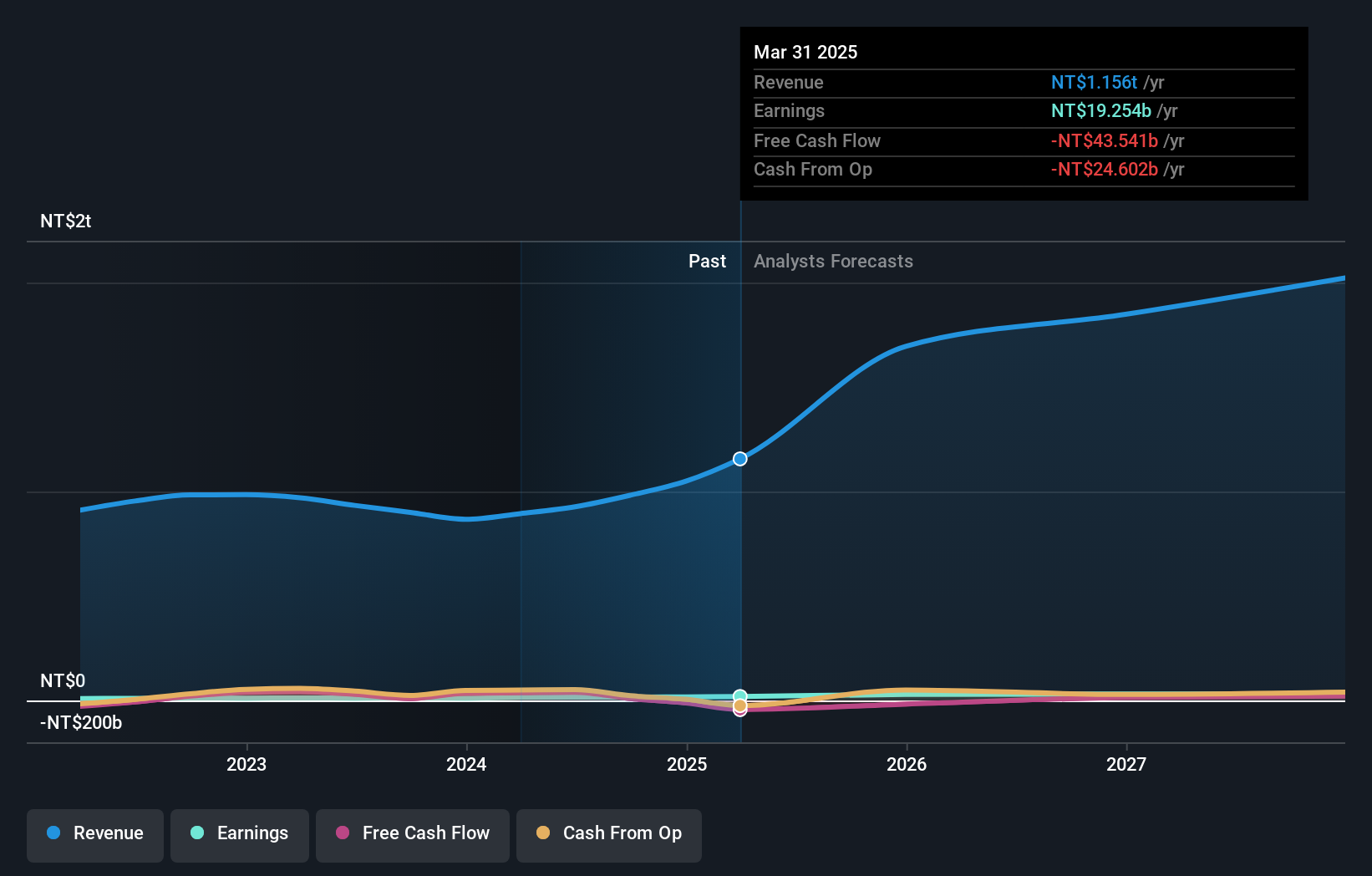

Overview: Wistron Corporation, with a market cap of NT$310.49 billion, operates in the design, manufacturing, and sale of information technology products across Taiwan, Asia, and international markets.

Operations: The company generates its revenue primarily through research and development and manufacturing services operations, amounting to NT$944.49 billion.

Wistron's recent financial performance reflects a robust trajectory, with third-quarter sales soaring to TWD 272.54 billion, up from TWD 217.04 billion the previous year, although net income slightly dipped to TWD 4.20 billion from TWD 4.70 billion. This growth underscores a significant annual revenue increase of 17.9%, outpacing the broader Taiwanese market's expansion rate of 12.3%. Moreover, Wistron's commitment to innovation is evident in its R&D investments and participation in key tech conferences, positioning it well within the competitive tech landscape despite some earnings volatility.

- Unlock comprehensive insights into our analysis of Wistron stock in this health report.

Understand Wistron's track record by examining our Past report.

Wiwynn (TWSE:6669)

Simply Wall St Growth Rating: ★★★★★★

Overview: Wiwynn Corporation specializes in the manufacturing and sale of servers and storage products for cloud infrastructure and hyperscale data centers across the United States, Europe, Asia, and other international markets, with a market cap of approximately NT$514.78 billion.

Operations: The company generates revenue primarily from the computer hardware segment, amounting to NT$303.48 billion.

Wiwynn's recent surge in financial metrics, with third-quarter sales doubling to TWD 97.82 billion from TWD 52.82 billion year-over-year and net income soaring to TWD 6.33 billion from TWD 2.62 billion, underscores its robust position in the tech industry. This performance is bolstered by a strategic expansion, exemplified by the construction of a new facility in Tainan Science Park, reflecting a commitment to scaling operations amid growing demand. The company's aggressive R&D investment aligns with this growth trajectory, ensuring continuous innovation and enhancement of its competitive edge in an ever-evolving technological landscape.

- Delve into the full analysis health report here for a deeper understanding of Wiwynn.

Evaluate Wiwynn's historical performance by accessing our past performance report.

Taking Advantage

- Explore the 1258 names from our High Growth Tech and AI Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wistron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3231

Wistron

Designs, manufactures, and sells information technology products in Taiwan, Asia, and internationally.

Very undervalued with solid track record.