- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A196450

Is CoAsia CMLtd (KOSDAQ:196450) Weighed On By Its Debt Load?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that CoAsia CM Co.,Ltd (KOSDAQ:196450) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for CoAsia CMLtd

What Is CoAsia CMLtd's Debt?

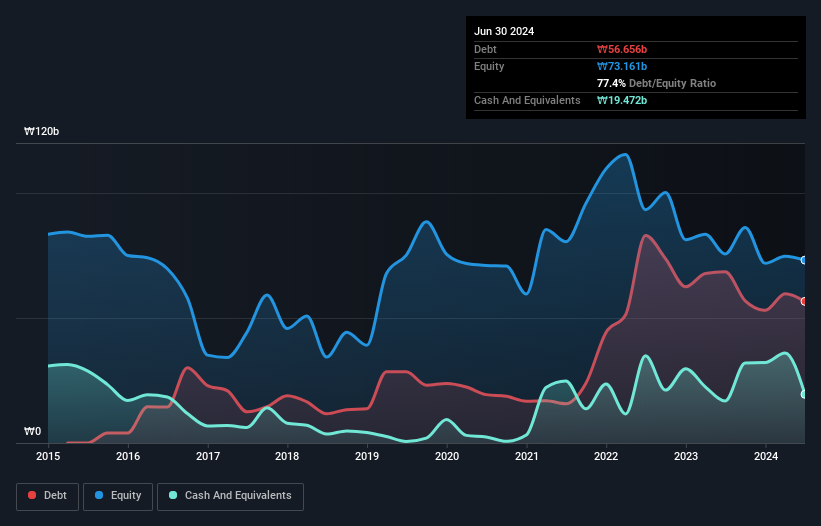

You can click the graphic below for the historical numbers, but it shows that CoAsia CMLtd had ₩56.7b of debt in June 2024, down from ₩68.5b, one year before. However, it does have ₩19.5b in cash offsetting this, leading to net debt of about ₩37.2b.

A Look At CoAsia CMLtd's Liabilities

We can see from the most recent balance sheet that CoAsia CMLtd had liabilities of ₩83.8b falling due within a year, and liabilities of ₩3.86b due beyond that. Offsetting this, it had ₩19.5b in cash and ₩25.3b in receivables that were due within 12 months. So its liabilities total ₩42.9b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of ₩43.4b, so it does suggest shareholders should keep an eye on CoAsia CMLtd's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. The balance sheet is clearly the area to focus on when you are analysing debt. But it is CoAsia CMLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, CoAsia CMLtd made a loss at the EBIT level, and saw its revenue drop to ₩287b, which is a fall of 7.5%. We would much prefer see growth.

Caveat Emptor

Over the last twelve months CoAsia CMLtd produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping ₩9.4b. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. For example, we would not want to see a repeat of last year's loss of ₩17b. So in short it's a really risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for CoAsia CMLtd (1 can't be ignored) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A196450

CoAsia CMLtd

Researches, produces, and sells camera modules and optical lens for smartphones and tablet PCs in South Korea and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026