- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A140070

Is SurplusGLOBAL's (KOSDAQ:140070) Share Price Gain Of 116% Well Earned?

SurplusGLOBAL, Inc. (KOSDAQ:140070) shareholders have seen the share price descend 14% over the month. But that doesn't detract from the splendid returns of the last year. Indeed, the share price is up an impressive 116% in that time. So it is important to view the recent reduction in price through that lense. More important, going forward, is how the business itself is going.

View our latest analysis for SurplusGLOBAL

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

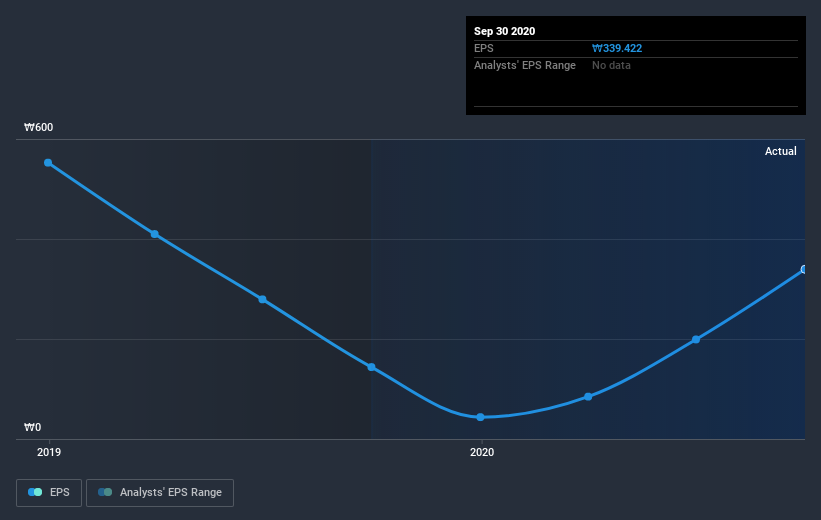

SurplusGLOBAL was able to grow EPS by 138% in the last twelve months. This EPS growth is reasonably close to the 116% increase in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. It makes intuitive sense that the share price and EPS would grow at similar rates.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into SurplusGLOBAL's key metrics by checking this interactive graph of SurplusGLOBAL's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between SurplusGLOBAL's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. SurplusGLOBAL's TSR of 118% for the year exceeded its share price return, because it has paid dividends.

A Different Perspective

It's nice to see that SurplusGLOBAL shareholders have gained 118% (in total) over the last year. That gain actually surpasses the 2.5% TSR it generated (per year) over three years. The improving returns to shareholders suggests the stock is becoming more popular with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for SurplusGLOBAL you should be aware of, and 1 of them is significant.

Of course SurplusGLOBAL may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade SurplusGLOBAL, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A140070

SurplusGLOBAL

Engages in the purchase, sale, refurbishment and reconfiguration, and rental of pre-owned semiconductor equipment in South Korea and internationally.

Low risk with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)