- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A131400

Shareholders Shouldn’t Be Too Comfortable With EV Advanced MaterialLtd's (KOSDAQ:131400) Strong Earnings

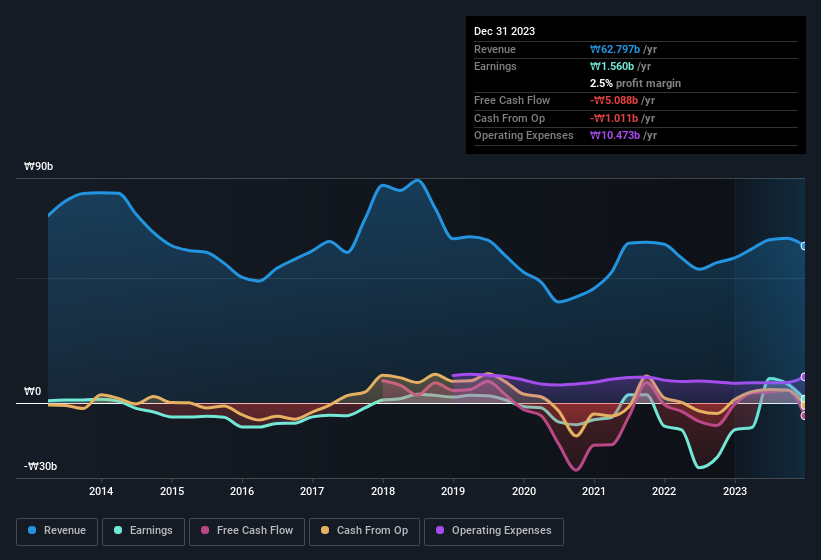

We didn't see EV Advanced Material Co.,Ltd's (KOSDAQ:131400) stock surge when it reported robust earnings recently. We looked deeper into the numbers and found that shareholders might be concerned with some underlying weaknesses.

View our latest analysis for EV Advanced MaterialLtd

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. EV Advanced MaterialLtd expanded the number of shares on issue by 24% over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out EV Advanced MaterialLtd's historical EPS growth by clicking on this link.

A Look At The Impact Of EV Advanced MaterialLtd's Dilution On Its Earnings Per Share (EPS)

Three years ago, EV Advanced MaterialLtd lost money. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

If EV Advanced MaterialLtd's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of EV Advanced MaterialLtd.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that EV Advanced MaterialLtd's profit was boosted by unusual items worth ₩4.7b in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. EV Advanced MaterialLtd had a rather significant contribution from unusual items relative to its profit to December 2023. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On EV Advanced MaterialLtd's Profit Performance

In its last report EV Advanced MaterialLtd benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. Considering all this we'd argue EV Advanced MaterialLtd's profits probably give an overly generous impression of its sustainable level of profitability. If you want to do dive deeper into EV Advanced MaterialLtd, you'd also look into what risks it is currently facing. You'd be interested to know, that we found 2 warning signs for EV Advanced MaterialLtd and you'll want to know about these.

Our examination of EV Advanced MaterialLtd has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if EV Advanced MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A131400

EV Advanced MaterialLtd

Engages in the manufacture and sale of flexible printed circuit boards (FPCBs) in South Korea.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion