- Hong Kong

- /

- Consumer Services

- /

- SEHK:2469

Top Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets show signs of recovery with U.S. indexes approaching record highs and a strong labor market boosting sentiment, investors are increasingly focused on companies that exhibit robust growth potential alongside significant insider ownership. In this context, stocks with high insider ownership often attract attention as they suggest that those closest to the company have confidence in its future prospects, aligning their interests with those of external shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 43.2% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Let's uncover some gems from our specialized screener.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. develops and sells electronic materials across several regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia with a market cap of ₩1.30 trillion.

Operations: Revenue Segments (in millions of ₩):

Insider Ownership: 28.5%

Daejoo Electronic Materials is experiencing significant growth, with earnings forecasted to rise 34.02% annually, outpacing the Korean market. Recent third-quarter results show a substantial increase in net income to ₩4.59 billion from ₩102.6 million the previous year, indicating improved profitability. Despite trading slightly below its estimated fair value and having high revenue growth expectations of 37% per year, its share price remains highly volatile and debt coverage by operating cash flow is inadequate.

- Get an in-depth perspective on Daejoo Electronic Materials' performance by reading our analyst estimates report here.

- The analysis detailed in our Daejoo Electronic Materials valuation report hints at an inflated share price compared to its estimated value.

Fenbi (SEHK:2469)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fenbi Ltd. is an investment holding company that offers non-formal vocational education and training services in the People's Republic of China, with a market cap of HK$6.16 billion.

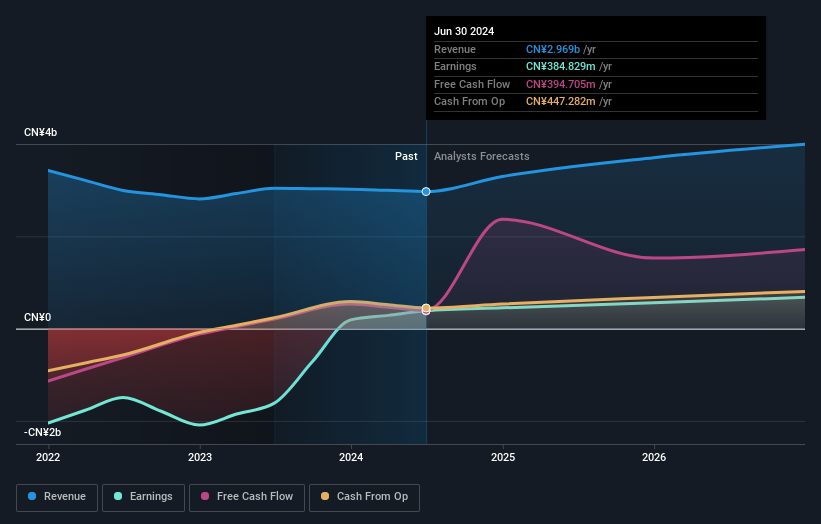

Operations: The company's revenue segments include CN¥648.46 million from sales of books and CN¥2.47 billion from tutoring services.

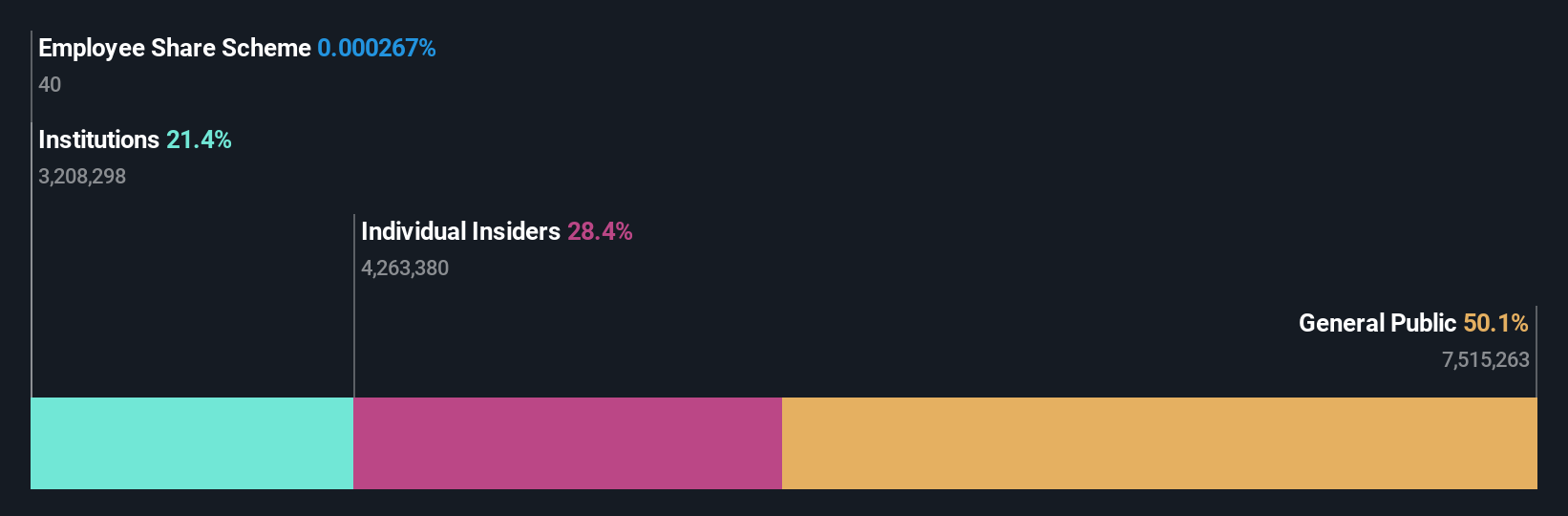

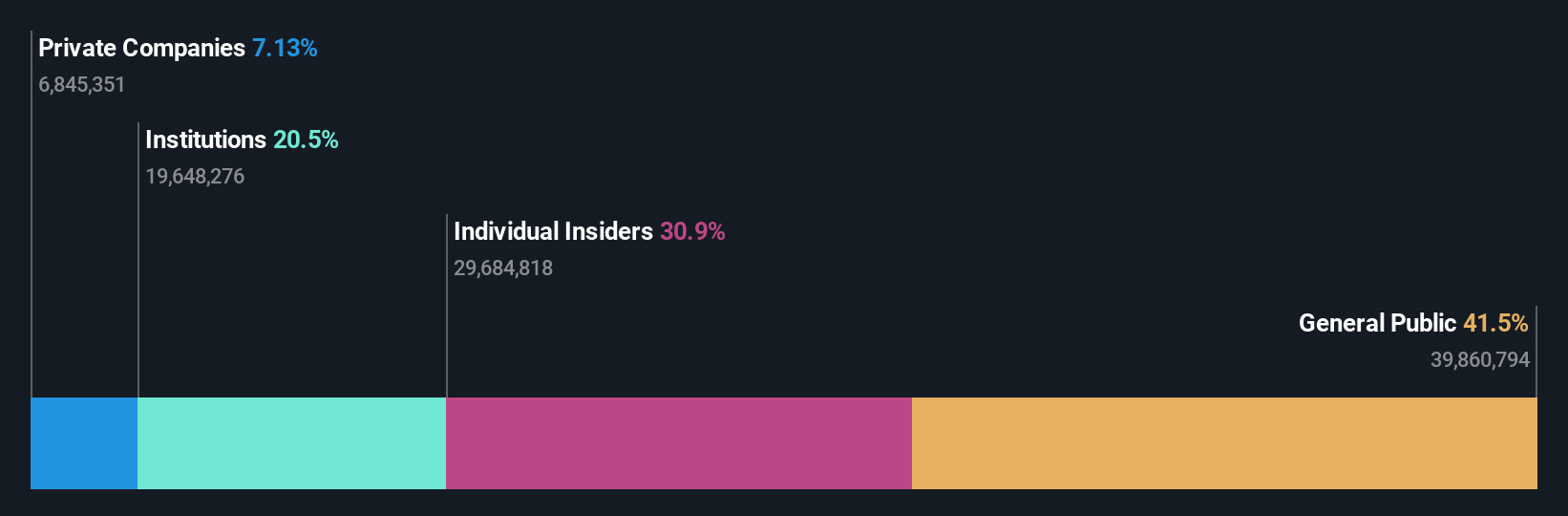

Insider Ownership: 30.4%

Fenbi's profitability has improved, becoming profitable this year, and earnings are expected to grow at 19.54% annually, surpassing the Hong Kong market's growth rate. Despite trading significantly below its estimated fair value, revenue growth is projected at 8.9% per year—higher than the market average but not exceptionally high. The share price has been volatile recently; however, insider activity shows more shares bought than sold over the past three months.

- Click here to discover the nuances of Fenbi with our detailed analytical future growth report.

- Our valuation report here indicates Fenbi may be undervalued.

Gudeng Precision Industrial (TPEX:3680)

Simply Wall St Growth Rating: ★★★★★★

Overview: Gudeng Precision Industrial Co., Ltd. offers technology services globally and has a market capitalization of NT$47.31 billion.

Operations: Revenue Segments (in millions of NT$):

Insider Ownership: 31.3%

Gudeng Precision Industrial's insider ownership aligns with its robust growth trajectory, as evidenced by a significant 31.9% increase in earnings over the past year and projected annual profit growth of 33%, outpacing the Taiwanese market. Recent Q3 results showed net income rising to TWD 415.11 million from TWD 170.58 million year-on-year, underscoring strong operational performance. The company plans strategic expansions, including a new subsidiary with an initial capital injection of TWD 280 million, indicating future growth potential.

- Take a closer look at Gudeng Precision Industrial's potential here in our earnings growth report.

- Our valuation report unveils the possibility Gudeng Precision Industrial's shares may be trading at a premium.

Taking Advantage

- Dive into all 1512 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2469

Fenbi

An investment holding company, provides non-formal vocational education and training services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives