- South Korea

- /

- Communications

- /

- KOSDAQ:A056360

Coweaver Co., Ltd. (KOSDAQ:056360) Looks Like A Good Stock, And It's Going Ex-Dividend Soon

Readers hoping to buy Coweaver Co., Ltd. (KOSDAQ:056360) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. You will need to purchase shares before the 29th of December to receive the dividend, which will be paid on the 10th of April.

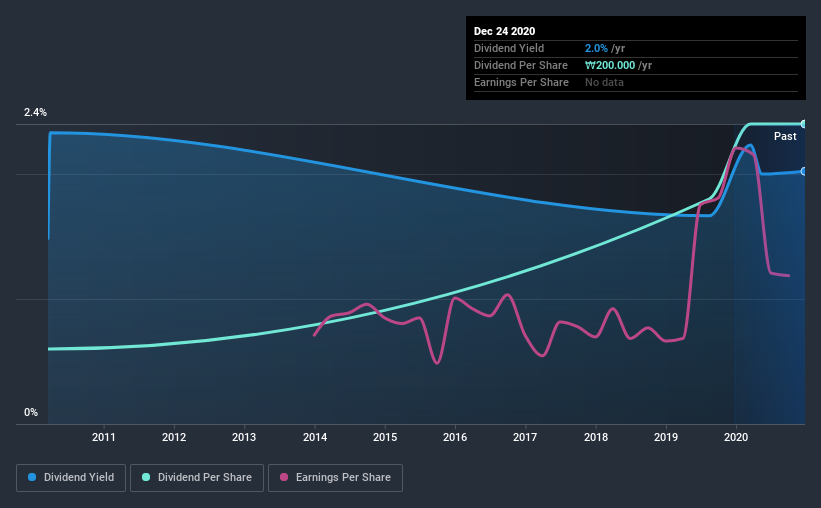

Coweaver's upcoming dividend is ₩200 a share, following on from the last 12 months, when the company distributed a total of ₩200 per share to shareholders. Looking at the last 12 months of distributions, Coweaver has a trailing yield of approximately 2.0% on its current stock price of ₩9890. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Coweaver

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Coweaver paid out just 17% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. The good news is it paid out just 13% of its free cash flow in the last year.

It's positive to see that Coweaver's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Coweaver paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're encouraged by the steady growth at Coweaver, with earnings per share up 6.9% on average over the last five years. Earnings per share have been growing at a decent rate, and the company is retaining more than three-quarters of its earnings in the business. This is an attractive combination, because when profits are reinvested effectively, growth can compound, with corresponding benefits for earnings and dividends in the future.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past 10 years, Coweaver has increased its dividend at approximately 15% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

Final Takeaway

Is Coweaver worth buying for its dividend? Earnings per share growth has been growing somewhat, and Coweaver is paying out less than half its earnings and cash flow as dividends. This is interesting for a few reasons, as it suggests management may be reinvesting heavily in the business, but it also provides room to increase the dividend in time. It might be nice to see earnings growing faster, but Coweaver is being conservative with its dividend payouts and could still perform reasonably over the long run. It's a promising combination that should mark this company worthy of closer attention.

So while Coweaver looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. Case in point: We've spotted 2 warning signs for Coweaver you should be aware of.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Coweaver, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A056360

Comunication WeaverLtd

Develops, manufactures, and supplies fiber optic transmission systems to state-owned corporate and financial industries in South Korea.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026