- South Korea

- /

- Communications

- /

- KOSDAQ:A051980

JOONGANG ADVANCED MATERIALS Co., Ltd.'s (KOSDAQ:051980) 27% Share Price Surge Not Quite Adding Up

JOONGANG ADVANCED MATERIALS Co., Ltd. (KOSDAQ:051980) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.5% in the last twelve months.

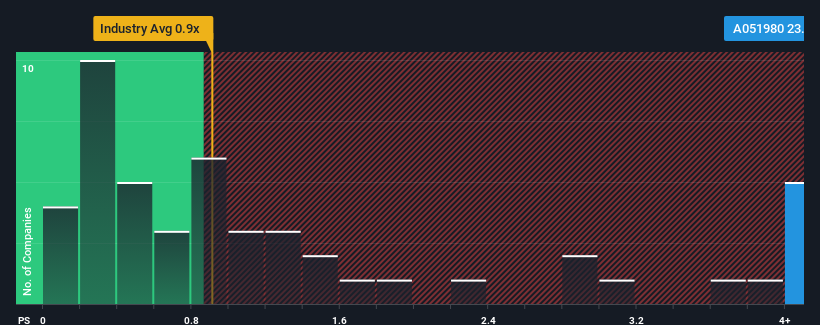

Since its price has surged higher, given around half the companies in Korea's Communications industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider JOONGANG ADVANCED MATERIALS as a stock to avoid entirely with its 23.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Our free stock report includes 3 warning signs investors should be aware of before investing in JOONGANG ADVANCED MATERIALS. Read for free now.Check out our latest analysis for JOONGANG ADVANCED MATERIALS

How Has JOONGANG ADVANCED MATERIALS Performed Recently?

As an illustration, revenue has deteriorated at JOONGANG ADVANCED MATERIALS over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on JOONGANG ADVANCED MATERIALS will help you shine a light on its historical performance.How Is JOONGANG ADVANCED MATERIALS' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like JOONGANG ADVANCED MATERIALS' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 29%. Still, the latest three year period has seen an excellent 43% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 40% shows it's noticeably less attractive.

With this in mind, we find it worrying that JOONGANG ADVANCED MATERIALS' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does JOONGANG ADVANCED MATERIALS' P/S Mean For Investors?

JOONGANG ADVANCED MATERIALS' P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that JOONGANG ADVANCED MATERIALS currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Before you settle on your opinion, we've discovered 3 warning signs for JOONGANG ADVANCED MATERIALS (2 can't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on JOONGANG ADVANCED MATERIALS, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A051980

JOONGANG ADVANCED MATERIALS

Manufactures and sells windows, doors, light emitting diode lightings, medical devices, plastic products, and ventilation flat ducts in the Middle East, Asia, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.