- South Korea

- /

- Communications

- /

- KOSDAQ:A051980

Investors bid JOONGANG ADVANCED MATERIALS (KOSDAQ:051980) up ₩151b despite increasing losses YoY, taking three-year CAGR to 71%

It hasn't been the best quarter for JOONGANG ADVANCED MATERIALS Co., Ltd. (KOSDAQ:051980) shareholders, since the share price has fallen 23% in that time. But that doesn't change the fact that the returns over the last three years have been spectacular. In fact, the share price has taken off in that time, up 398%. Arguably, the recent fall is to be expected after such a strong rise. The share price action could signify that the business itself is dramatically improved, in that time.

The past week has proven to be lucrative for JOONGANG ADVANCED MATERIALS investors, so let's see if fundamentals drove the company's three-year performance.

Given that JOONGANG ADVANCED MATERIALS didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years JOONGANG ADVANCED MATERIALS saw its revenue grow at 6.6% per year. Considering the company is losing money, we think that rate of revenue growth is uninspiring. So we're surprised that the share price has soared by 71% each year over that time. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. Shareholders would want to be sure that the share price rise is sustainable.

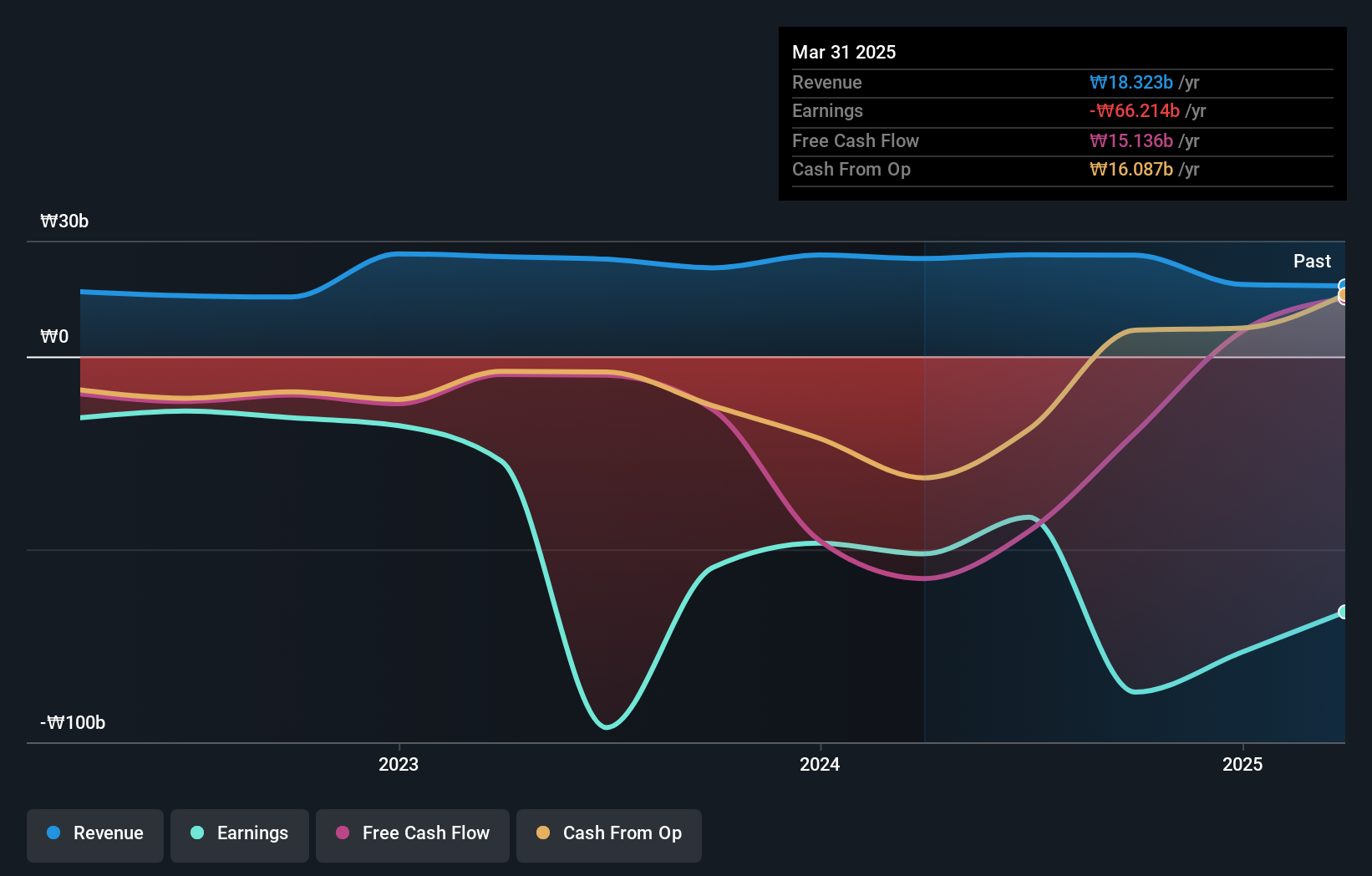

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at JOONGANG ADVANCED MATERIALS' financial health with this free report on its balance sheet.

A Different Perspective

Investors in JOONGANG ADVANCED MATERIALS had a tough year, with a total loss of 68%, against a market gain of about 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that JOONGANG ADVANCED MATERIALS is showing 2 warning signs in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A051980

JOONGANG ADVANCED MATERIALS

Manufactures and sells windows, doors, light emitting diode lightings, medical devices, plastic products, and ventilation flat ducts in the Middle East, Asia, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives