- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A045970

Investors ignore increasing losses at CoAsia (KOSDAQ:045970) as stock jumps 21% this past week

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. To wit, the CoAsia Corporation (KOSDAQ:045970) share price is 65% higher than it was a year ago, much better than the market return of around 37% (not including dividends) in the same period. That's a solid performance by our standards! Having said that, the longer term returns aren't so impressive, with stock gaining just 25% in three years.

Since it's been a strong week for CoAsia shareholders, let's have a look at trend of the longer term fundamentals.

CoAsia isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

CoAsia grew its revenue by 1.3% last year. That's not a very high growth rate considering it doesn't make profits. The modest growth is probably largely reflected in the share price, which is up 65%. That's not a standout result, but it is solid - much like the level of revenue growth. It could be worth keeping an eye on this one, especially if growth accelerates.

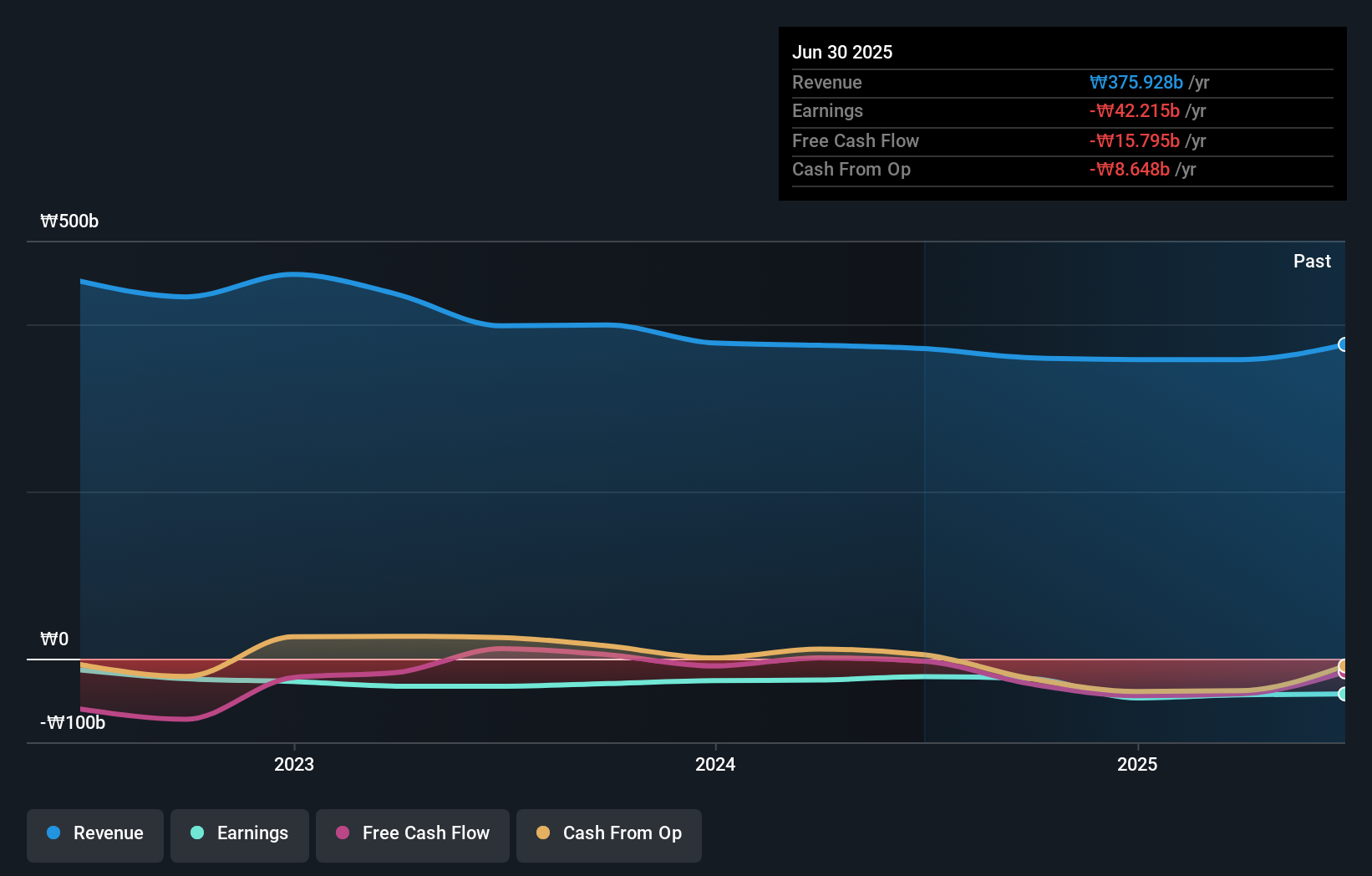

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling CoAsia stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that CoAsia shareholders have received a total shareholder return of 65% over the last year. That certainly beats the loss of about 3% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for CoAsia that you should be aware of.

We will like CoAsia better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A045970

CoAsia

An investment holding company, provides system solutions in South Korea and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives