- South Korea

- /

- IT

- /

- KOSDAQ:A372800

A Piece Of The Puzzle Missing From ITEYES Inc.'s (KOSDAQ:372800) 32% Share Price Climb

The ITEYES Inc. (KOSDAQ:372800) share price has done very well over the last month, posting an excellent gain of 32%. Unfortunately, despite the strong performance over the last month, the full year gain of 8.6% isn't as attractive.

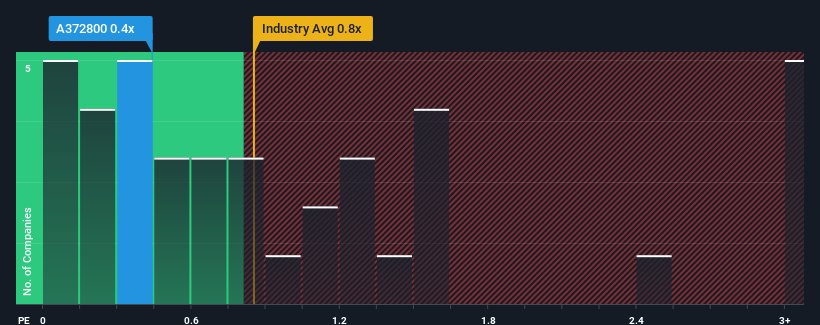

Even after such a large jump in price, you could still be forgiven for feeling indifferent about ITEYES' P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the IT industry in Korea is also close to 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for ITEYES

What Does ITEYES' Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for ITEYES, which is generally not a bad outcome. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on ITEYES will help you shine a light on its historical performance.How Is ITEYES' Revenue Growth Trending?

In order to justify its P/S ratio, ITEYES would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.2%. The latest three year period has also seen a 19% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 2.6% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that ITEYES' P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On ITEYES' P/S

Its shares have lifted substantially and now ITEYES' P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To our surprise, ITEYES revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with ITEYES, and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A372800

ITEYES

Iteyes Inc. provides various IT solutions to customers in the financial industry.

Good value with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026