- South Korea

- /

- IT

- /

- KOSDAQ:A070590

Hansol Inticube Co., Ltd.'s (KOSDAQ:070590) 33% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Hansol Inticube Co., Ltd. (KOSDAQ:070590) shares have been powering on, with a gain of 33% in the last thirty days. The last 30 days bring the annual gain to a very sharp 64%.

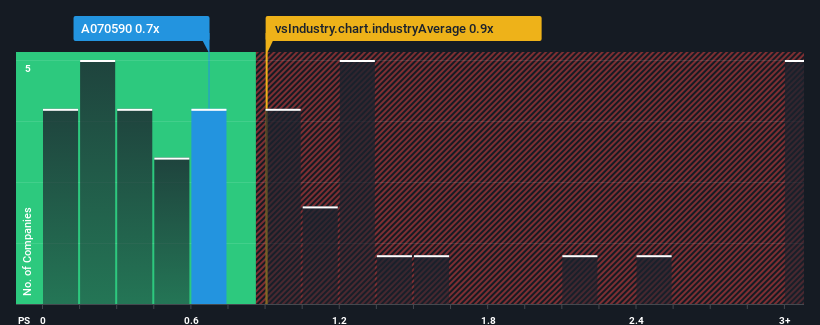

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Hansol Inticube's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the IT industry in Korea is also close to 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

We've discovered 4 warning signs about Hansol Inticube. View them for free.See our latest analysis for Hansol Inticube

How Hansol Inticube Has Been Performing

Revenue has risen firmly for Hansol Inticube recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Hansol Inticube, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Hansol Inticube's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hansol Inticube's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. Still, revenue has fallen 18% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 2.5% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Hansol Inticube is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

What Does Hansol Inticube's P/S Mean For Investors?

Its shares have lifted substantially and now Hansol Inticube's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We find it unexpected that Hansol Inticube trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It is also worth noting that we have found 4 warning signs for Hansol Inticube (3 are a bit unpleasant!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hansol Inticube might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A070590

Hansol Inticube

Engages in setting up contact center infrastructure, and developing contact center solutions and wireless Internet solutions in South Korea.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026