- South Korea

- /

- Software

- /

- KOSDAQ:A065440

Earnings Tell The Story For ELUON Corporation (KOSDAQ:065440) As Its Stock Soars 36%

ELUON Corporation (KOSDAQ:065440) shareholders have had their patience rewarded with a 36% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 30%.

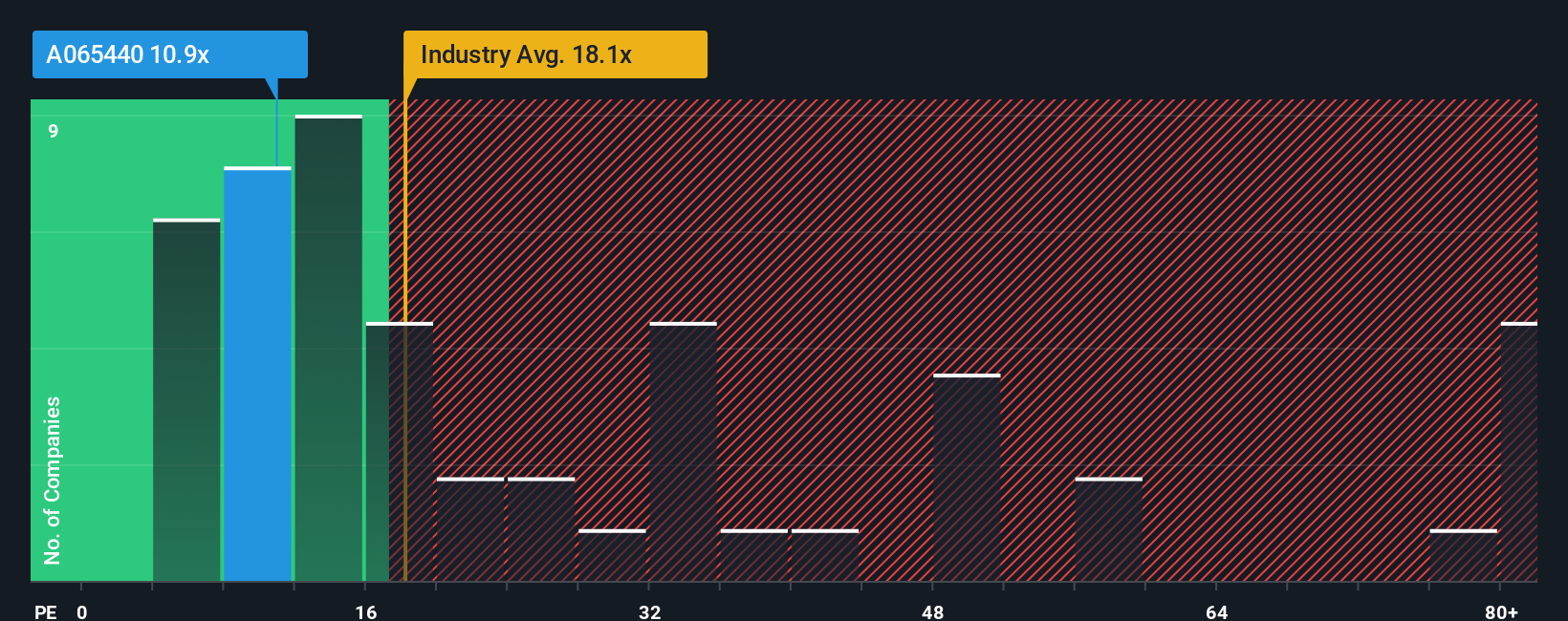

In spite of the firm bounce in price, it's still not a stretch to say that ELUON's price-to-earnings (or "P/E") ratio of 10.9x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

The earnings growth achieved at ELUON over the last year would be more than acceptable for most companies. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for ELUON

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like ELUON's to be considered reasonable.

Retrospectively, the last year delivered a decent 9.2% gain to the company's bottom line. The latest three year period has also seen an excellent 108% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 27% shows it's about the same on an annualised basis.

In light of this, it's understandable that ELUON's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Final Word

ELUON appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of ELUON revealed its three-year earnings trends are contributing to its P/E, given they look similar to current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware ELUON is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if ELUON might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A065440

ELUON

Engages in the development and sales of software and network equipment in South Korea and Indonesia.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026