- South Korea

- /

- Software

- /

- KOSDAQ:A057680

T Scientific Co.,Ltd.'s (KOSDAQ:057680) 36% Jump Shows Its Popularity With Investors

Despite an already strong run, T Scientific Co.,Ltd. (KOSDAQ:057680) shares have been powering on, with a gain of 36% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 26% in the last twelve months.

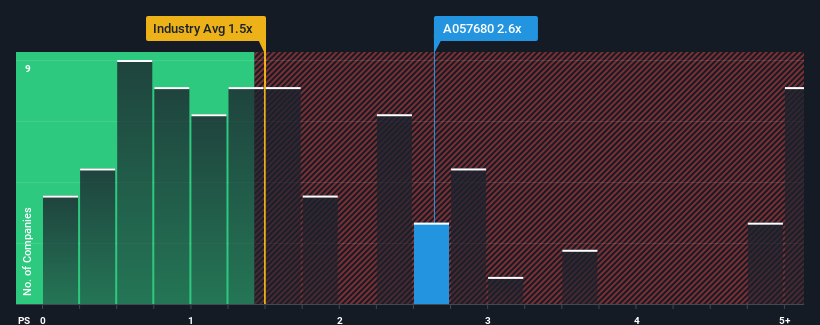

Following the firm bounce in price, you could be forgiven for thinking T ScientificLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.6x, considering almost half the companies in Korea's Software industry have P/S ratios below 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for T ScientificLtd

How Has T ScientificLtd Performed Recently?

T ScientificLtd certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for T ScientificLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For T ScientificLtd?

The only time you'd be truly comfortable seeing a P/S as high as T ScientificLtd's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 113%. The latest three year period has also seen an excellent 273% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 18% shows it's noticeably more attractive.

With this information, we can see why T ScientificLtd is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

The large bounce in T ScientificLtd's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of T ScientificLtd revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Before you take the next step, you should know about the 4 warning signs for T ScientificLtd (2 can't be ignored!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if T ScientificLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A057680

T ScientificLtd

Engages in the IT and mobile commerce businesses in South Korea.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)