- South Korea

- /

- Software

- /

- KOSDAQ:A053800

Undiscovered Gems With Strong Fundamentals January 2025

Reviewed by Simply Wall St

As we enter 2025, global markets are experiencing a mix of optimism and caution, with major indices like the S&P 500 and Nasdaq Composite showing moderate gains despite recent dips in consumer confidence and economic indicators. In this environment, investors are increasingly on the lookout for small-cap stocks that combine strong fundamentals with growth potential, making them standout opportunities amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Hong Ho Precision TextileLtd | 7.48% | 36.01% | 84.13% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

AhnLab (KOSDAQ:A053800)

Simply Wall St Value Rating: ★★★★★★

Overview: AhnLab, Inc. offers information security solutions and services to consumers, enterprises, and small to medium businesses globally with a market cap of ₩673.15 billion.

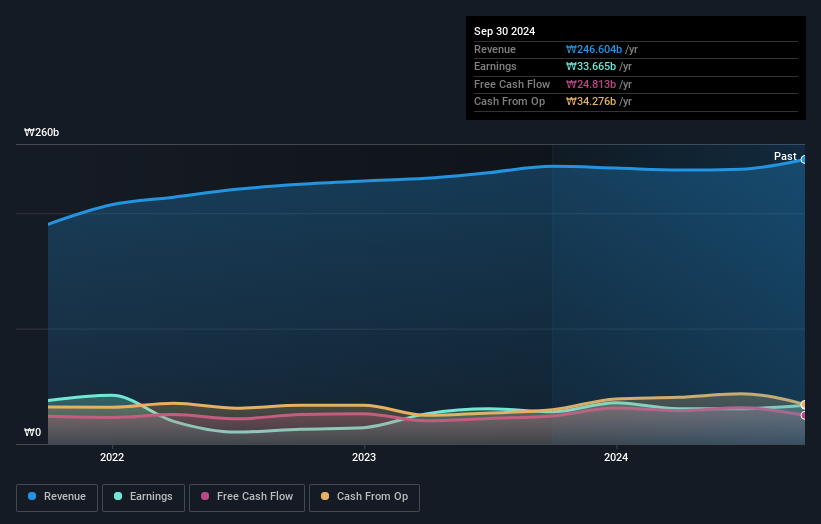

Operations: AhnLab generates revenue primarily from the sales of security programs and provision of services, amounting to ₩246.60 billion. The company's financial performance is influenced by its ability to manage costs associated with delivering these solutions and services.

AhnLab, a nimble player in the software industry, has shown a promising financial trajectory with earnings growth of 20.4% over the past year, outpacing the industry's -3.8%. Despite recent shareholder dilution, AhnLab remains debt-free and boasts high-quality earnings. The company reported third-quarter sales of KRW 1.70 billion (US$1.28 million), up from KRW 1.53 billion (US$1.15 million) last year, with net income rising to KRW 9.38 billion (US$7 million). A share repurchase program aims to stabilize stock prices and enhance shareholder value by buying back up to 300,000 shares by January 2025.

- Navigate through the intricacies of AhnLab with our comprehensive health report here.

Understand AhnLab's track record by examining our Past report.

Sebang Global Battery (KOSE:A004490)

Simply Wall St Value Rating: ★★★★★☆

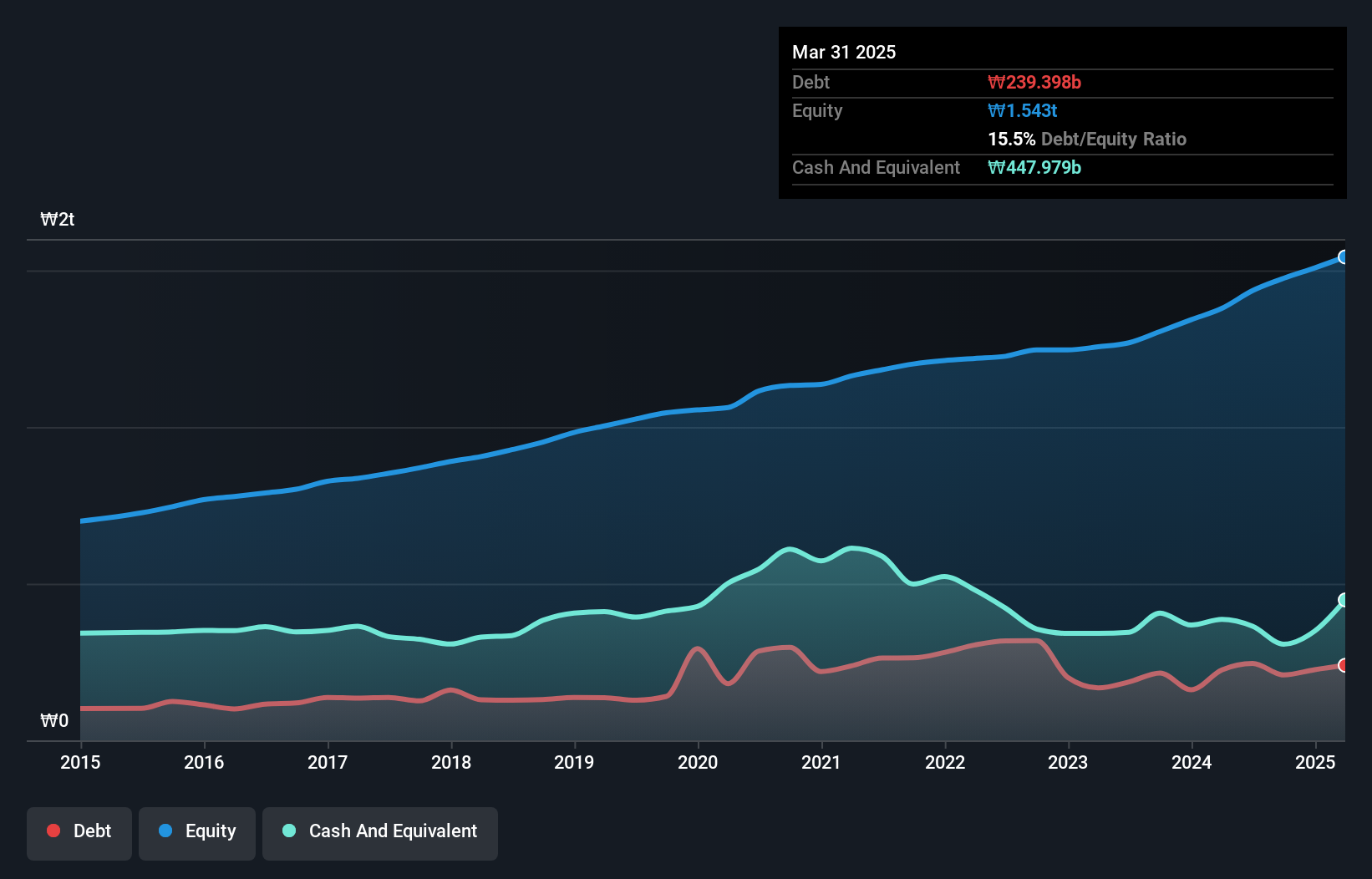

Overview: Sebang Global Battery Co., Ltd. manufactures and sells lead acid batteries both domestically in South Korea and internationally, with a market cap of approximately ₩933.97 billion.

Operations: Sebang Global Battery generates revenue primarily from the manufacturing and sale of automotive and industrial storage batteries, amounting to approximately ₩1.99 trillion. The company's financial performance is reflected in its net profit margin, which provides insight into its profitability relative to total sales.

Sebang Global Battery, a nimble player in the auto components sector, has shown impressive earnings growth of 114% over the past year, outpacing industry peers at 10%. This growth is supported by high-quality earnings and a positive free cash flow position. The company seems to manage its debt well with more cash than total liabilities and interest payments comfortably covered by profits. Trading at 77% below its estimated fair value, Sebang appears undervalued. However, the debt-to-equity ratio has slightly increased from 13.4 to 14.1 over five years, which investors might want to monitor closely moving forward.

Wee Hur Holdings (SGX:E3B)

Simply Wall St Value Rating: ★★★★★★

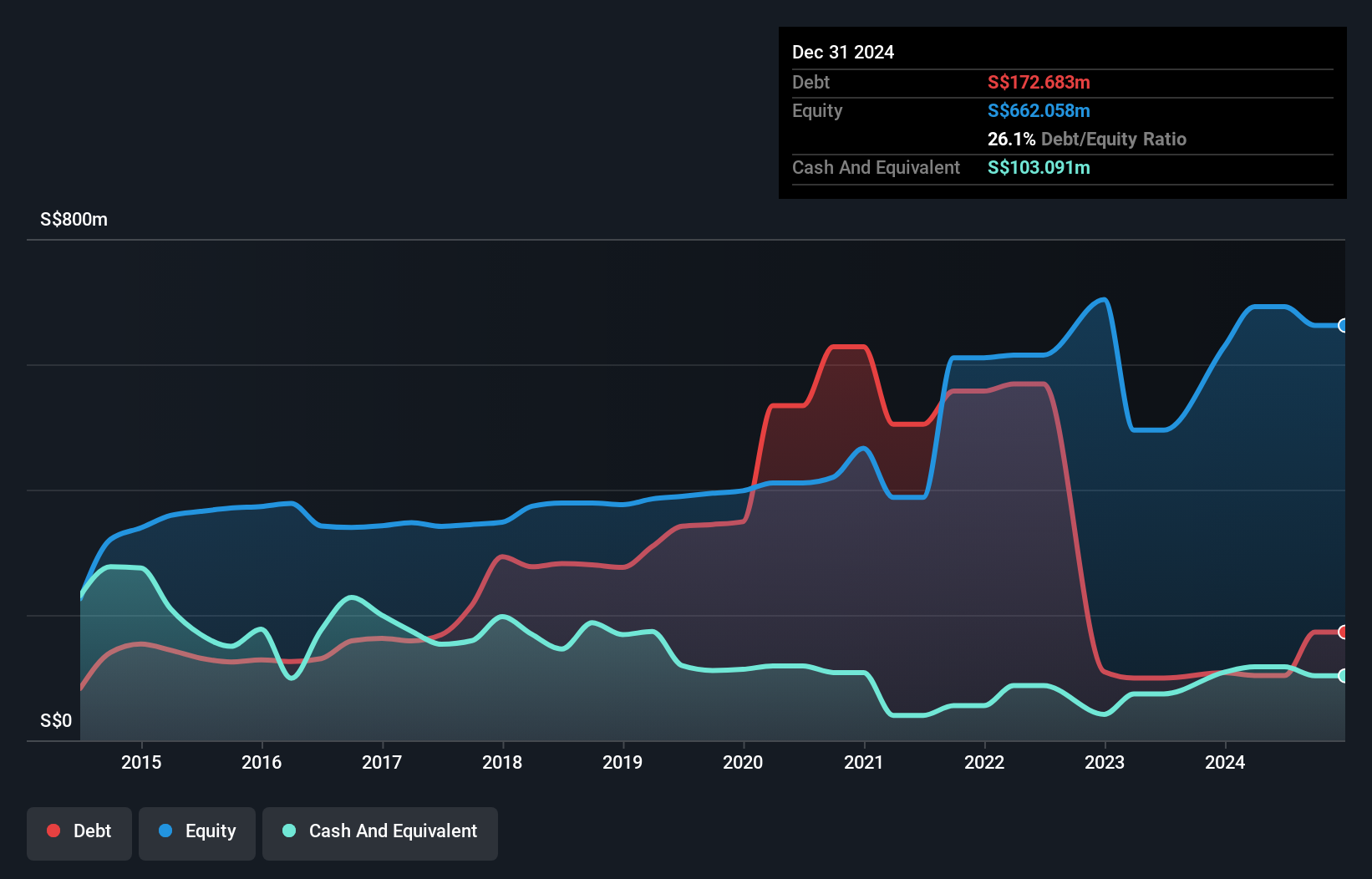

Overview: Wee Hur Holdings Ltd. is an investment holding company involved in general building and civil engineering construction in Singapore and Australia, with a market capitalization of SGD386.08 million.

Operations: Wee Hur Holdings generates revenue primarily from its Building Construction segment (SGD121.19 million) and Workers Dormitory operations (SGD76.45 million), with additional contributions from Property Development in Singapore (SGD50.76 million). The company faces inter-segment sales adjustments of SGD24.30 million, impacting overall financial results.

Wee Hur Holdings, a small player in the construction sector, has recently caught attention with rumors of selling its student accommodation business in Australia. This buzz led to a stock surge, climbing 19% last week to A$0.43 and an additional 10% to A$0.475 on October 22nd. Financially, Wee Hur's debt-to-equity ratio improved from 87.7% to 14.9% over five years, showcasing prudent financial management while maintaining free cash flow positivity at A$81 million as of June 2024. Despite the excitement around potential deals, future earnings are projected to decline by an average of 12.5% annually for three years ahead.

- Take a closer look at Wee Hur Holdings' potential here in our health report.

Explore historical data to track Wee Hur Holdings' performance over time in our Past section.

Next Steps

- Investigate our full lineup of 4644 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A053800

AhnLab

Provides information security solutions and services for consumers, enterprises, and small and medium businesses worldwide.

Flawless balance sheet with solid track record.