- South Korea

- /

- Pharma

- /

- KOSE:A001060

Unveiling None And 2 Other Promising Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic indicators, small-cap stocks have shown resilience, with indices like the Russell 2000 posting modest gains. In this environment, identifying promising small-cap companies with strong fundamentals is crucial for investors seeking potential opportunities amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Hong Ho Precision TextileLtd | 7.48% | 36.01% | 84.13% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Neosem (KOSDAQ:A253590)

Simply Wall St Value Rating: ★★★★★★

Overview: Neosem Inc. specializes in the manufacturing and sale of semiconductor inspection equipment and has a market cap of ₩383.34 billion.

Operations: The company generates revenue primarily from its semiconductor equipment and services segment, totaling ₩96.47 billion.

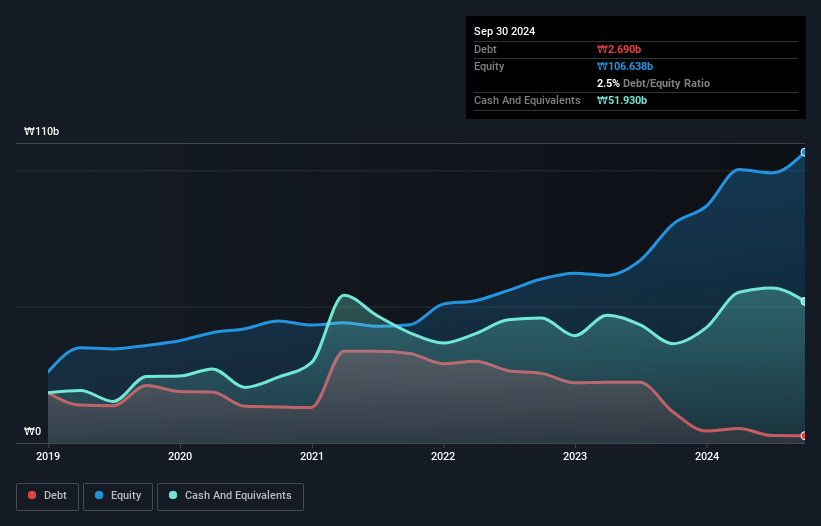

Neosem's performance in the semiconductor sector shines with earnings growth of 19.7% over the past year, outpacing the industry average of 7.4%. The company is trading at a significant discount, approximately 60.6% below its estimated fair value, suggesting potential undervaluation. With a debt-to-equity ratio reduced from 58.9% to just 2.5% over five years, Neosem demonstrates strong financial management and stability. Despite shareholder dilution in the past year, its high-quality earnings and positive free cash flow position it as an intriguing prospect for those eyeing emerging opportunities within this dynamic industry space.

- Delve into the full analysis health report here for a deeper understanding of Neosem.

Gain insights into Neosem's past trends and performance with our Past report.

JW Pharmaceutical (KOSE:A001060)

Simply Wall St Value Rating: ★★★★★★

Overview: JW Pharmaceutical Corporation is engaged in the manufacturing and sale of medicines and medical supplies both in Japan and internationally, with a market capitalization of approximately ₩598.21 billion.

Operations: JW Pharmaceutical generates revenue primarily from its pharmaceutical business, amounting to ₩736.54 billion. The company's market capitalization is approximately ₩598.21 billion.

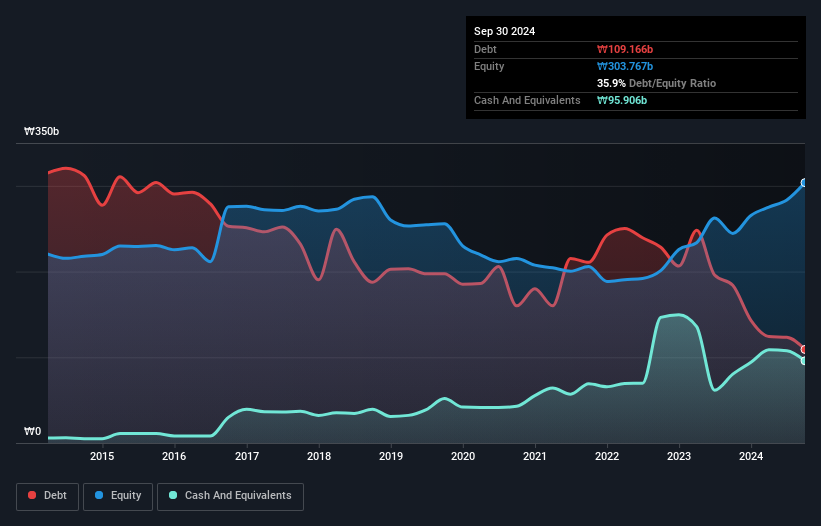

JW Pharma, a dynamic player in the pharmaceutical sector, has shown impressive financial resilience. The firm's net income for the third quarter was KRW 19.85 billion compared to a net loss of KRW 17.91 billion last year, indicating a significant turnaround. Its earnings per share surged to KRW 807 from a loss of KRW 728 previously. With its debt well-covered by EBIT at an impressive 18.5x and trading at 73% below estimated fair value, JW appears undervalued relative to peers. The company’s strategic collaboration with Tempus could further enhance its innovative edge in oncology research and development efforts.

- Click here to discover the nuances of JW Pharmaceutical with our detailed analytical health report.

Explore historical data to track JW Pharmaceutical's performance over time in our Past section.

Xin Point Holdings (SEHK:1571)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xin Point Holdings Limited is an investment holding company that manufactures and sells automotive and electronic components across China, North America, Europe, and other international markets with a market capitalization of HK$4.39 billion.

Operations: Xin Point Holdings generates revenue primarily from the manufacture and sale of automotive and electronic components, amounting to CN¥3.23 billion. The company's financial performance is influenced by its cost structure and market dynamics across various regions.

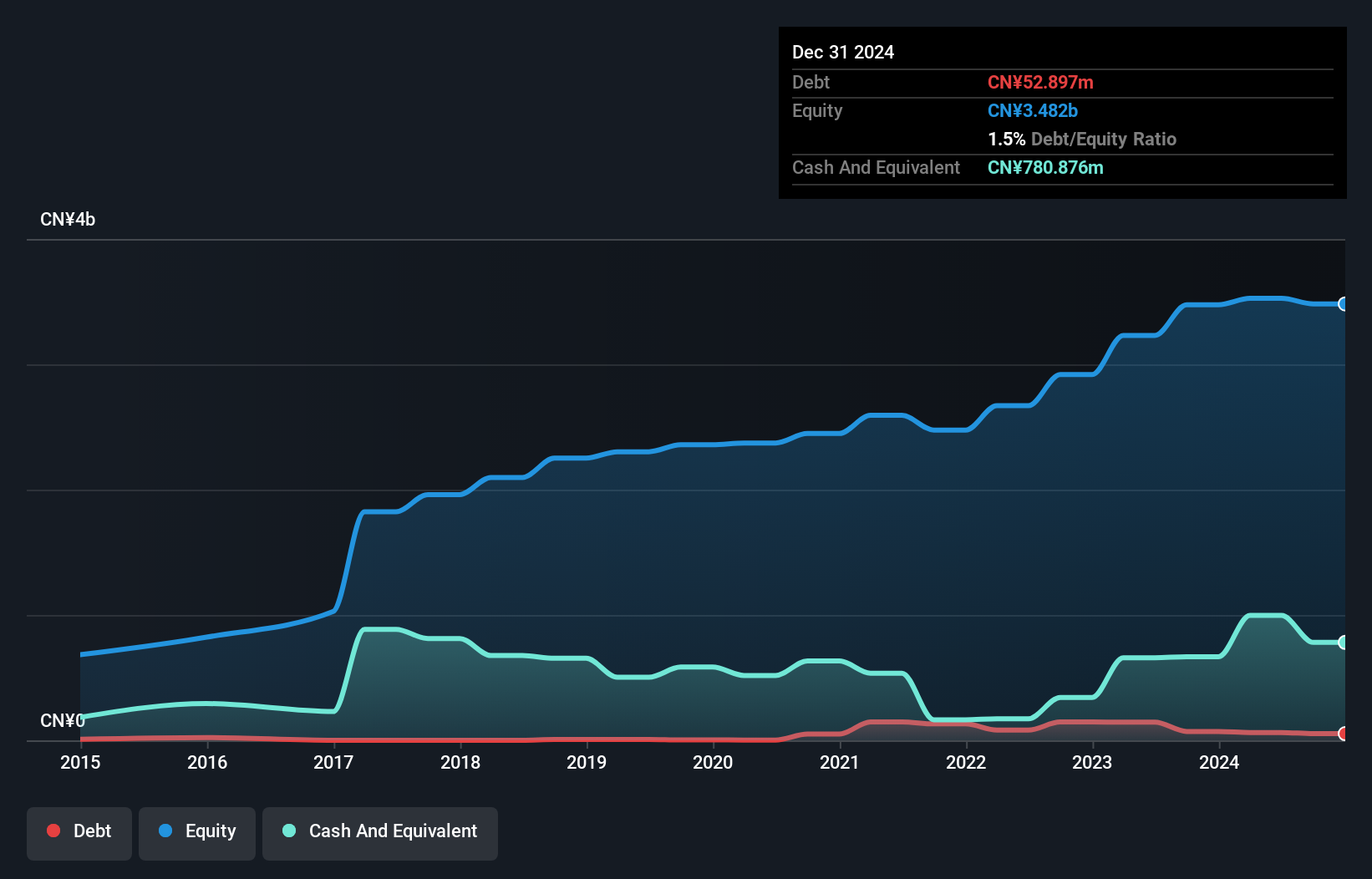

Xin Point Holdings, a small player in the auto components sector, showcases intriguing potential. Over the past year, its earnings surged by 27%, outpacing an industry decline of 19%. This growth is supported by robust financials; it boasts more cash than total debt and covers interest payments comfortably. Despite a rising debt-to-equity ratio from 0.3 to 1.8 over five years, Xin Point trades at a significant discount of nearly 75% below estimated fair value. With high-quality earnings and positive free cash flow now at US$643 million, this company seems well-positioned for future growth prospects.

- Click here and access our complete health analysis report to understand the dynamics of Xin Point Holdings.

Evaluate Xin Point Holdings' historical performance by accessing our past performance report.

Next Steps

- Dive into all 4644 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A001060

JW Pharmaceutical

Manufactures and sells medicines and medical supplies in Japan and internationally.

Outstanding track record with flawless balance sheet.