- South Korea

- /

- Software

- /

- KOSDAQ:A053300

Korea Information Certificate Authority, Inc.'s (KOSDAQ:053300) Price Is Right But Growth Is Lacking

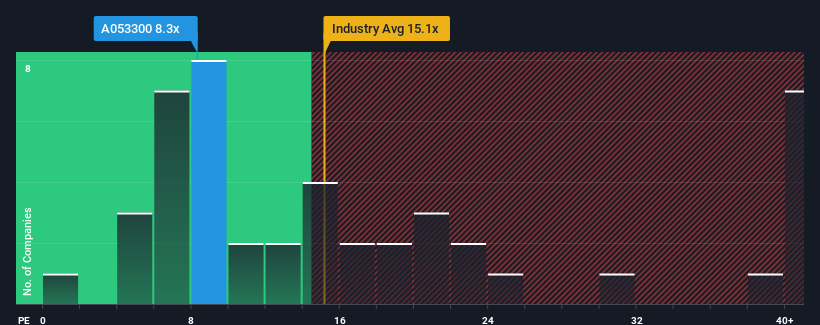

When close to half the companies in Korea have price-to-earnings ratios (or "P/E's") above 12x, you may consider Korea Information Certificate Authority, Inc. (KOSDAQ:053300) as an attractive investment with its 8.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been quite advantageous for Korea Information Certificate Authority as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Korea Information Certificate Authority

Is There Any Growth For Korea Information Certificate Authority?

There's an inherent assumption that a company should underperform the market for P/E ratios like Korea Information Certificate Authority's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 125% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Comparing that to the market, which is predicted to deliver 31% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Korea Information Certificate Authority's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Korea Information Certificate Authority maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Korea Information Certificate Authority, and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Korea Information Certificate Authority. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Korea Information Certificate Authority might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A053300

Korea Information Certificate Authority

Korea Information Certificate Authority, Inc.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives