- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A330860

Some Confidence Is Lacking In Nepes Ark Corporation (KOSDAQ:330860) As Shares Slide 25%

Unfortunately for some shareholders, the Nepes Ark Corporation (KOSDAQ:330860) share price has dived 25% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 33% share price drop.

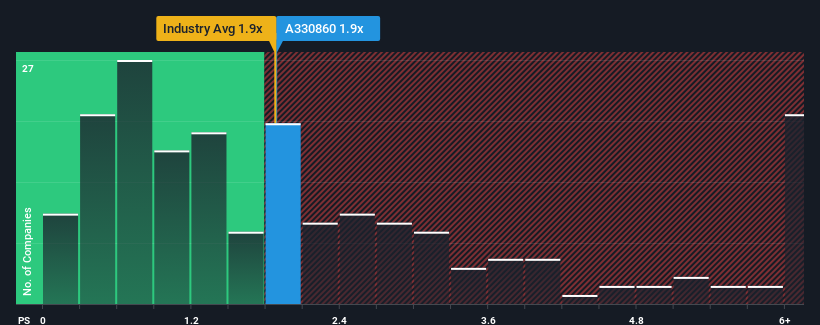

In spite of the heavy fall in price, it's still not a stretch to say that Nepes Ark's price-to-sales (or "P/S") ratio of 1.9x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in Korea, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Nepes Ark

How Nepes Ark Has Been Performing

As an illustration, revenue has deteriorated at Nepes Ark over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Nepes Ark's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nepes Ark's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 9.4% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 83% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is predicted to deliver 89% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Nepes Ark's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What We Can Learn From Nepes Ark's P/S?

With its share price dropping off a cliff, the P/S for Nepes Ark looks to be in line with the rest of the Semiconductor industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Nepes Ark's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Nepes Ark with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nepes Ark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A330860

Nepes Ark

Engages in the semiconductor manufacturing-related testing and engineering service, semiconductor test production, and semiconductor product wholesale and retail businesses in South Korea.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives