- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A192650

High Growth Tech Stocks To Consider This January 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of easing inflation and robust bank earnings, major U.S. stock indexes have rebounded, with value stocks outperforming growth shares amid a backdrop of strong economic indicators. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that exhibit resilience and innovation in sectors poised to benefit from current market trends and economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1227 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

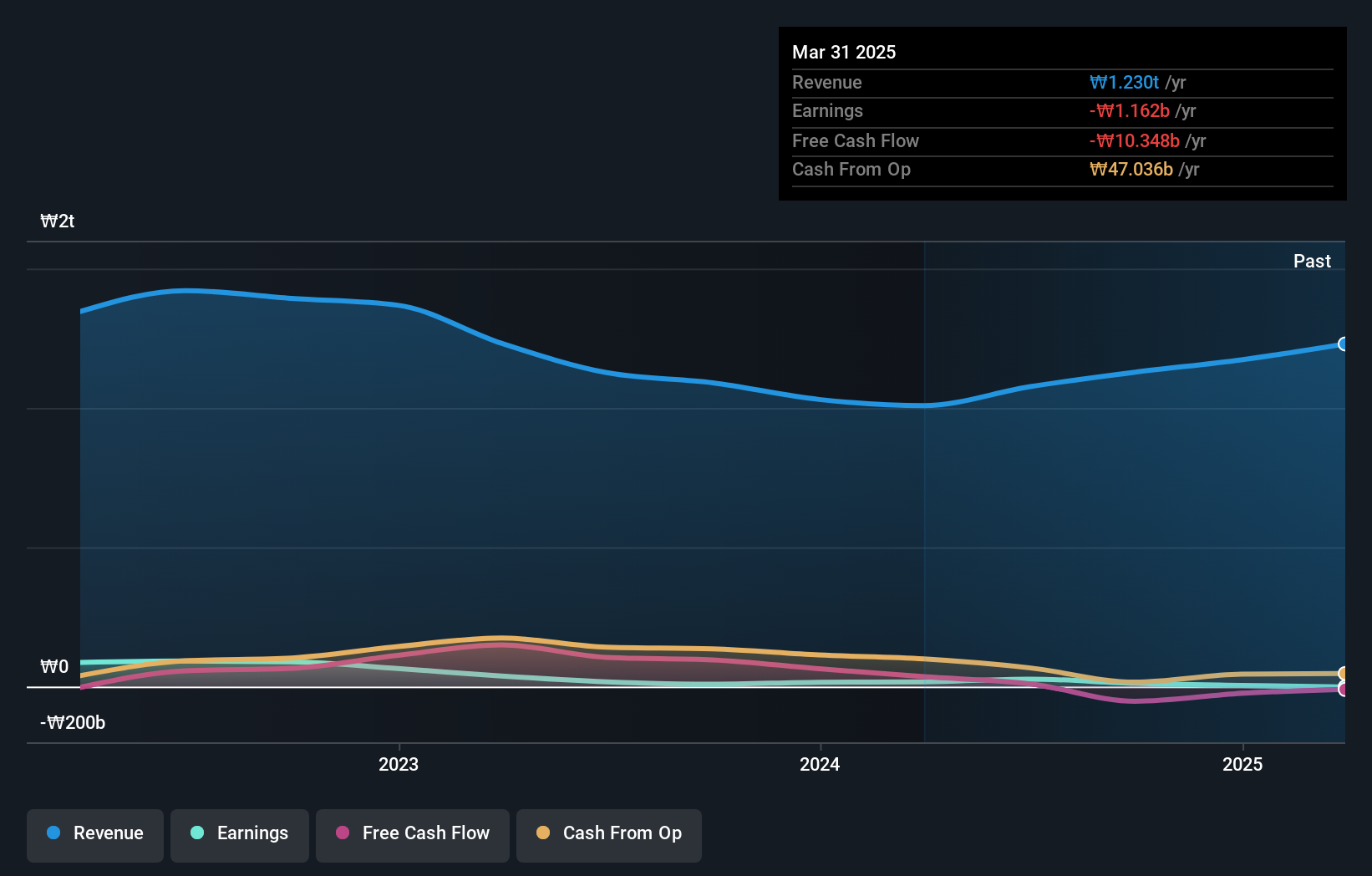

Overview: PharmaResearch Co., Ltd. is a South Korean biopharmaceutical company that operates with its subsidiaries in the industry, with a market cap of approximately ₩2.50 trillion.

Operations: PharmaResearch, along with its subsidiaries, focuses on the biopharmaceutical sector in South Korea, generating revenue primarily from its Pharmaceuticals segment, which amounts to approximately ₩317 billion.

PharmaResearch, a standout in the biotech sector, has demonstrated robust financial and operational performance. With earnings growth of 36.8% last year outpacing the industry average of 7.9%, the company is on a trajectory that exceeds many peers. Its revenue growth forecast at 22.2% annually is set to outperform the broader KR market's 9.4%. Furthermore, PharmaResearch's commitment to innovation is evident from its R&D investments, crucial for maintaining its competitive edge in developing cutting-edge pharmaceutical solutions. The firm's strategic focus on high-quality earnings and positive free cash flow underscores its operational efficiency and potential for sustained growth in a dynamic industry landscape.

- Take a closer look at PharmaResearch's potential here in our health report.

Gain insights into PharmaResearch's historical performance by reviewing our past performance report.

DREAMTECH (KOSE:A192650)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DREAMTECH Co., Ltd. specializes in the design, development, and manufacture of modules both in South Korea and internationally, with a market capitalization of approximately ₩489.19 billion.

Operations: DREAMTECH Co., Ltd. generates revenue primarily from IT & Mobile Communications and Compact Camera Modules, contributing ₩455.56 billion and ₩441.55 billion respectively. The Biometrics, Healthcare & Convergence segment adds ₩230.61 billion to the total revenue stream.

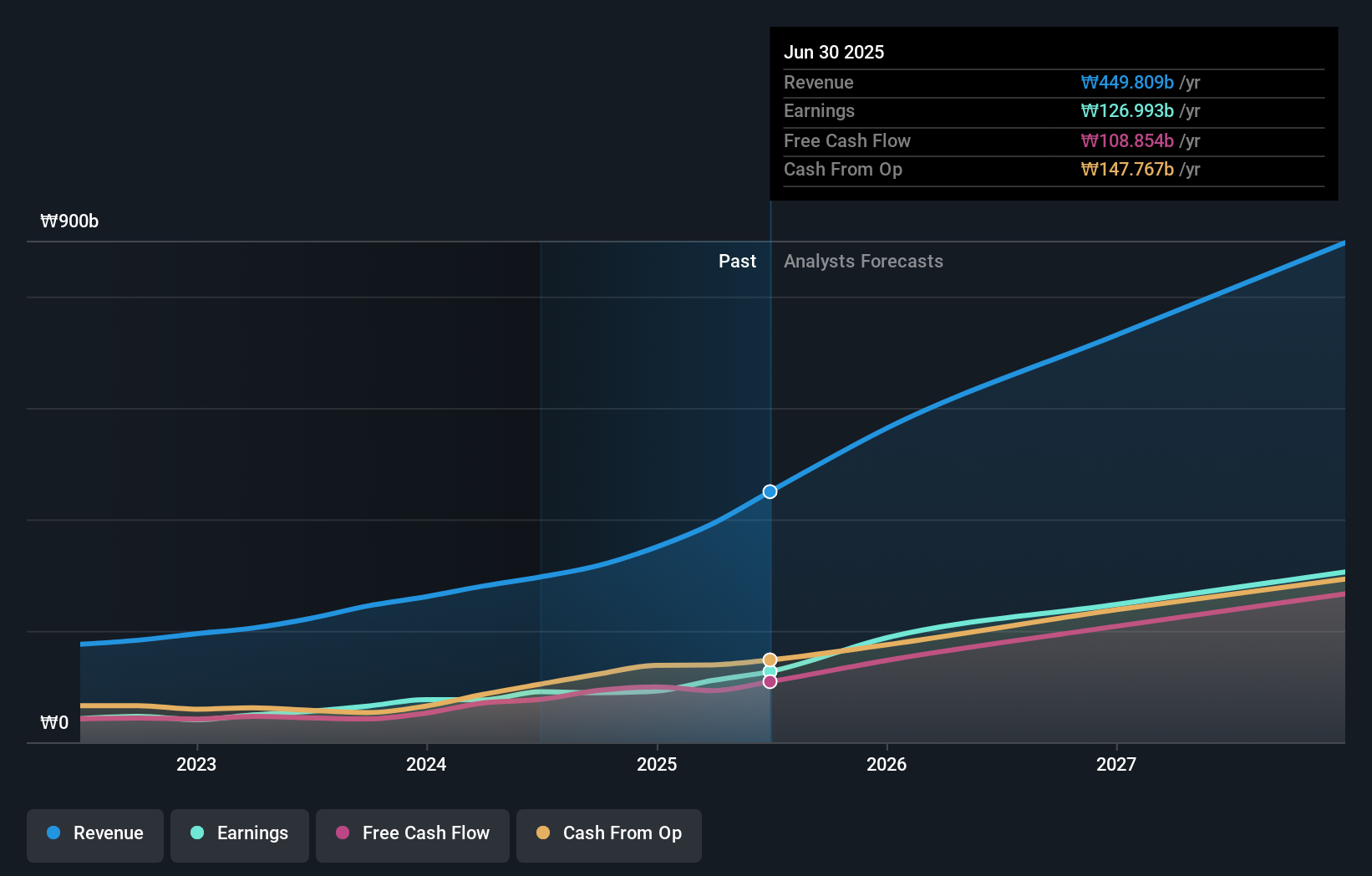

DREAMTECH has showcased a compelling growth trajectory with its earnings forecast to surge by 36.5% annually, significantly outpacing the broader KR market's projection of 28.8%. This performance is underpinned by a robust annual revenue increase of 14.7%, which also exceeds the market average growth rate of 9.4%. The company's commitment to innovation and technological advancement is evident in its strategic R&D investments, crucial for maintaining competitive edge in the fast-evolving tech landscape. Moreover, DREAMTECH recently extended its buyback plan, reinforcing confidence in its financial health and future prospects.

- Get an in-depth perspective on DREAMTECH's performance by reading our health report here.

Examine DREAMTECH's past performance report to understand how it has performed in the past.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

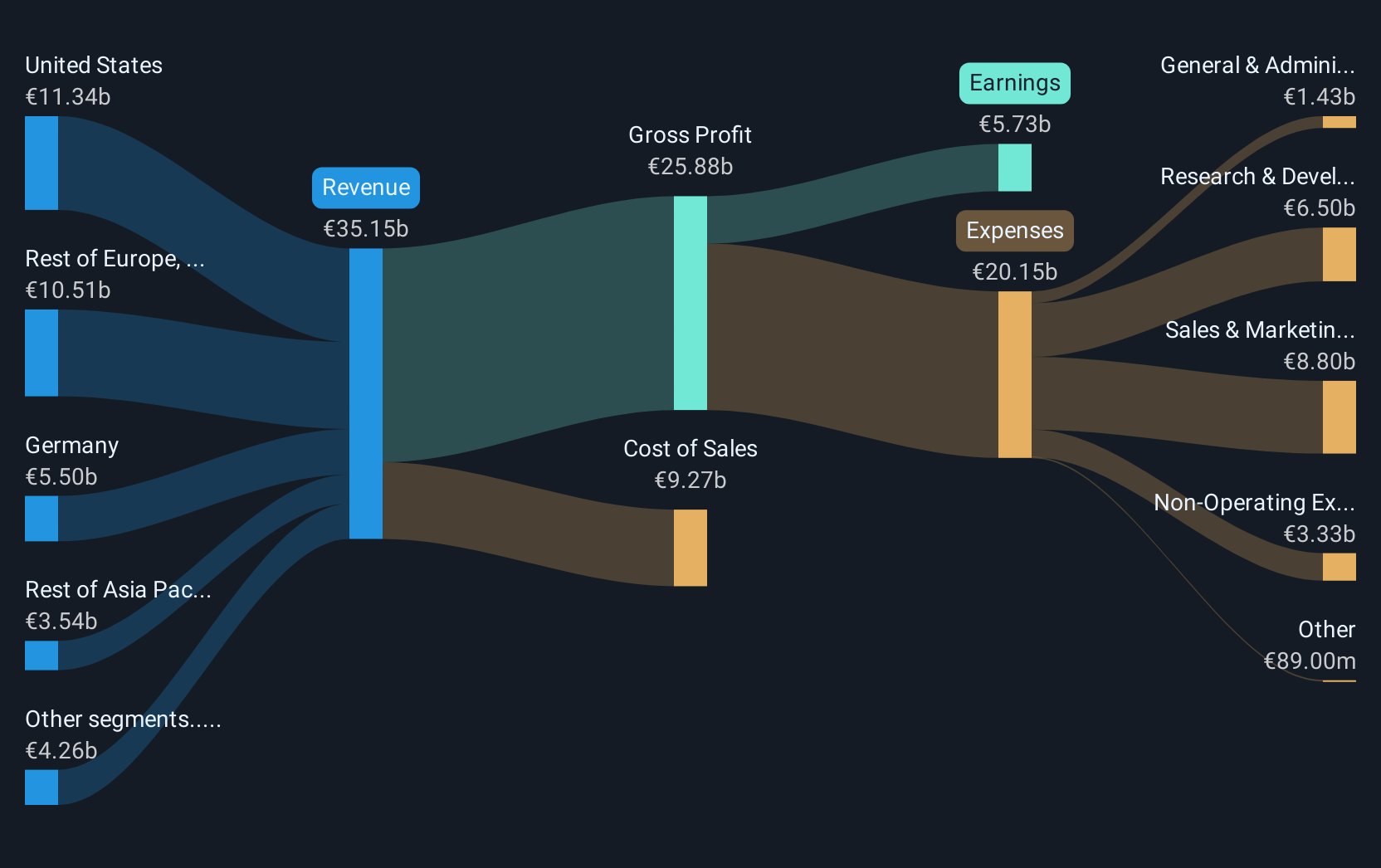

Overview: SAP SE, along with its subsidiaries, offers a range of applications, technology, and services globally with a market capitalization of €305.27 billion.

Operations: The company's primary revenue stream is from its Applications, Technology & Services segment, generating €33.27 billion. The focus on this segment highlights its significance in SAP's overall business model.

SAP's strategic collaborations and product innovations underscore its adaptability in the evolving tech landscape. With a robust annual revenue growth of 10.6% and an impressive earnings forecast of 41.4% per year, SAP is outpacing the German market significantly. The recent launch of RISE with SAP on IBM Power Virtual Server highlights its commitment to facilitating faster cloud migrations, which is critical as businesses increasingly seek efficient, scalable ERP solutions. This initiative not only enhances SAP's service offering but also solidifies its position by leveraging high-security and reliable server environments to reduce migration times significantly—underpinning potential future growth in cloud-based ERP solutions.

- Dive into the specifics of SAP here with our thorough health report.

Gain insights into SAP's past trends and performance with our Past report.

Make It Happen

- Discover the full array of 1227 High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A192650

DREAMTECH

Engages in the design, development, and manufacture of modules in South Korea and internationally.

Excellent balance sheet with reasonable growth potential.