- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A226590

Revenues Tell The Story For MEGAELECTRONICS Co., Ltd. (KOSDAQ:226590) As Its Stock Soars 29%

MEGAELECTRONICS Co., Ltd. (KOSDAQ:226590) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

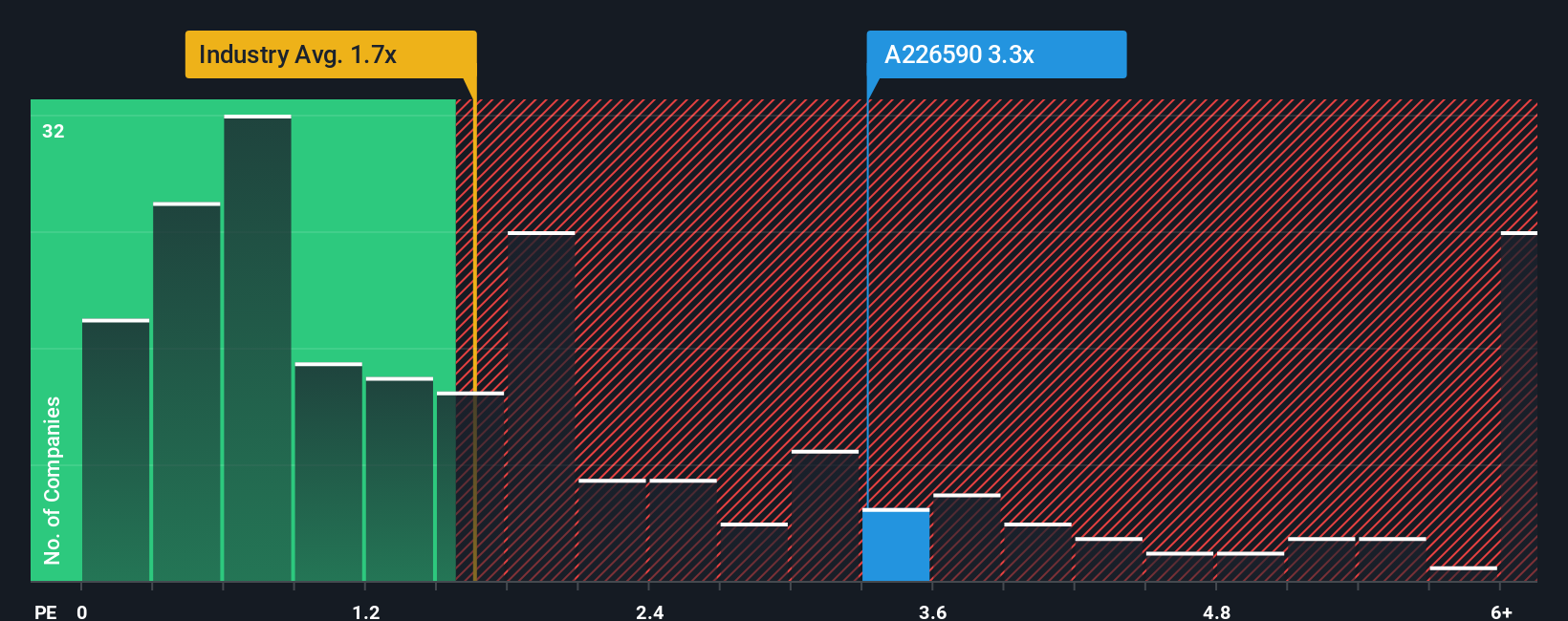

Following the firm bounce in price, you could be forgiven for thinking MEGAELECTRONICS is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.3x, considering almost half the companies in Korea's Semiconductor industry have P/S ratios below 1.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for MEGAELECTRONICS

What Does MEGAELECTRONICS' P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, MEGAELECTRONICS has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for MEGAELECTRONICS, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is MEGAELECTRONICS' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like MEGAELECTRONICS' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 122% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 136% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 25% shows it's noticeably more attractive.

In light of this, it's understandable that MEGAELECTRONICS' P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does MEGAELECTRONICS' P/S Mean For Investors?

The large bounce in MEGAELECTRONICS' shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of MEGAELECTRONICS revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

We don't want to rain on the parade too much, but we did also find 2 warning signs for MEGAELECTRONICS that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A226590

MEGAELECTRONICS

Designs, manufactures, and sells storage devices in South Korea.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success