- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A200710

We're Not Counting On ADTechnologyLtd (KOSDAQ:200710) To Sustain Its Statutory Profitability

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. In this article, we'll look at how useful this year's statutory profit is, when analysing ADTechnologyLtd (KOSDAQ:200710).

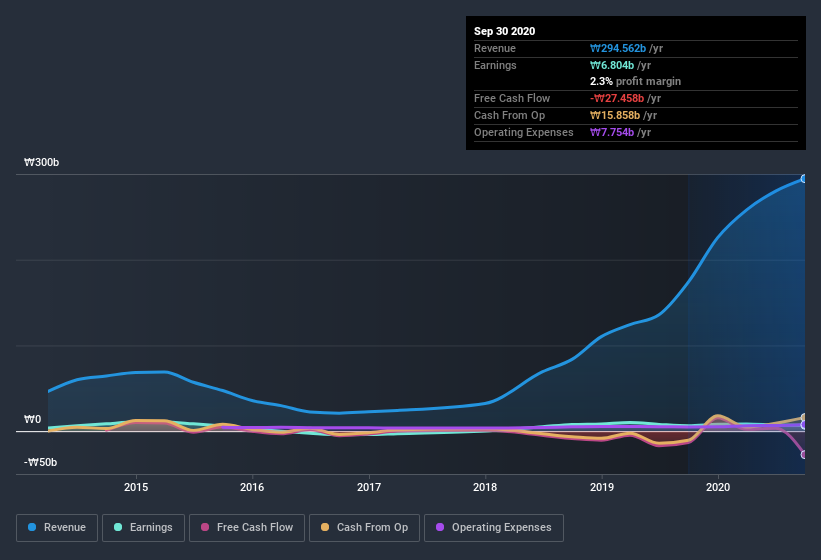

It's good to see that over the last twelve months ADTechnologyLtd made a profit of ₩6.80b on revenue of ₩294.6b. At the risk of seeming quaint, we do like to at least examine profit, even when a stock is improving revenue and considered a 'growth stock'. The chart below shows that revenue has improved over the last three years, and, even better, the company has moved from unprofitable to profitable.

Check out our latest analysis for ADTechnologyLtd

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. So today we'll look at what ADTechnologyLtd's cashflow tells us about its earnings, as well as examining how issuing shares is impacting shareholder value. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of ADTechnologyLtd.

A Closer Look At ADTechnologyLtd's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

ADTechnologyLtd has an accrual ratio of 0.45 for the year to September 2020. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. Even though it reported a profit of ₩6.80b, a look at free cash flow indicates it actually burnt through ₩27b in the last year. We also note that ADTechnologyLtd's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of ₩27b. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, ADTechnologyLtd increased the number of shares on issue by 44% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of ADTechnologyLtd's EPS by clicking here.

How Is Dilution Impacting ADTechnologyLtd's Earnings Per Share? (EPS)

ADTechnologyLtd was losing money three years ago. The good news is that profit was up 7.2% in the last twelve months. But EPS was less impressive, up only 4.4% in that time. So you can see that the dilution has had a fairly significant impact on shareholders.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if ADTechnologyLtd can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On ADTechnologyLtd's Profit Performance

As it turns out, ADTechnologyLtd couldn't match its profit with cashflow and its dilution means that earnings per share growth is lagging net income growth. Considering all this we'd argue ADTechnologyLtd's profits probably give an overly generous impression of its sustainable level of profitability. If you'd like to know more about ADTechnologyLtd as a business, it's important to be aware of any risks it's facing. When we did our research, we found 3 warning signs for ADTechnologyLtd (1 is significant!) that we believe deserve your full attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade ADTechnologyLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A200710

ADTechnologyLtd

Designs and develops semiconductor devices in South Korea.

Mediocre balance sheet with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026